Income Approach Real Estate Calculator

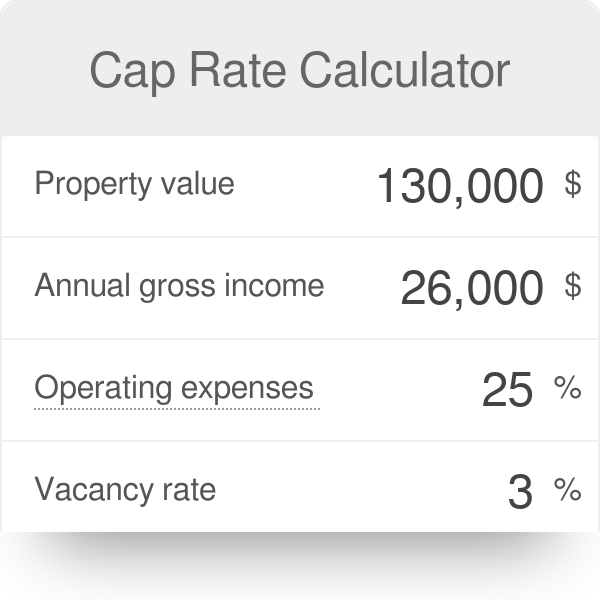

25 000 is the estimate of the valuation of this property using the income capitalization approach.

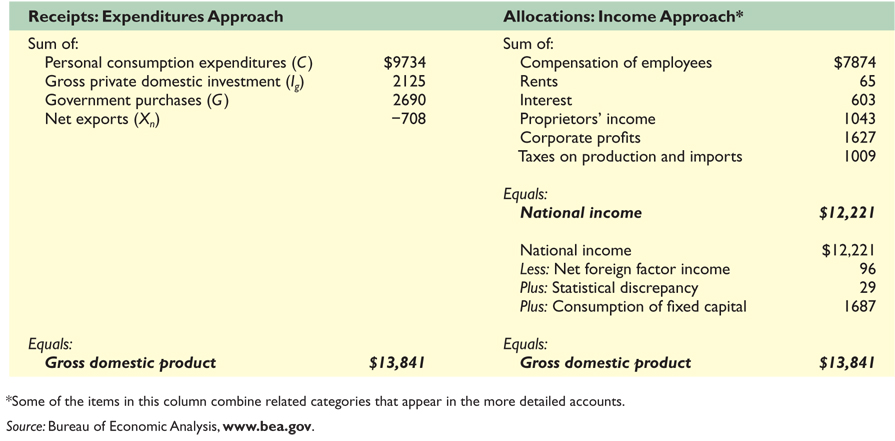

Income approach real estate calculator. This method converts the income of a property into an estimate of its value. Appraisers generally use this method for commercial buildings such as shopping centers office buildings. If a rental cottage costs 120 000 to buy and the projected monthly income from the rental is 1 200 the capitalization rate is 12 percent 12 x 1200 120 000. The income approach is a real estate valuation method that uses the income the property generates to estimate fair value.

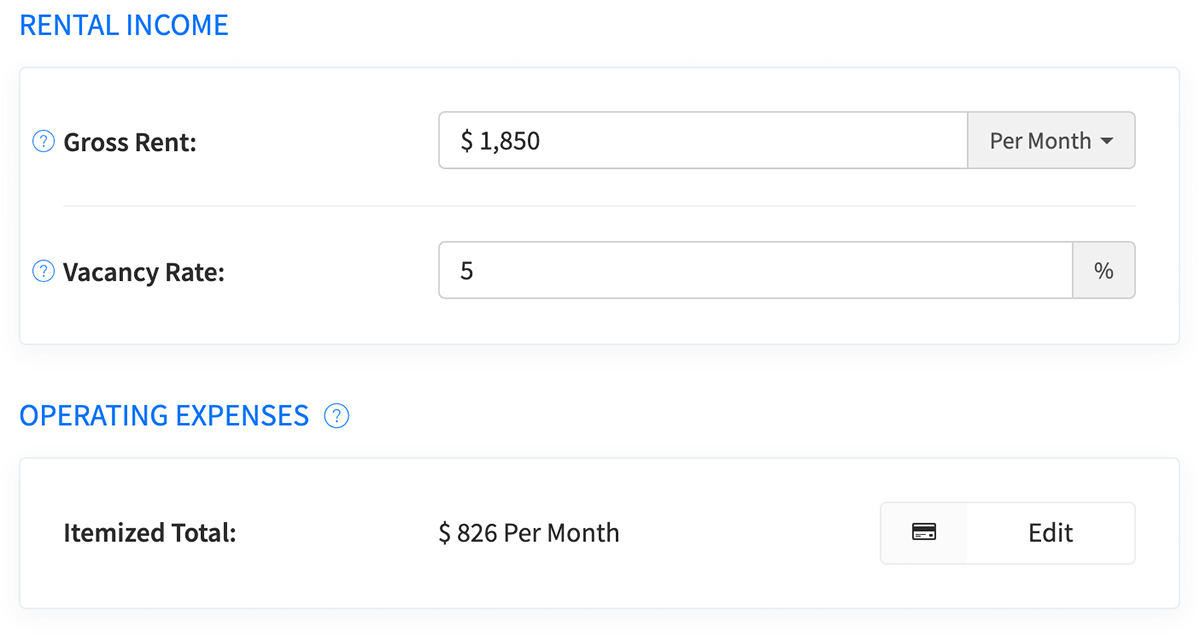

The income approach is one of three techniques commercial real estate appraisers use to value real estate. Real estate investments generate income through rent some people invest in properties such as buildings commercial complexes or houses for the purpose of renting them out. When a property s intended use is to generate income from rents or leases the income method of appraisal or valuation is most commonly used. The income approach only works if you have an accurate net operating income for the property.

