Income Annuity Prior To 59 1 2

Money in an annuity grows tax deferred with distributions after age 59 1 2 being added to ordinary income.

Income annuity prior to 59 1 2. Yes it has its tax benefits but these pale in comparison to iras and 401ks especially when you consider the additional estate planning and asset protection benefits of a true retirement account. Returns of contributions and earnings. Your taxable account is your least tax efficient way to invest. The irs imposes penalties for withdrawing money from a non qualified annuity prior to age 59 1 2.

For example if the annuity is part of an ira 403 b or similar tax advantaged vehicle a qualified annuity the. The income taxation of annuities are dependent on how the contract is held. The circumstances on how the annuity was created may affect how it is taxed when it is distributed. Since the growth portion of your annuity account is withdrawn first the entire amount of the early distribution will be fully taxable in addition to a 10 percent penalty.

Taxes on distributions when you cash out your annuity the money you receive gets split into two categories. Annuity product guarantees rely on the financial strength and claims paying ability of the issuing insurer. Even if you re well past your contract s surrender period if you take money out of an annuity before you reach the age of 59 1 2 you. A retirement annuity may have been created by an employer retirement plan an ira annuity or as a supplemental retirement account.

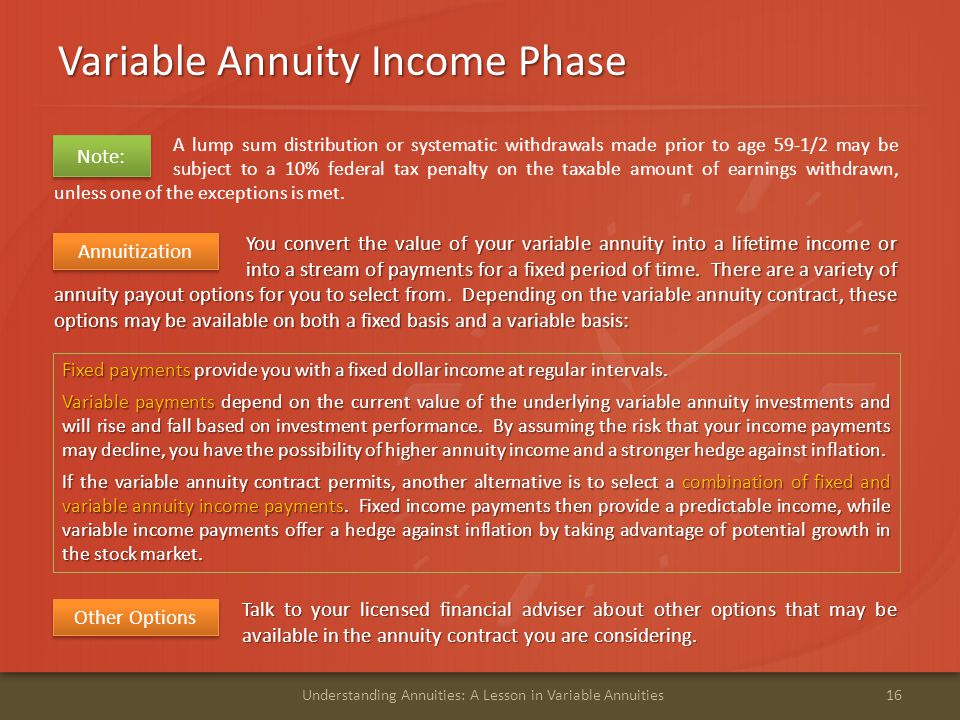

8 tips for getting to your money before age 59 1 2 1 burn your taxable account first. In that case the irs exempts certain distributions from the penalty tax if the account that is making the distributions is a lifetime immediate annuity. However if you cash out before you turn 59 1 2 you could face not only taxes and penalties from uncle sam but also surrender charges from your financial institution. A 10 irs penalty may apply to withdrawals prior to age 59.