Income Approach To Value Would Be Most Important In The Appraisal Of

They are all in regular use either individually or collectively by brokers commercial real estate assessors investors and the general public.

Income approach to value would be most important in the appraisal of. The sales comparison approach to value would be most important when estimating the value of a n a. The income approach is one of three techniques commercial real estate appraisers use to value real estate. When a property s intended use is to generate income from rents or leases the income method of appraisal or valuation is most commonly used. The income approach to value would be most important in the appraisal of a.

This approach to value bases its opinion of value on what similar properties otherwise known as comparables or comps in the vicinity have. The sales comparison approach. The income approach is a real estate appraisal method that allows investors to estimate the value of a property based on the income it generates. This approach to value is best suited for income generating properties that has adequate market data because it is meant to reflect the behaviors and expectation of participant of typical market.

The second income approach method is the discounted. The net income generated by the property is measured in conjunction with certain other factors to calculate its value on the current market if it were to be sold. The income approach to value would be most important in the appraisal of a n a. The appraisal methods follow different approaches to the valuation of a property.

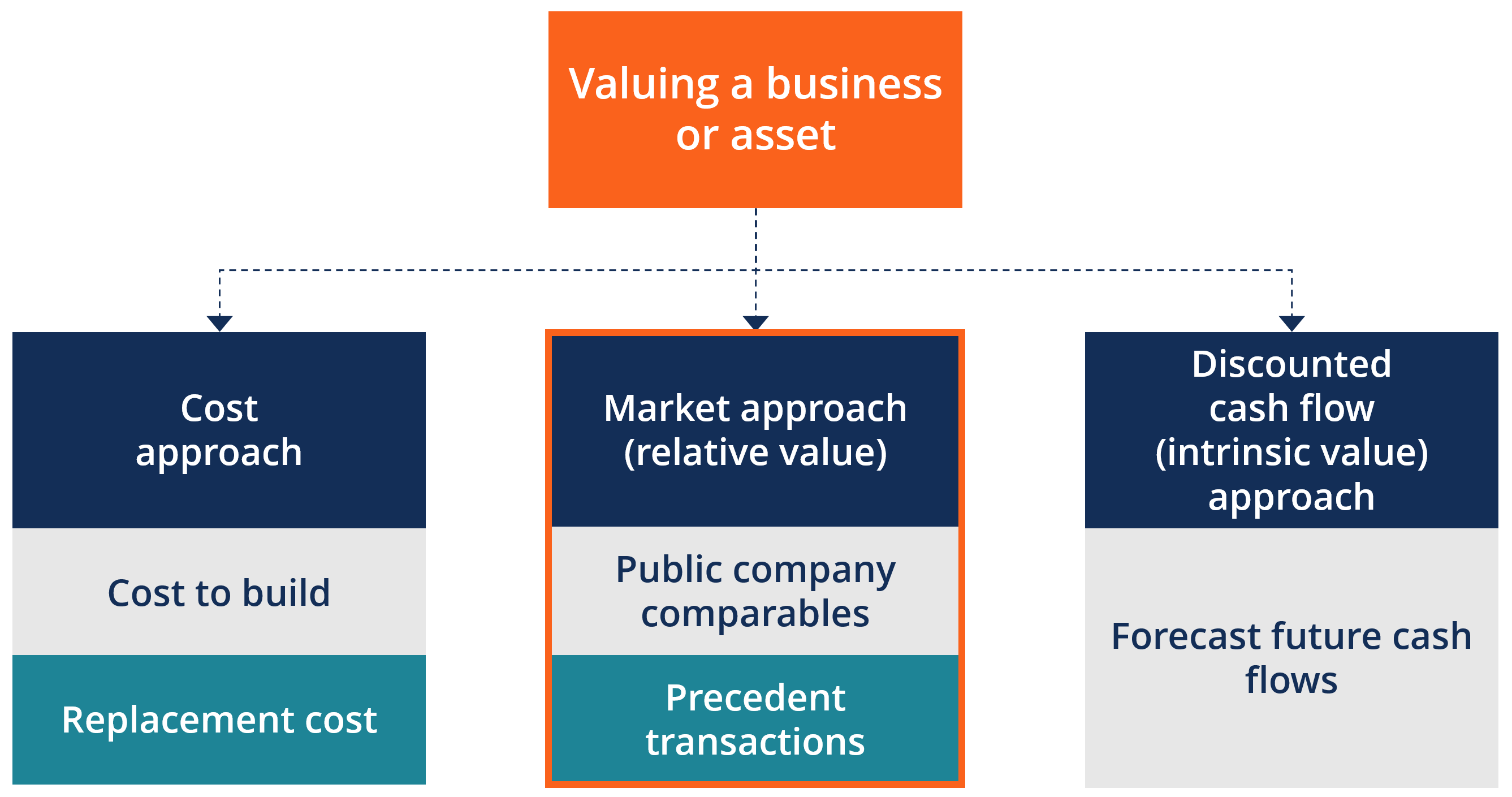

Apply the most appropriate approach es to value i e the sales comparison approach cost approach and or income approach. A vacant residential lot. The income approach includes two methods the simpler of the two is the direct capitalization method which this post will cover. The three most common are the cost approach the sales comparison method and the income approach.

The income approach. In commercial real estate there are a few generally accepted methods for appraising or valuing real property. For personal property the sales comparison approach is normally the. Estimate the value of the property.

The purpose of an appraisal is to a. The income capitalization approach is the approach which is applied to determine the value of an investment or commercial property. Compared to the other two techniques the sales comparison approach and the cost approach the income approach is more complicated and therefore it is often confusing for many commercial real estate professionals.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)