Income Approach Appraisal Example

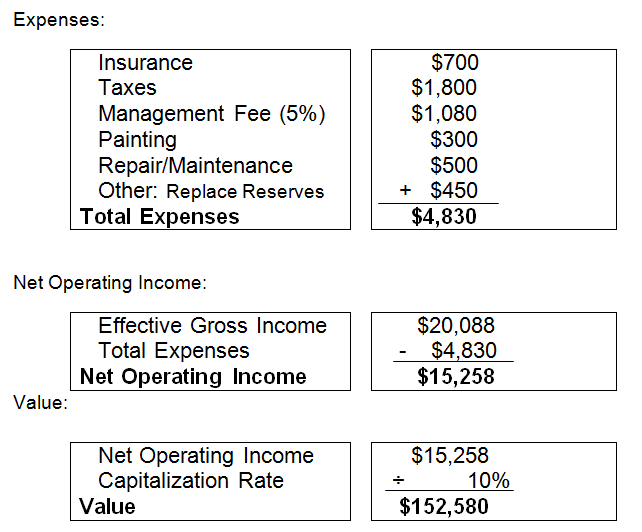

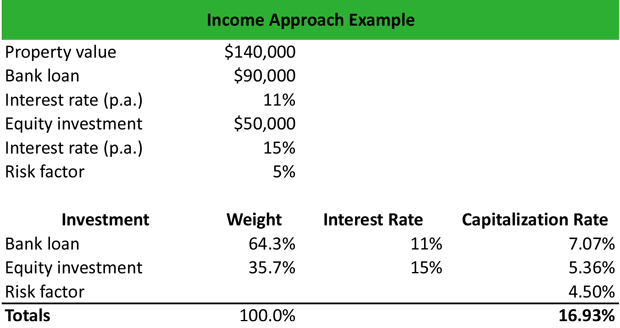

He is asked to calculate the capitalization rate of a real estate investment for a client using the income approach valuation method and determine the property s present value.

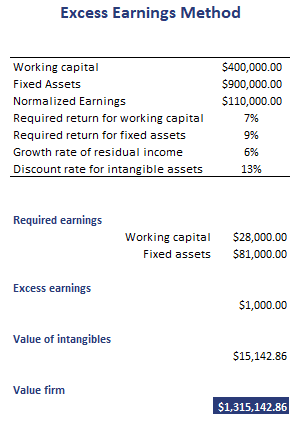

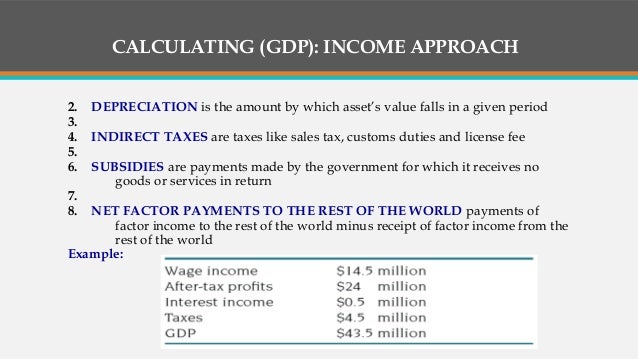

Income approach appraisal example. Nicholas is an investment advisor. The asset based valuation approach will typically yield the lowest valuation of the 3 approaches for a profitable company but it may result in an appropriate value depending on the situation. Net operating income i sales price v capitalization rate r this formula is applied using the net operating income and sale price of each comparable that you re analyzing. This approach to value is best suited for income generating properties that has adequate market data because it is meant to reflect the behaviors and expectation of participant of typical market.

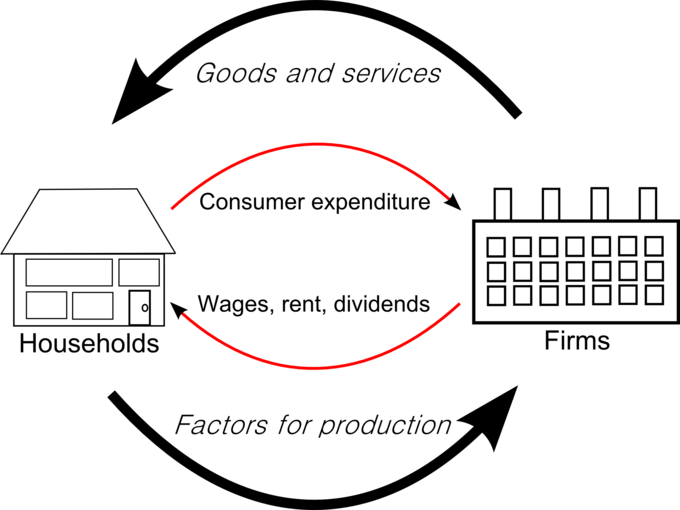

A building sells for 200 000. When a property s intended use is to generate income from rents or leases the income method of appraisal or valuation is most commonly used. The income approach sometimes referred to as the income capitalization approach is a type of real estate appraisal method that allows investors to estimate the value of a property based on the. The net income generated by the property is measured in conjunction with certain other factors to calculate its value on the current market if it were to be sold.

