Income Approach Business Valuation Example

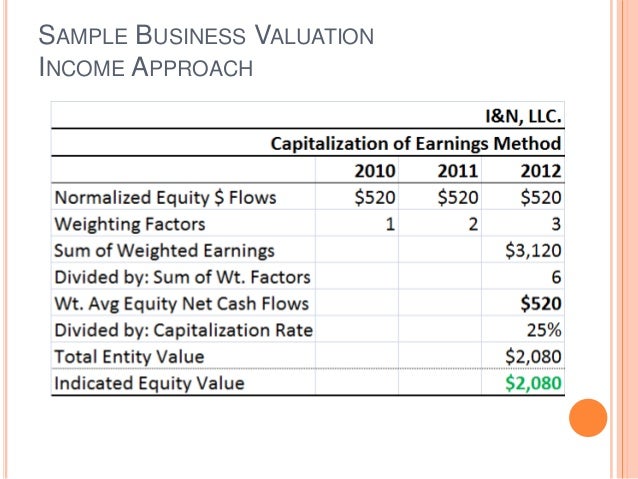

This is an income valuation approach that determines the value of a business by looking at the current cash flow the annual rate of return and the expected value of the business.

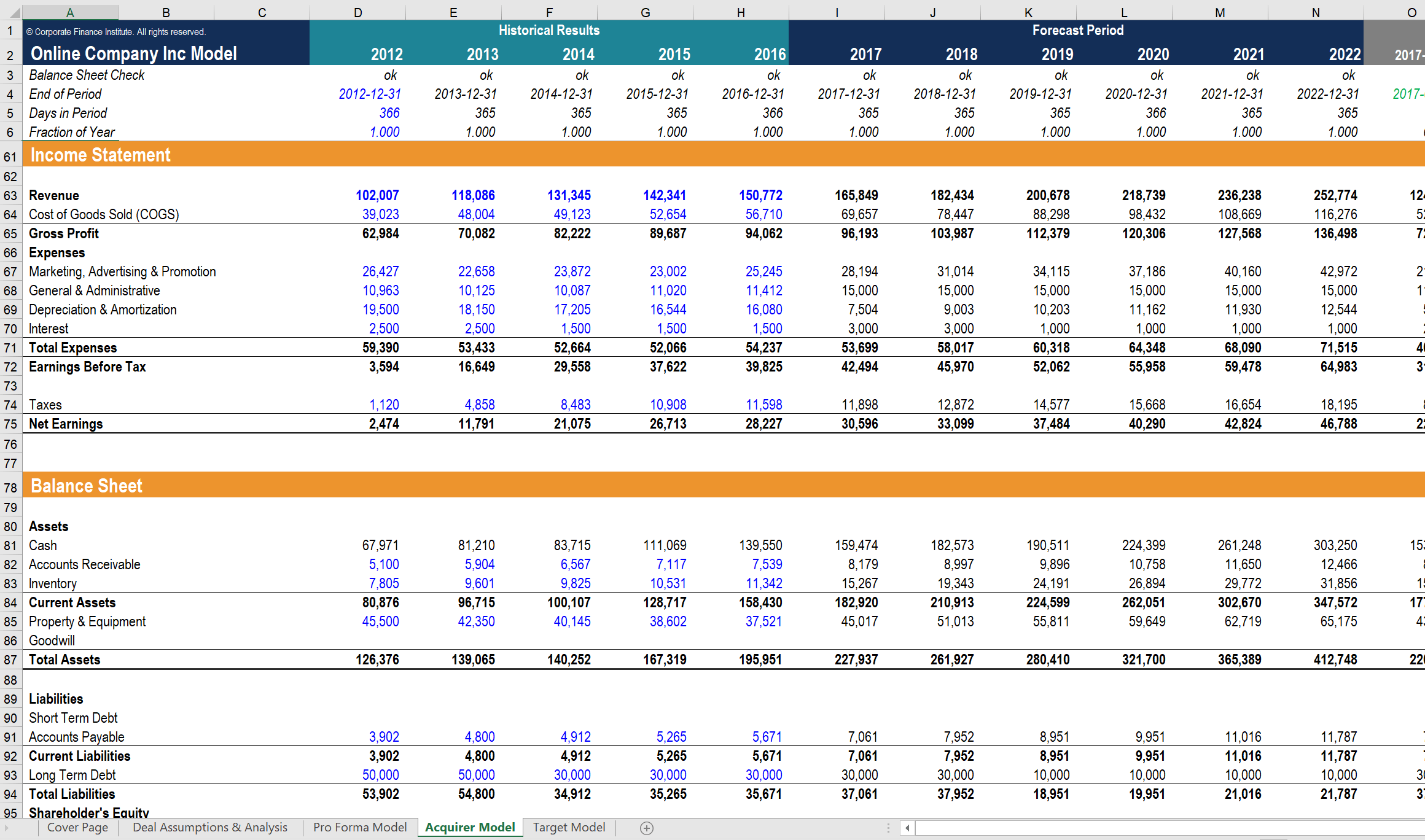

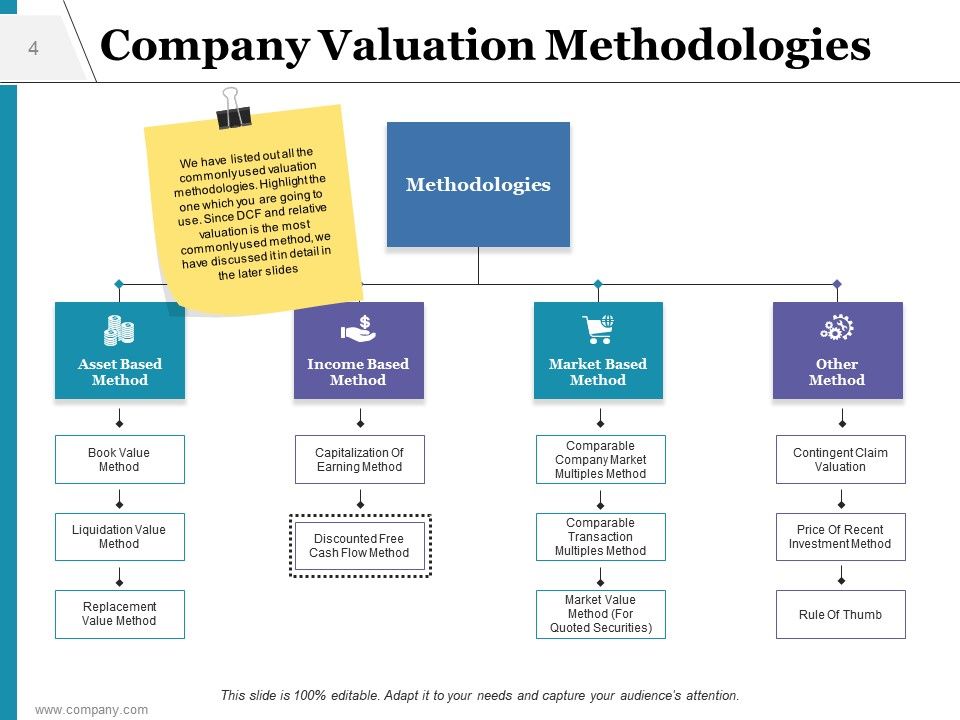

Income approach business valuation example. Perform an income approach valuation using both the capitalization of benefits and discounted future benefits methods. Determining the market value of debt. The discounted cash flow dcf method is an income oriented approach. Under the asset approach you adopt the view of a business as a set of assets and liabilities.

