Final Withholding Tax On Passive Income

A withholding tax or a retention tax is an income tax to be paid to the government by the payer of the income rather than by the recipient of the income.

Final withholding tax on passive income. The taxpayer actually shoulders the tax but it is the income payor who withholds and pays the tax the amount of tax withheld if final pm. T foreign governments and foreign government owned and controlled corporations are exempt from final tax. Section 27 d on the other hand provides that certain passive income which also includes royalties shall be subject to a final withholding tax rate of 20. The tax is thus withheld or deducted from the income due to the recipient.

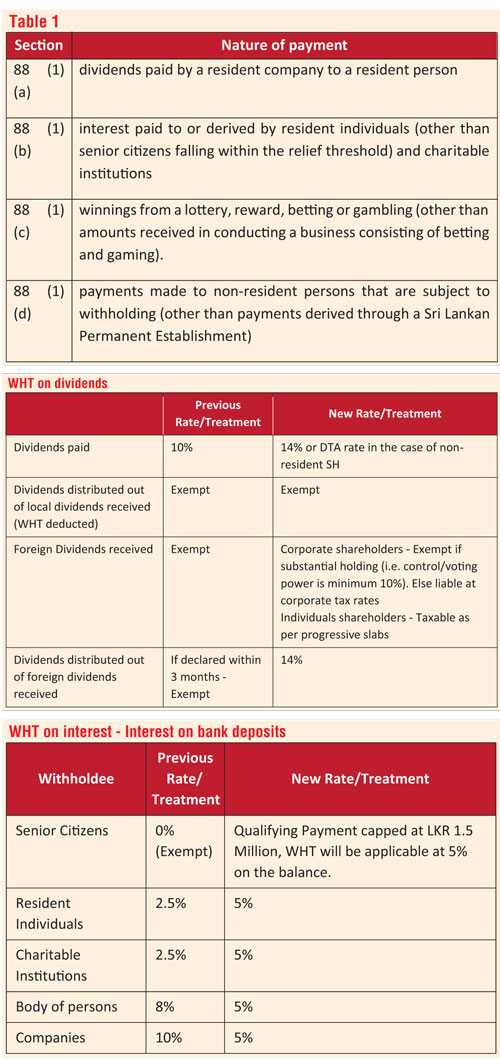

Section 27 a of the tax code provides that gross income including royalties shall be subject to a regular corporate income tax rate of 30. Withholding tax rates on final income taxes bir form 1601 f. The final regulations implement an amendment made by the tax cuts and jobs act of 2017 tcja to internal revenue code code section 3405 which changed the default rate of withholding that applies when no withholding certificate is in effect on periodic payments from being determined by treating the payee as a married individual. This tax is usually a final tax on the interest payment in the source state for the non resident lender.

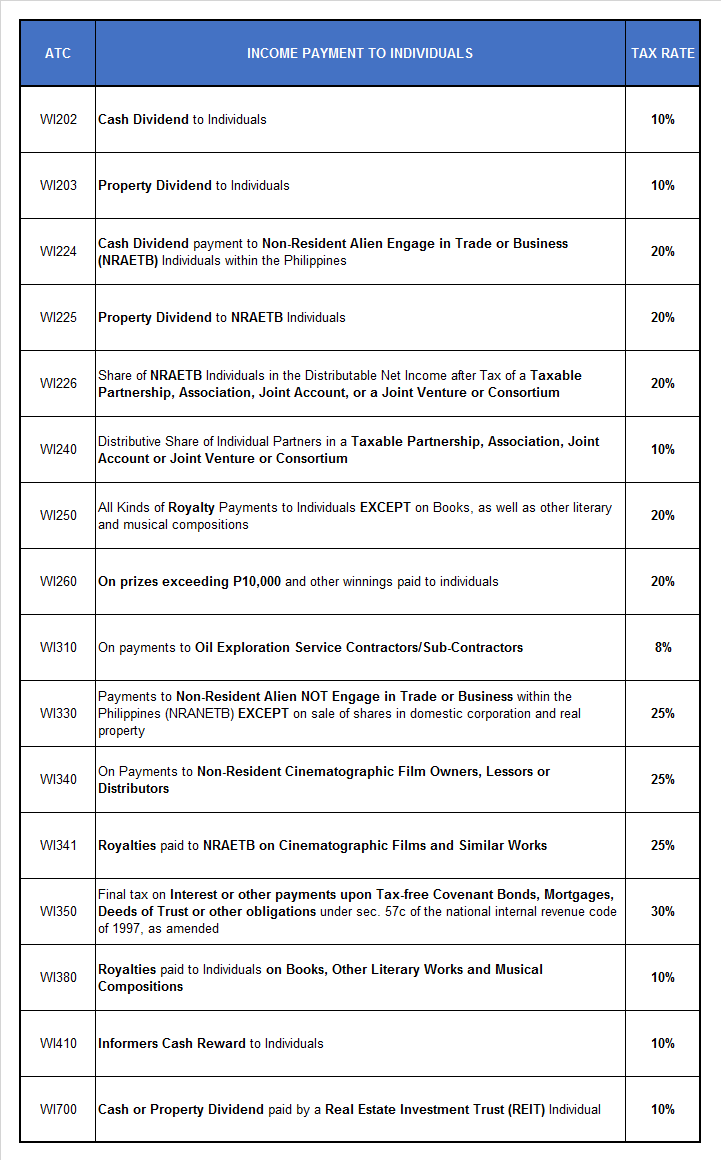

Enrico tabag 1 235 views. Nature of income payments tax rates royalties paid to citizens resident aliens and nraetb on books other literary works and musical compositions 10 withholding tax rates on final income taxes bir form 1601 f. In most jurisdictions withholding tax applies to employment income. The newly approved train tax reform law also adjusted the tax rates on certain passive income in addition to revised personal income tax rates and new taxes imposed on oil sugary beverages tobacco mining etc.

8 2018 which discusses the income tax provisions of the train law. What is passive income and how to make more of it. In cases where the agreed interest is paid free of taxes the withholding tax is levied on the grossed up amount. Final tax interests passive income prizes royalties this is subject to final withholding income tax as follows.

The taxpayer has no more responsibility to file an income tax return for the passive income covered subject to fwt. Passive income final tax posted by jonathan ruiz cpa may 15 2017 may 7 2017 posted in taxation tags. Many jurisdictions also require withholding tax on payments of interest or dividends. F the final withholding tax return shall be filled by the withholding agent on or begore the 15 th day of the month the final taxes were withheld.

Which is correct with regard to the final income taxation. Final withholding tax fwt and creditable withholding tax cwt duration. Multiple choice 1 1.