Can Passive Income Be Qbi

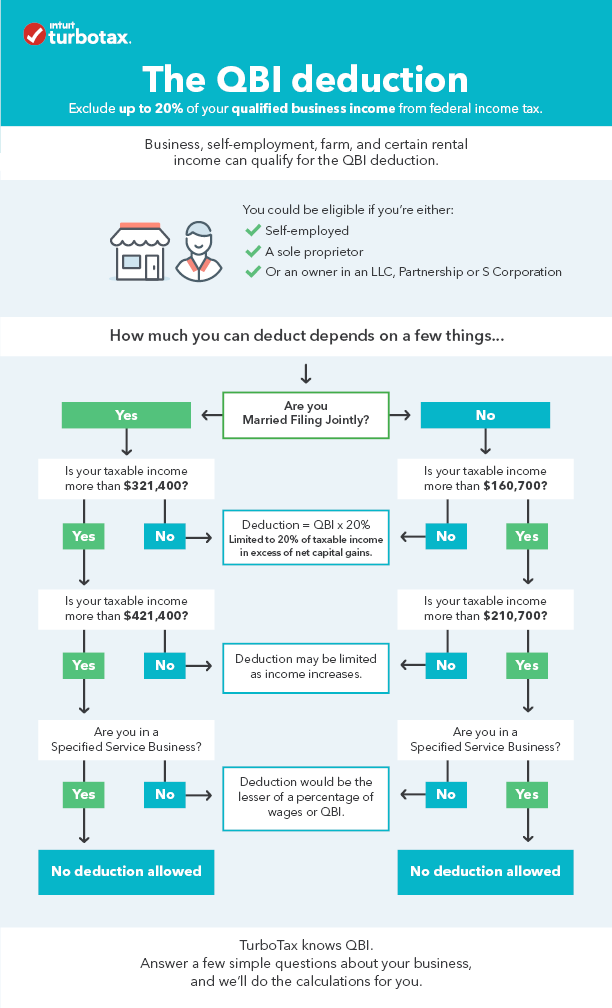

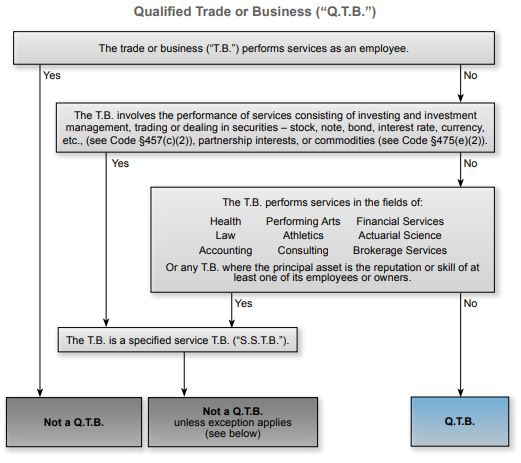

To qualify for the qualified business income qbi deduction you must be an owner of a pass through entity within the u s have qualified business income and not be barred from taking the deduction due to having substantial income and operating in a particular type of business.

