Income Approach Intangible Asset Valuation

Based on the economics principle of anticipation.

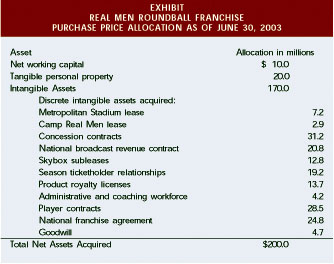

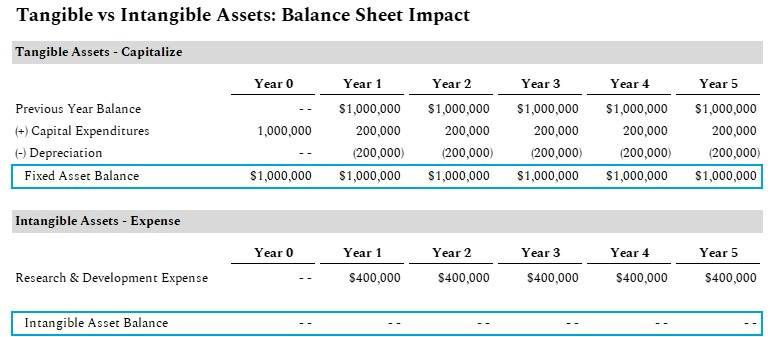

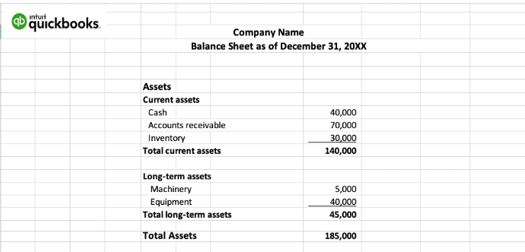

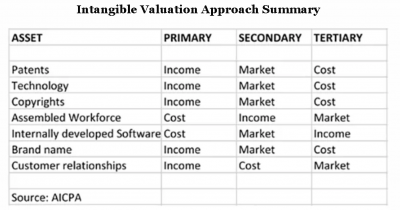

Income approach intangible asset valuation. Five of the more common valuation methods for intangible assets that are within the framework of the cost market and income approach are described below. Valuation models for intangible assets. These approaches can be integrated into an analysis of non gaap kpis and other conceptual frameworks. Just as in other valuation assignments an income approach technique converts future benefits such as cash flows or earnings to a single discounted amount usually as a result of increased turnover or cost savings.

Income based models are best used when the intangible asset is income producing or when it allows an asset to generate cash flow. That is the value of any investment is the pres ent value of the income that the owner expects to receive from owning that investment. In this approach income and expense data relating to the intangible asset is being valued and estimated. These approaches have much in common with those used for brand valuation business valuation and intellectual property valuation.

When carrying out an intangible asset valuation intangible business adopts widely accepted approaches based on a combination of the income market and cost approaches. Applied to the intangible asset. All income approach methods involve a projection of some. All income approach valuation methods are.

K2 unrecognized intangible assets without market value k 3 w 3 3.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Difference_between_Revenue_and_Sales_Oct_2020-012-e50d6c289ebf4d00987fbae938815fd4.jpg)