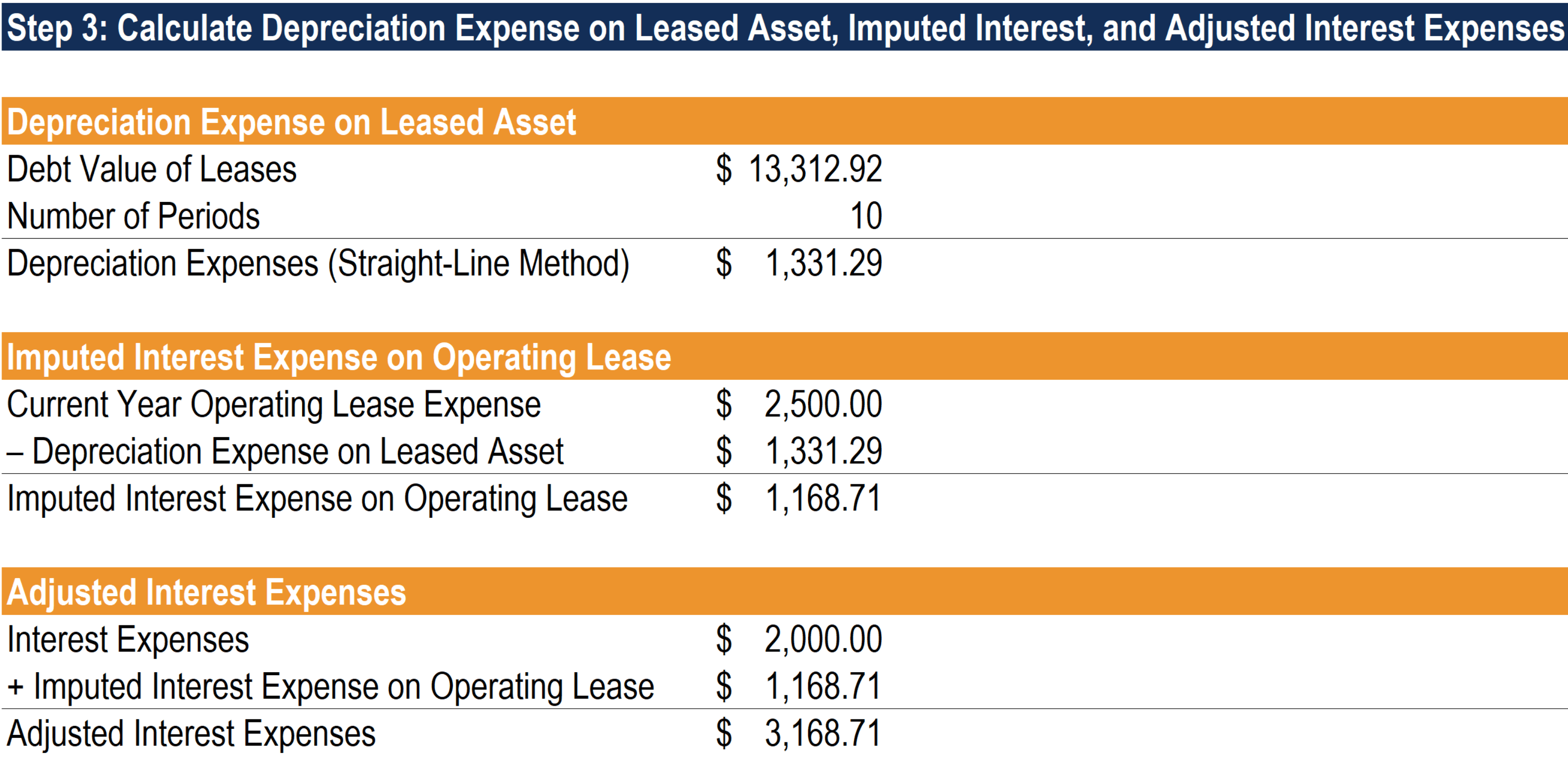

It is calculated by dividing the net operating income by the capitalization rate. Dscr debt service coverage ration noi net operating income nim net income multiplier cap capitalization ratio and more. The net income generated by the property is measured in conjunction with certain other factors to calculate its value on the current market if it were to be sold. A method that will be covered on the real estate license exam for appraising real estate based on its income is known as the income capitalization approach.

This calculator will compute several important factors for determining the potential and viability of an existing or proposed residential income property. Income generating properties include warehouse units apartments office buildings rental houses and more. To calculate the noi start by annualizing the property s rental income and subtracting a vacancy. Compared to the other two techniques the sales comparison approach and the cost approach the income approach is more complicated and therefore it is often confusing for many commercial real estate professionals.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)