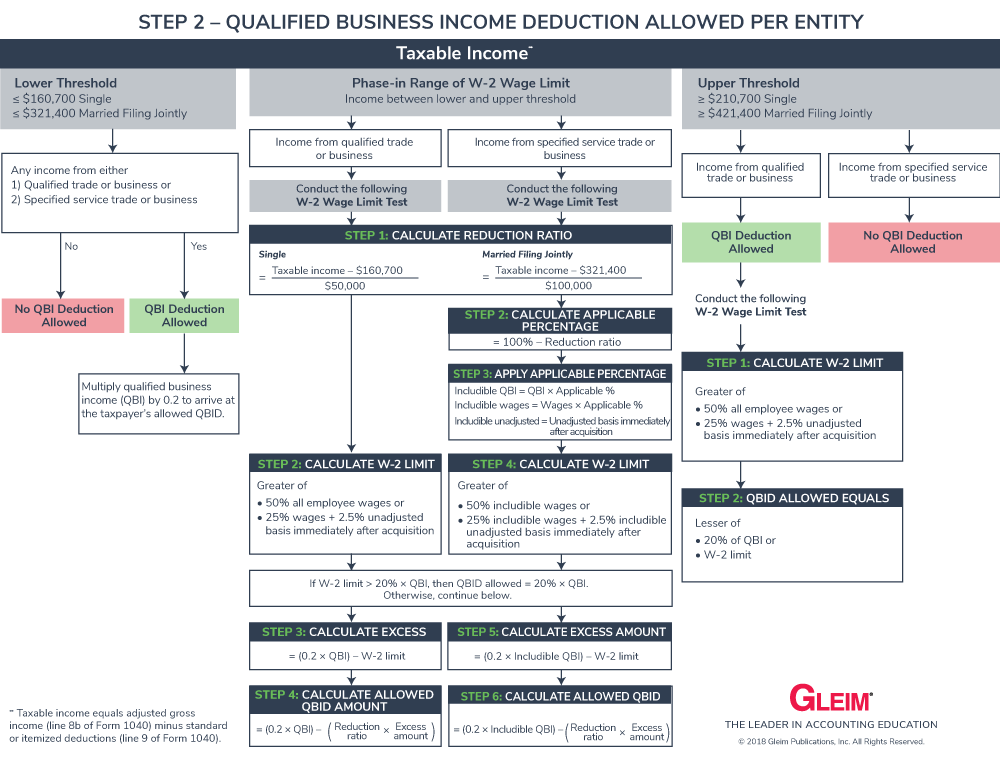

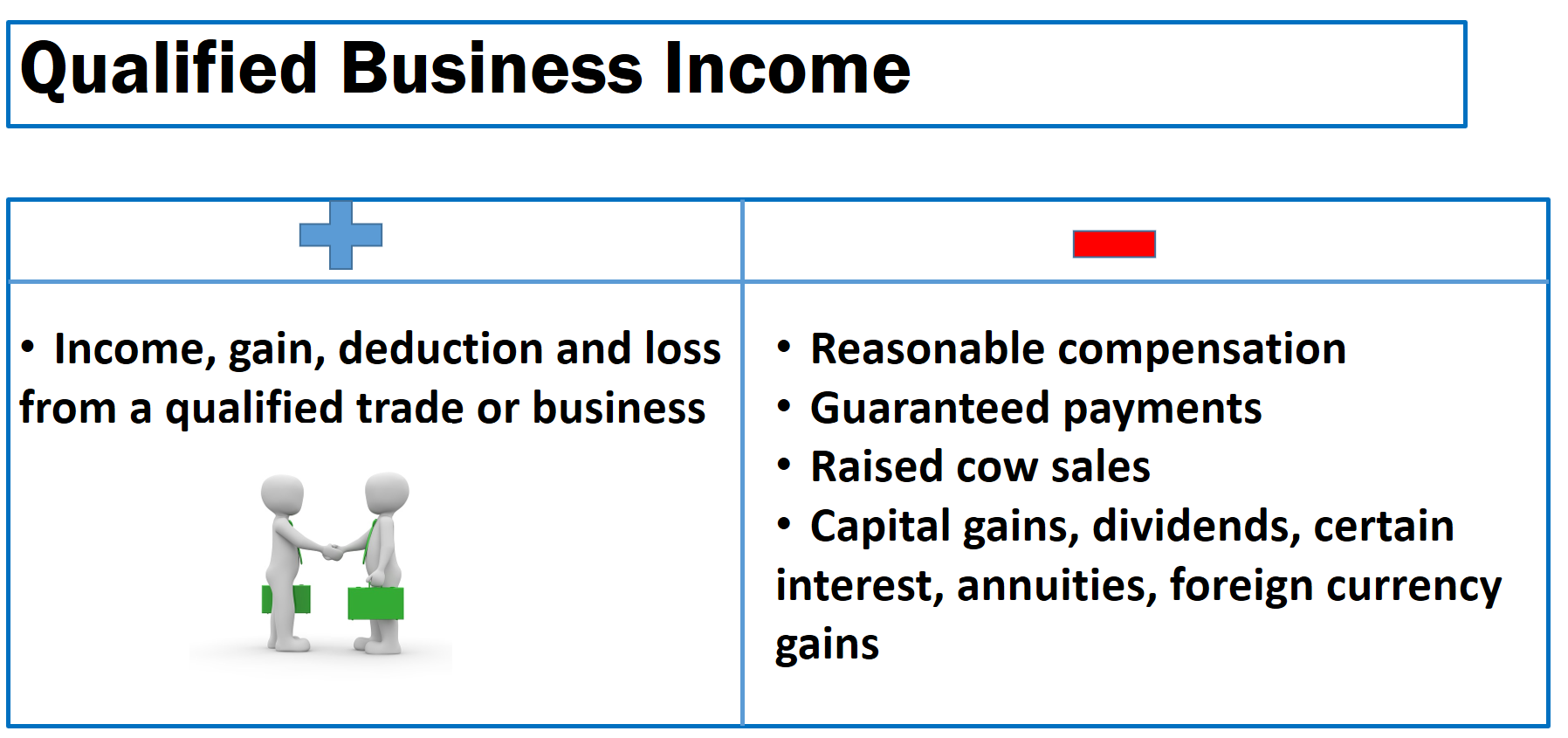

Can passive income be qbi. Passive rental activities that are not considered a trade or business for example a single family dwelling rented out for a year or more in which there is little or no interaction between the landlord and the. January 23 2020 8 44 am. If the net overall qbi is less than zero it is carried forward as a loss from a separate qualified business and will reduce any potential qbi deduction. The qualified business income deduction or qbi deduction is a personal deduction limited to owners of pass through entities.

Qbi for passive income. George and louise file a joint return that reports taxable income before any qbi deduction of 350 000. Can i get the qbi deduction on rental income. Qualified business income or qbi is the net income generated by any qualified trade or business under internal revenue code irc 162.

Qualified business income qbi passive activity loss carryover is created when losses from one qbi qualified business are netted against the gains from another. Starting any new business specifically an on the internet business can be truly challenging. There is so much details available as well as a lot of it just does not function is outdated and also incorrect or is just simply scammy. There is so much information out there and a lot of it simply does not work is obsoleted and incorrect or is just merely scammy.

Archie is in the 24 bracket so his federal tax savings from the qbi deduction is 5 136 21 400 x 24. Therefore archie can claim a qbi deduction of 21 400 the lesser of those two amounts. Starting any brand new business especially an on line business can be truly difficult.