Can Passive Income Offset Passive Loss

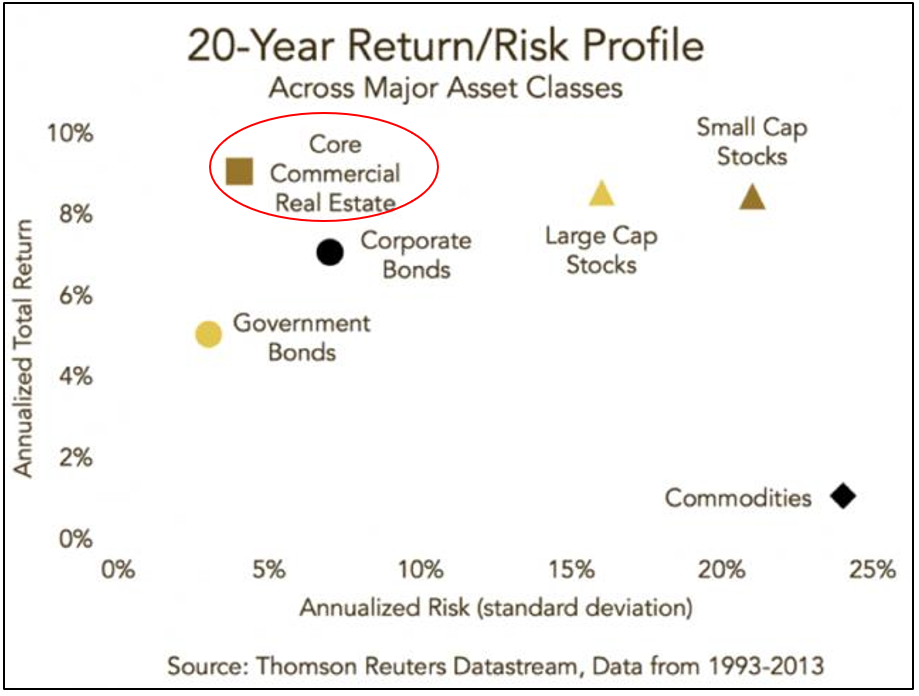

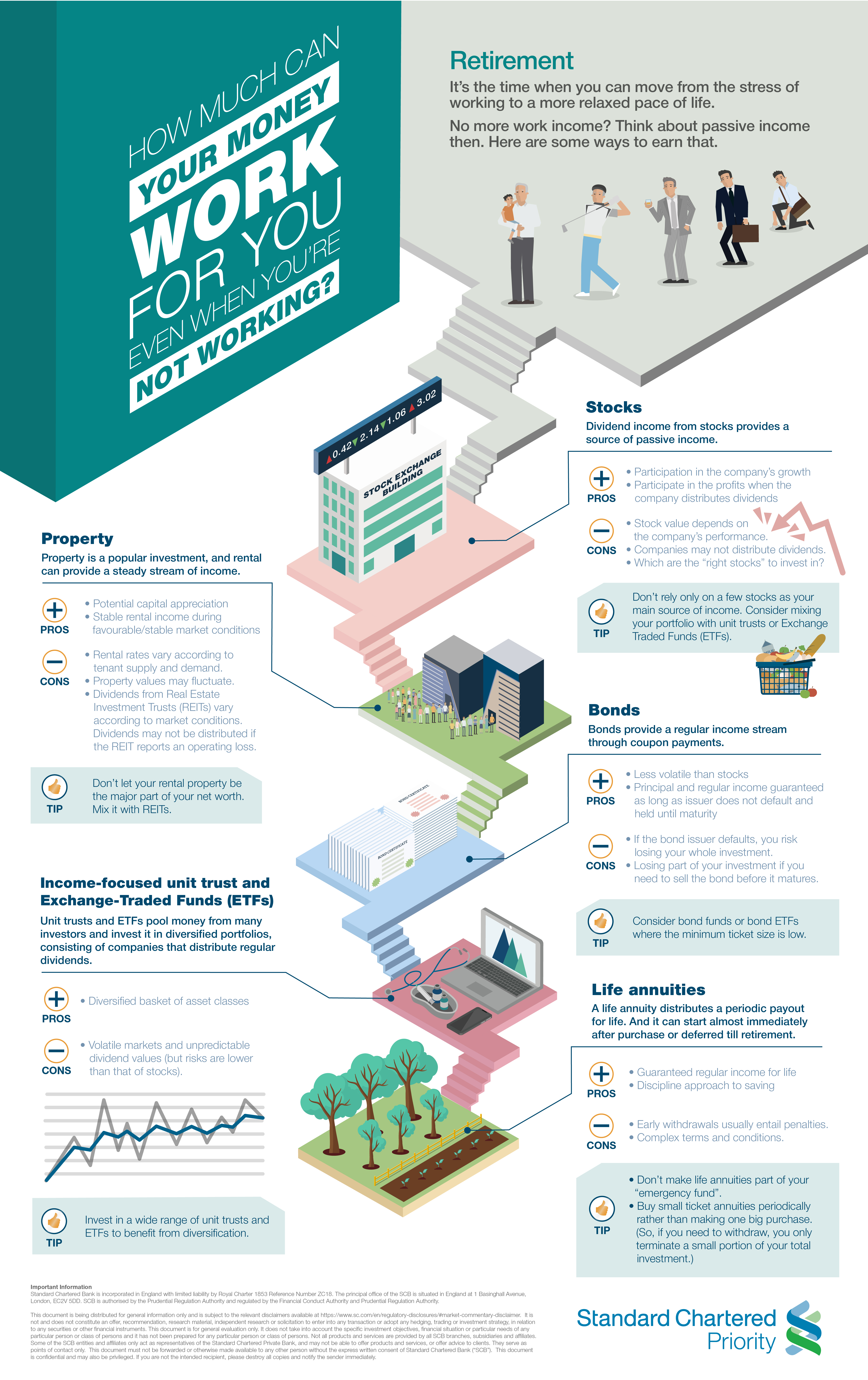

Passive losses are only deductible up to the amount of passive income.

Can passive income offset passive loss. Each and every single company on earth that manufactures or produces a product wants to sell it. I believe after several hours of research on the internet the answer is yes you can use passive loss carryover to offset up to 25k of ordinary income if you make less than 100k which my wife and myself do as we only have a household income of about 40k per year mostly from social security. They would use this lease income ordinarily passive income to offset the losses from their rentals. Losses from rental property are considered passive losses and can generally offset passive income only that is income from other rental properties or another small business in which you do not materially participate not including investments.

Passive activity losses are generally not deductible. The short answer is maybe the internal revenue service irs generally doesn t allow passive losses from real estate investments to be deducted from any type of income other than rental profits. They can be used. Classification of losses affects the ability to offset other profits profits from other activities not related to the business that the investor includes in her personal income.

And a loss that results from rental real estate is always considered to be passive even if you meet the 500 hour requirement. So if you have a passive loss from a passive activity and nonpassive income from a nonpassive activity such as a sole proprietorship that you own and run you would not be allowed to deduct a loss from the passive activity from a net profit of the sole proprietorship. Passive activity loss rules are a set of irs rules stating that passive losses can be used only to offset passive income. Passive losses can be used to offset passive income.

Likewise active losses can be used to offset active income. Currently what do you assume costs much more for that corporation. A permanent salaried and commissioned salesman with a workplace a corporate vehicle and also a business charge card. As a result of this combination of income and losses the beechers paid no tax on the rental income paid to them by their corporations this amounted to over 85 000 of tax free income over three years.

To qualify your modified adjusted gross income must not exceed 100 000 for the year. A passive activity is one wherein the taxpayer did not materially. You may not offset passive losses against nonpassive income.