Deferred Income Annuity Uk

Up to 135 000 of ira assets can buy an annuity and be exempt from required.

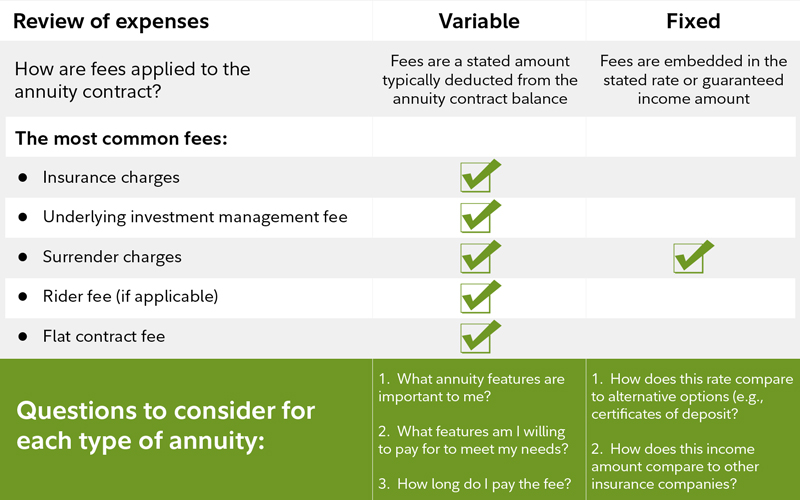

Deferred income annuity uk. Unlike its counterpart the immediate annuity the deferred annuity has two distinct components. Fixed variable equity indexed and longevity. Here the annuitant can receive an income from an annuity and use a future annuity transfer option to convert to a conventional annuity at a later date. A deferred annuity is a long term investment in which you invest a sum of money then receive payments several years down the line after the initial sum has accrued interest.

Here is an overview of four main types of deferred annuities. A contingent deferred annuity is an income guarantee that you can attach to your traditional stock and bond portfolio. Personal pension within ira. The time between purchasing your annuity and taking your income is known as the deferred period.

For example if an immediate care fees annuity were to cost 100 000 for a 20 000 annual level income then a 3 year deferred annuity may only cost 40 000 saving the estate an initial outlay of 60 000. This guide offers a more in depth look at the different types of deferred annuities available. Deferred fixed annuities have an accumulation period and an optional payout period annuitize. After they reach a certain age they receive a guaranteed income.

As deferred annuities are rarely offered by providers to individuals one way to defer an conventional annuity purchase is a with profits annuity. There customers can buy a deferred annuity at retirement. Deferred income annuities a contract is purchased now but pays out later. Deferred annuities can come with all sorts of features at a cost that provide specific types of death benefits and or future income guarantees.

An investment phase and an income phase. Deferred annuities are the opposite of immediate annuities in that you would grow your retirement plan over time versus starting an annuity income stream today. Pension quality mark chairman adrian boulding believes the uk could take inspiration from the example of individual longevity insurance in the us. A deferred care fees annuity is a variety of care fees annuity plans where although you pay the premium at outset the income provided doesn t start immediately but only after an agreed waiting or deferred period which can be normally 12 24 or 36 months.