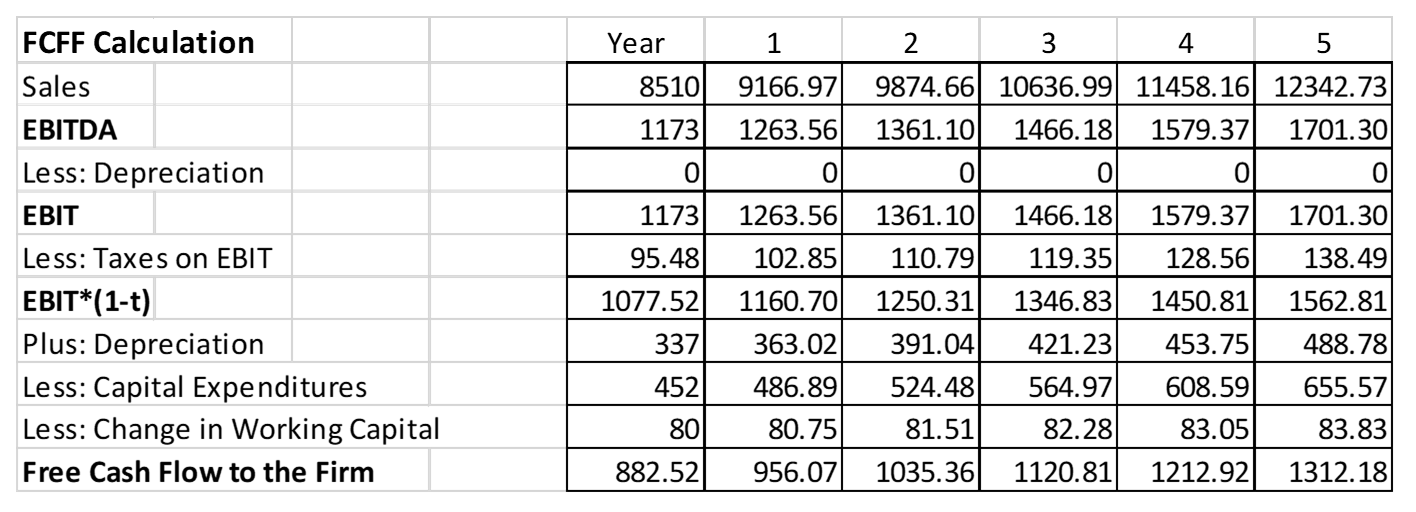

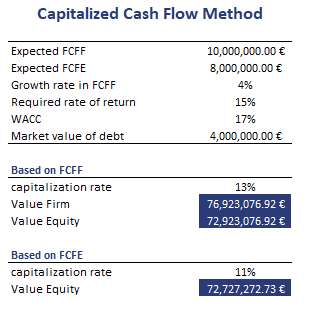

An asset based valuation approach is usually adopted when a business has a very low or negative value as an ongoing business. Discounted cash flow method the discounted cash flow method is an income based approach to valuation that is based upon the theory that the value of a business is equal to the present value of its projected future benefits including the present value of its terminal value. More information related to the discounted cash flow method is provided below along with an example. Basically it is an income approach with a business valuation formula that determines what a company is worth by looking at the expected future value the annual rate of return and the current cash flow.

Consider the case of an airline company that has few routes high labor and operating costs and is losing money every year. Louis presents a summary of valuation methods such as income approach and discounted cash flow dcf model. In income approach of business valuation a business is valued at the present value of its future earnings or cash flows. These types of issues can result in a significant amount of dickering over the valuation of a business.

Discounted cash flow dcf method. The balance sheet elements serve as building blocks to create the picture of business value. How to value a business three ways. So under this method the value of the business is determined by discounting its future earnings.

Income approach cont d understand when to use and how to derive and apply the weighted average cost of capital wacc. For example a competitor has sales of 3 000 000 and is acquired for 1 500 000. Using the other valuation methodologies one can derive a negative valuation for the company. Future earnings cash flows are determined by projecting the business s earnings cash flows and adjusting them for changes in growth rate cost structure and taxes etc.

Approach where an analyst forecasts the business unlevered free cash flow cash flow cash flow cf is the increase or decrease in the amount of money a business institution or individual has.