Can Royalty Income Offset Passive Losses

A limited partner is generally passive due to more restrictive tests for.

Can royalty income offset passive losses. In other words if a taxpayer has a loss from a passive activity he or she will not be able to deduct the loss except against passive income. Married taxpayers may not offset income loss from separately owned property. Nonresidents are subject to pennsylvania tax on net income from rents royalties copyrights or patents from property located and or used within pennsylvania. For items of income such as royalties however how can one determine if the royalties are active or passive income.

This provision disallows losses from passive activities. Any disallowed passive activity losses are carried forward to the succeeding tax year where they again can be offset only against passive income. Here is how you can deduct passive losses from real estate taxes. There are limited partnerships that might pass passive income through a k 1.

A passive activity is one wherein the taxpayer did not materially. Oil royalties are not passive income. This deduction phases out 1 for every 2 of magi above 100 000 until 150 000 when it is completely phased out. However spouses may not offset each other s income and losses in this class.

Federal tax on royalties 3. Section 27 a of the tax code provides that gross income including royalties shall be subject to a regular corporate income tax rate of 30. Tax implications of owning a residential rental property 2. Under the passive activity rules you can deduct up to 25 000 in passive losses against your ordinary income w 2 wages if your modified adjusted gross income magi is 100 000 or less.

Passive activity loss rules are a set of irs rules stating that passive losses can be used only to offset passive income. Passive losses are only offset by passive income not income from stocks bonds interest and dividends. Rentals and businesses without material participation.

/GettyImages-951640954-158bffdec37041f5b772279def9c6d83.jpg)

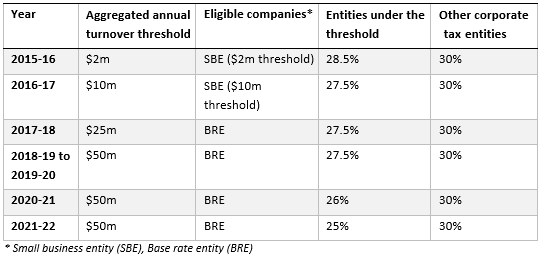

:max_bytes(150000):strip_icc()/rx-pharmacy-prescription-bottle-of-pills--100-usa-v2-1143294186-825ac411d0814eb28e822a9b3590e8d8.jpg)