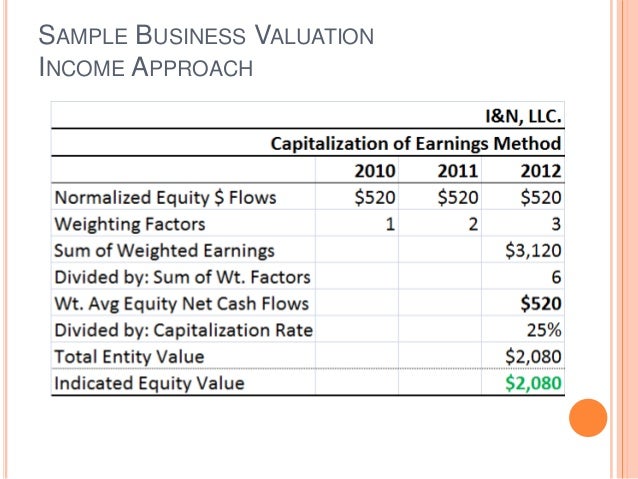

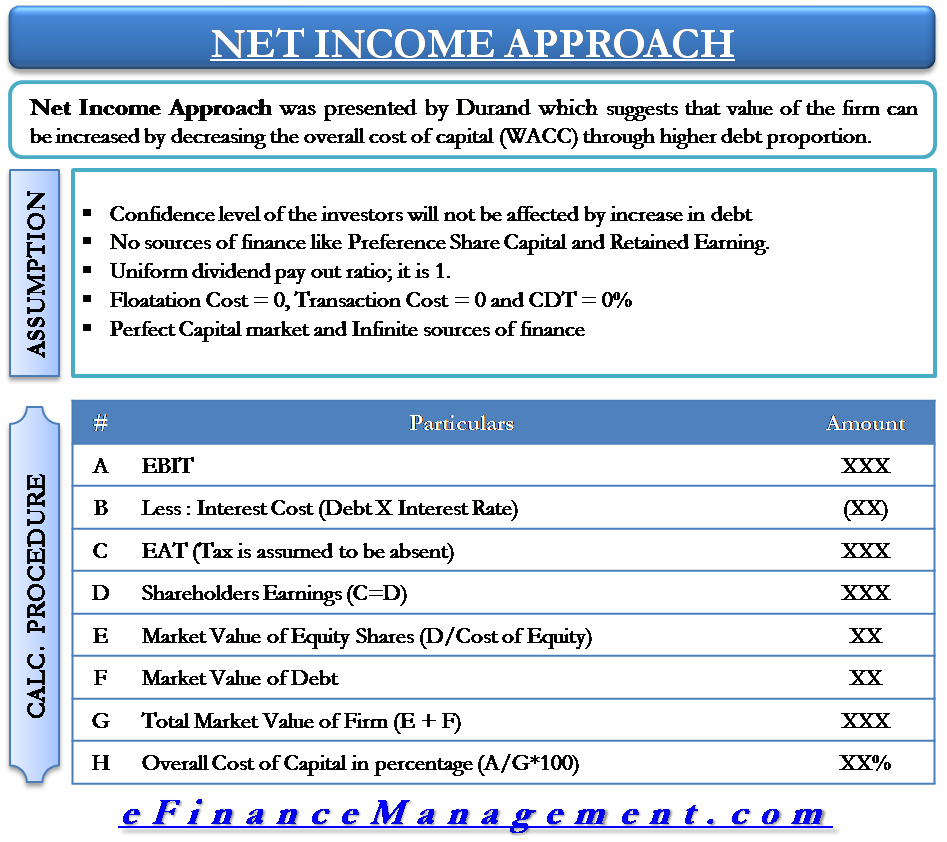

The income approach includes two methods the simpler of the two is the direct capitalization method which this post will cover. To summarize the discounted cash flow method is an income based approach to valuation that is based on the company s ability to generate cash flows in the future. An example of a direct to equity discounted cash flow analysis is presented below. The three most common are the cost approach the sales comparison method and the income approach.

The income capitalization approach is the approach which is applied to determine the value of an investment or commercial property. The income approach is one of three techniques commercial real estate appraisers use to value real estate. For example let s consider a retail business which has only one location. In commercial real estate there are a few generally accepted methods for appraising or valuing real property.

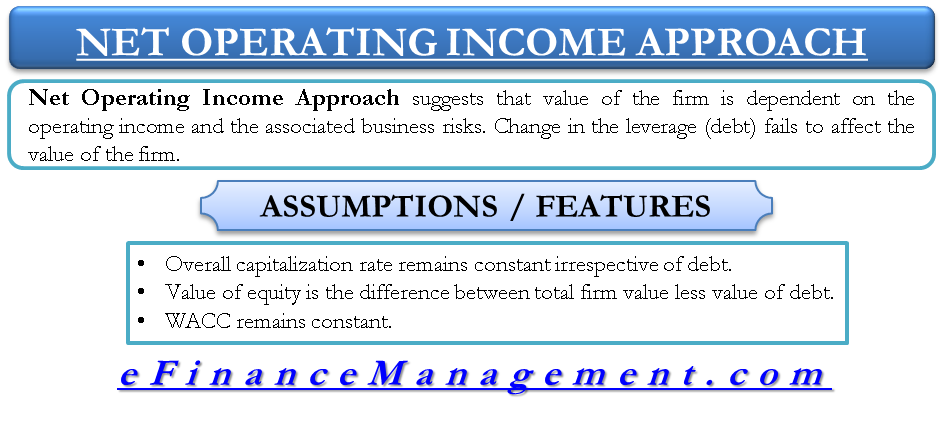

In income approach of business valuation a business is valued at the present value of its future earnings or cash flows. Future earnings cash flows are determined by projecting the business s earnings cash flows and adjusting them for changes in growth rate cost structure and taxes etc. Asset approach may be used in conjunction with the other valuation methods. Its net operating income is 20 000.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)