Definition Of Relative In Income Tax For Gift

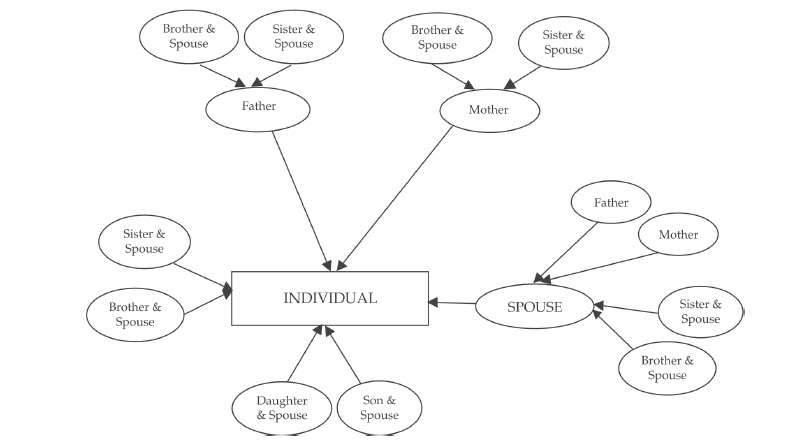

Section 2 41 relative in relation to an individual means the husband wife brother or sister or any lineal ascendant or descendant of that individual.

Definition of relative in income tax for gift. In case of an individual. Gifts received from relatives are not charged to tax meaning of relative has been discussed earlier. The persons who are considered as relatives are. 1 2 each society country is unique as it posses its distinct identity of culture and traditions.

Gift from relatives are not taxable under the income tax act. Gift received from a relative is not taxable in hands of the recipient under section 56 of income tax act. This article provides list of relatives covered section 56 2 vii of the income tax act 1961. Priti mittal jaipur any gift received in cash or kind exceeding rs 50 000 or purchase of movable or immovable property for inadequate payment is taxed in the hands of recipient as income from other sources.

Brother or sister of individual or of spouse. Hence only money received from the following persons will be exempt from income tax for an individual taxpayer. If an individual huf receives from any person or persons any gift exceeding rs. 50000 in any previous year as per income tax laws the aggregate amount shall be taxable as income from other sources in the hands of individual or huf under section 56.

As per gift tax any relative means as per section 56 2. Spouse of the individual. 1 gift any sum of money without consideration. As per the income tax act.

Brother or sister of either of the parents of the individual. For example in the case of direct taxes viz. As per the income tax act the following list of persons are defined as a relative of an individual. The gift can be the following.

Brother or sister of either parents. As per section 2 41 of the income tax act 1961 relative in relation to an individual means the husband wife brother or sister or any lineal ascendant or descendant of that individual. Brother or sister of the individual. The definition is explained further in section 56 2 vii under which it is cleared that gifts received from relatives are not chargeable under income from other sources further clarifying that they are not taxable.

As per the income tax act. Brother or sister of the spouse of the individual. As per section 56 2 vii if any gift received from relative which are covered under following list will be exempt in the hands of receiver. Section 2 41 relative in relation to an individual means the husband wife brother or sister or any lineal ascendant or descendant of that individual.

Brother or sister of the individual. Friend is not a relative as defined in the above list and hence gift received from friends will be charged to tax if other criteria of taxing gift are satisfied. As per gift tax any relative means as per section 56 2 spouse. Let us understand the definition of relatives as per the income tax act for gift and under fema.

What is the current law on gifts tax.