Income Approach Business Valuation Calculator

Business valuation bv is typically based on one of three methods.

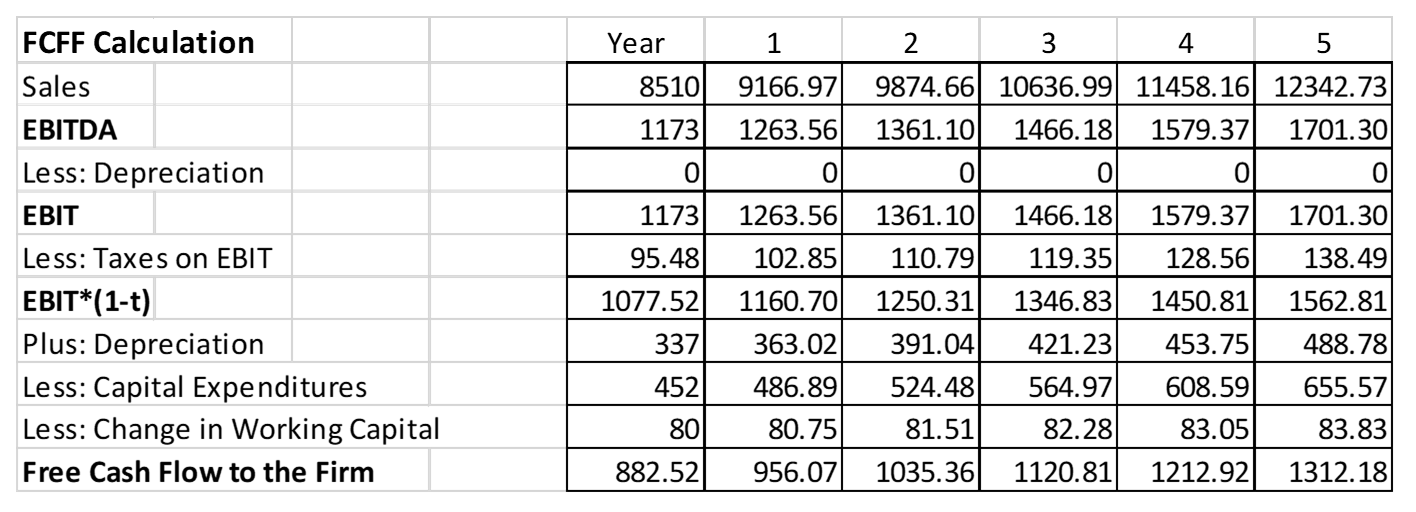

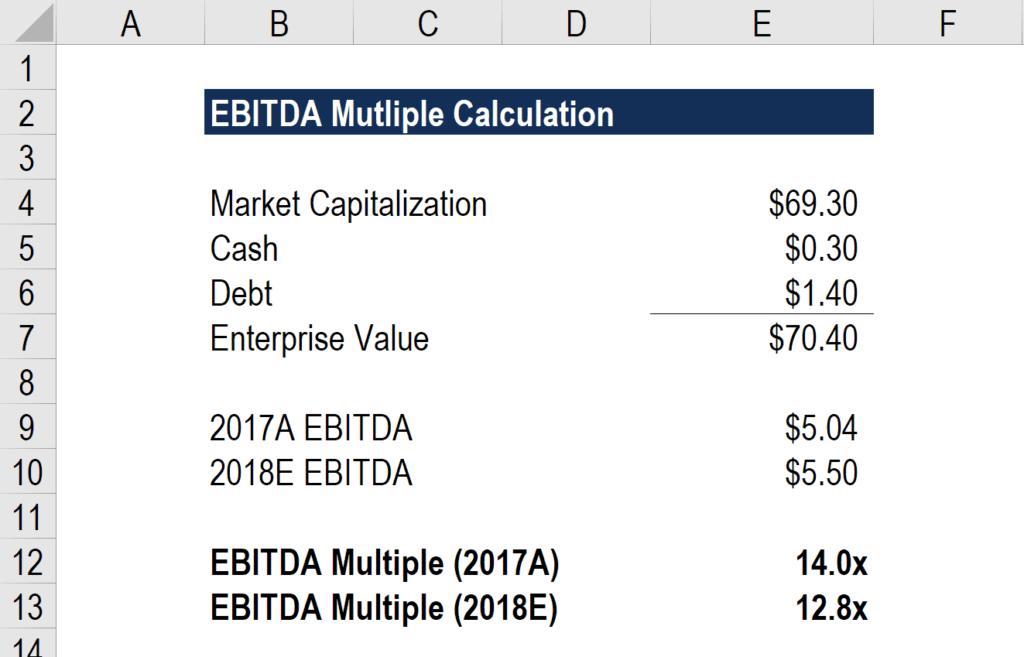

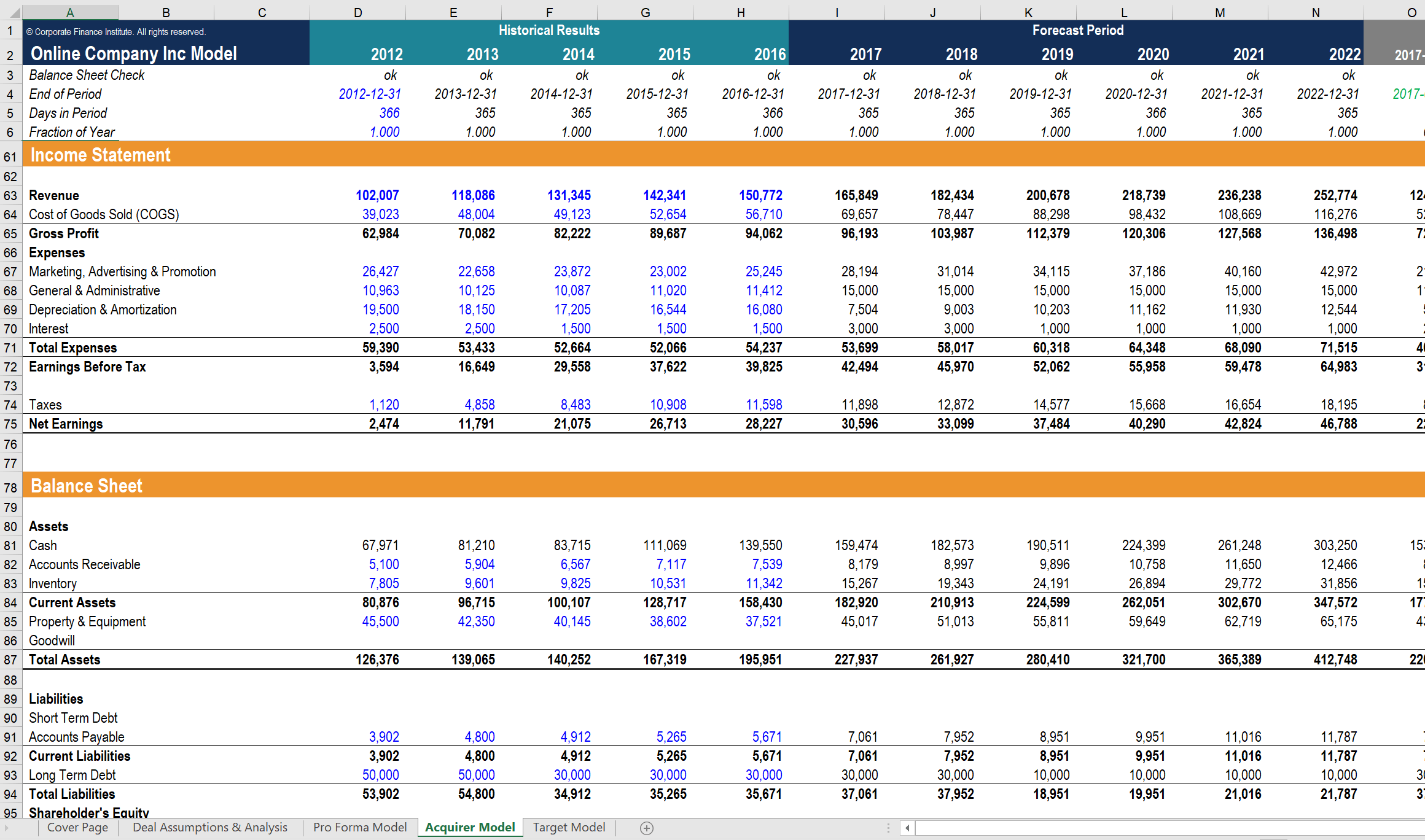

Income approach business valuation calculator. Business valuation business valuation is typically based on three major methods. The income approach the asset approach and the market comparable sales approach. Among the income approaches is the discounted cash flow methodology that calculates the net present value npv of future cash flows for a business. Two of the most common business valuation formulas begin with either annual sales or annual profits also known as seller discretionary earnings multiplied by an industry multiple.

A business valuation calculator helps buyers and sellers determine a rough estimate of a business s value. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for. The income approach the cost approach or the market comparable sales approach. Among the income approaches is the discounted cash flow methodology calculating the net present value npv of future cash flows for an enterprise.

The multiple is similar to using a discounted cash flow or capitalization rate used by top business. The formula we use is based on the multiple of earnings method which is most commonly used in valuing small businesses. Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings. The income approach the asset approach and the market comparable sales approach.

Both methods are great starting points to accurately value your business.