Excess Passive Income Tax

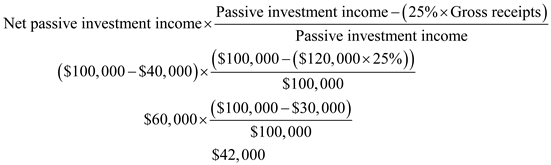

The surplus net passive income is 42 000.

Excess passive income tax. However i m still new to turbo tax and tax in general. And 2 the net passive income less deductions is multiplied by this percentage to arrive at excess net passive. The excess net passive income tax applies if passive income is more than 25 of the s corporation s gross receipts. In particular passive losses are typically deductible only against passive income and.

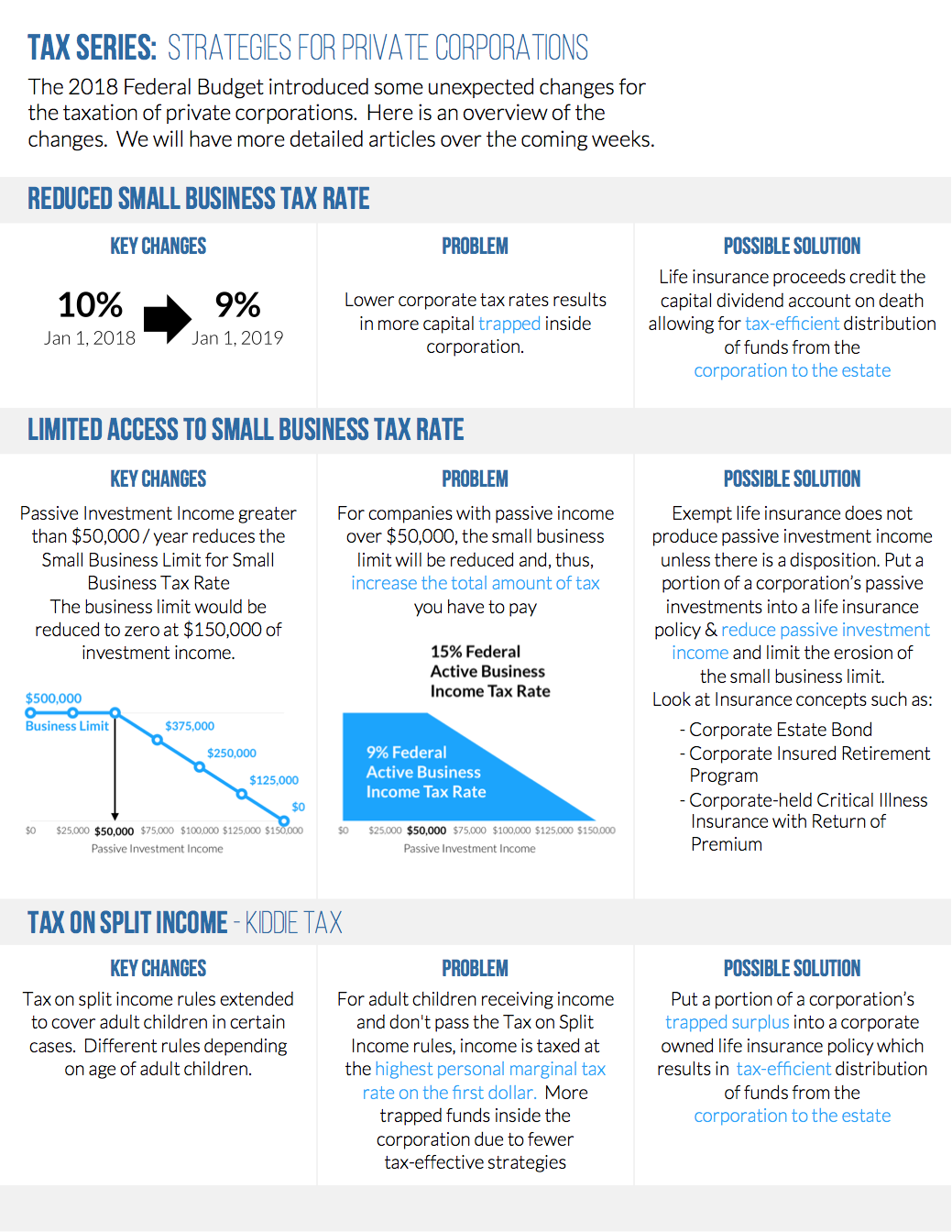

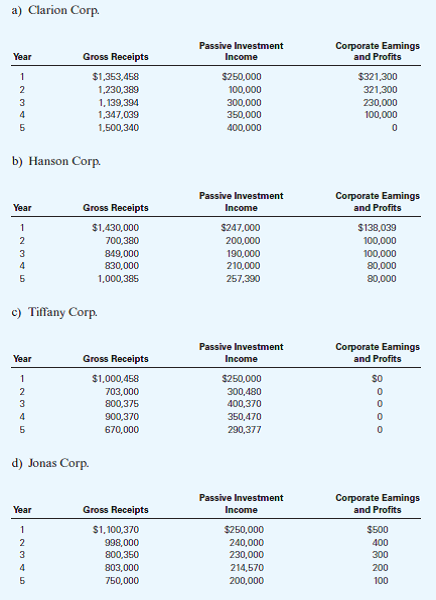

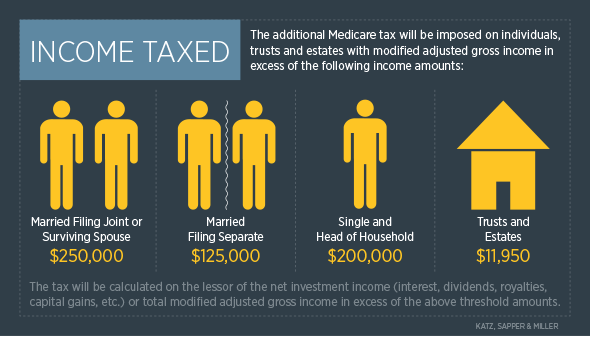

Excess net passive income tax. Passive income includes income from interest dividends annuities rents and royalties. Excess net passive income is a corporate level tax on the passive income earned by an s corporation. The threshold for the enpi calculation is triggered when gross enpi is greater than 25 of gross receipts and the corporation has e p at year end.

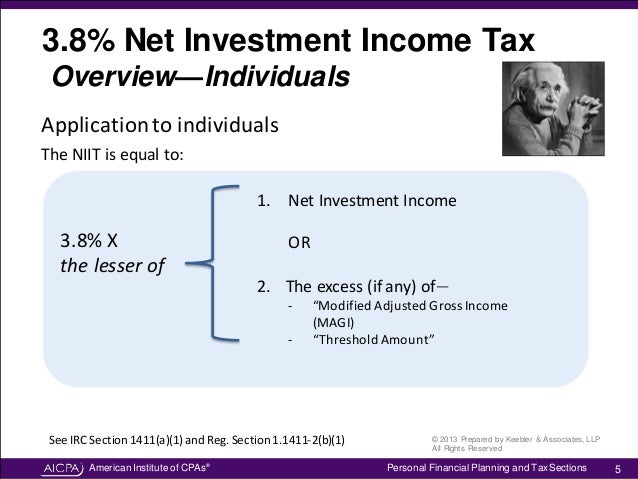

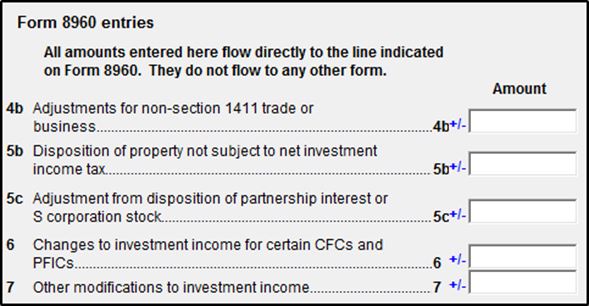

Excess net passive income is computed under a formula in which 1 the passive investment income in excess of 25 of gross receipts for the taxable year is divided by the corporation s passive investment income for the taxable year. Surplus net passive income tax is calculated 35 of least of the following. Surplus net passive income. Passive activity income often gets very different tax treatment from the ordinary income that people have.

