Fedloan Income Driven Repayment Plan Calculator

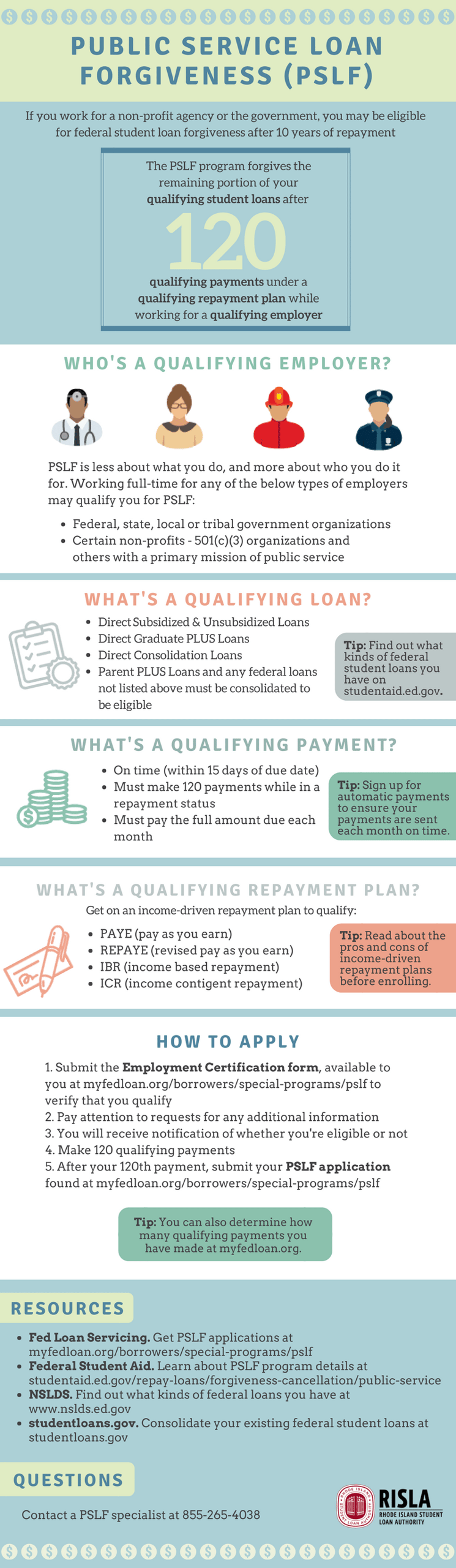

Income based repayment ibr is available to federal student loan borrowers and helps make your monthly student loan payments more manageable.

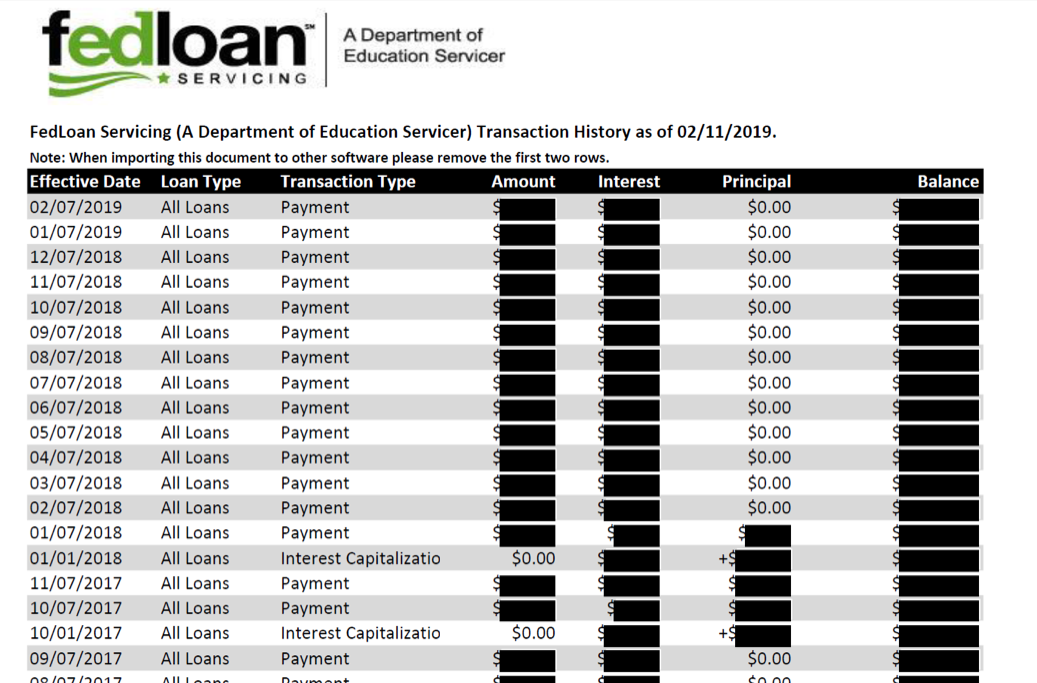

Fedloan income driven repayment plan calculator. Payments are generally adjusted based on your income using the lesser of. It also compares your loans on ibr with the standard 10 year plan so you can see how your monthly payments loan term and overall balance would change. It can account for compounding periods payment frequency and either a fixed loan term or fixed payback amount. Discretionary income is what you have left after taxes and an allowance for necessary spending such as food and shelter.

20 of your discretionary income. Like the rest of the plans it sets your monthly payments based on your income family size and other financial factors. Experiment with many other loan related calculators or explore hundreds of other calculators addressing finance math fitness health and many more. There are three other income driven repayment options offered by the federal government.

These plans are typically better options for borrowers who are eligible as they have lower monthly payment caps 10 15 as well as shorter repayment. Our income based repayment ibr calculator will show you how much you ll pay towards your student loans under this federal repayment plan. This income based repayment calculator reveals what your monthly payments would be if you put your student loans on ibr. Federal student loan borrowers pay a percentage of their discretionary income 10 15 or 20 depending on the specific income driven repayment plan you choose.

You may be eligible for an income based repayment ibr which is based on your ability to pay. After making payments for years you will have paid a total of and would receive in forgiveness compared to your current plan where you will pay over the next years. Payments are made for up to 25 years. Federal student aid.

Of the 4 available income driven repayment plans available income based repayment is the most widely used. Check out income based repayment ibr pay as you earn paye and income contingent repayment icr. Your obligations are dependent on factors such as income life changes family size and how and when you file your tax return. The amount you would pay under a fixed repayment plan over 12 years.

Assuming annual income growth of 3 5 your final monthly payment would be. Fill out your information in the income based repayment calculator to see what your federal student loan payments could be.