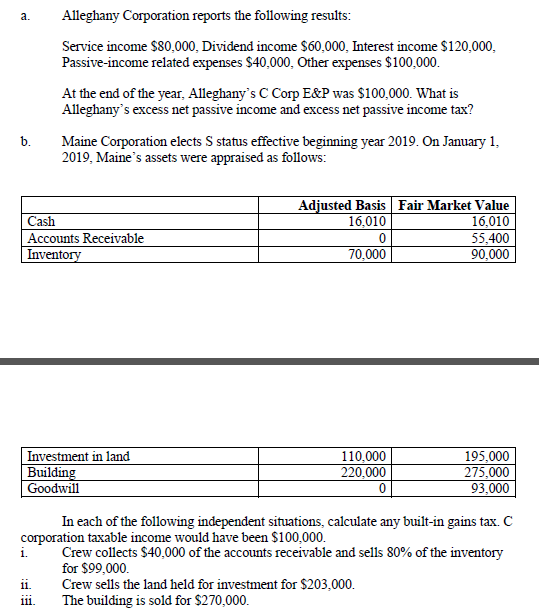

A corp s surplus net passive income tax needs to be computed under following scenarios as shown below. Taxable income if it was still a c corporation is 40 000. Excess net passive income tax if an s corporation previously operated as a c corporation and has accumulated earnings and profits at the end of the year from a prior c corporation year it may be subject to the excess net passive income tax. By reducing taxable income the s corporation is able to minimize the passive income tax.

53 congress created this tax to encourage s corporations to distribute their accumulated earnings and profits from prior c corporation years. It is still placing me back onto the excessive net passive income tax. I ve never done this and was wondering what is that. Also the passive income tax calculated using the lesser of excessive net passive income or taxable income.

Hi thank you for answering this. Can you please explain this in lemans term. Even if there is no taxable income and the sting tax does not apply if the s corporation has both e p and excess passive investment income for three consecutive tax years then under section 1362 d 3 the s corporation status will be lost on the first day of the fourth tax year. Passive income when used as a technical term is defined as either net rental income or income from a business in which the taxpayer does not materially participate and in some cases.