Income Approach Valuation Calculator

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)

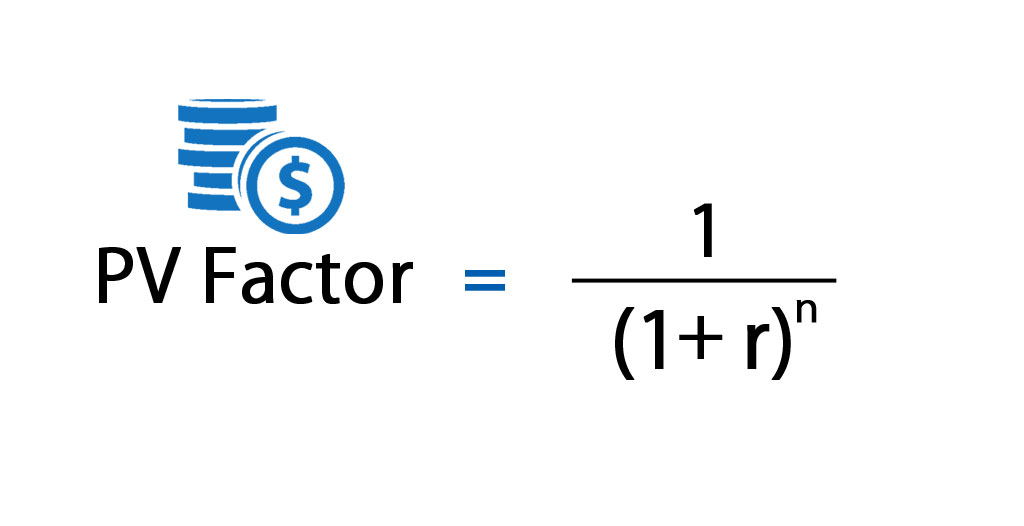

Among the income approaches is the discounted cash flow methodology calculating the net present value npv of future cash flows for an enterprise.

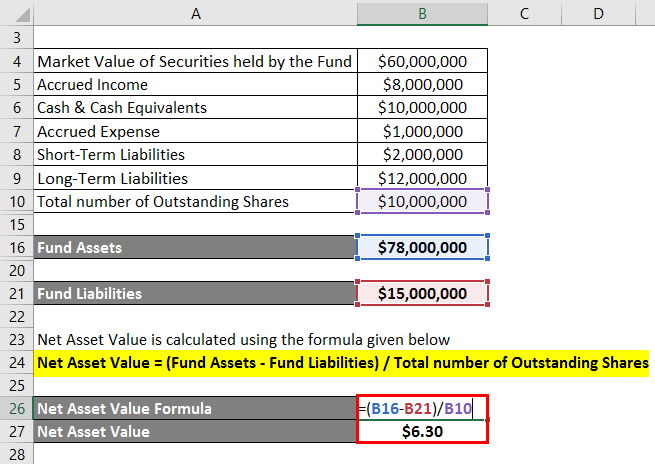

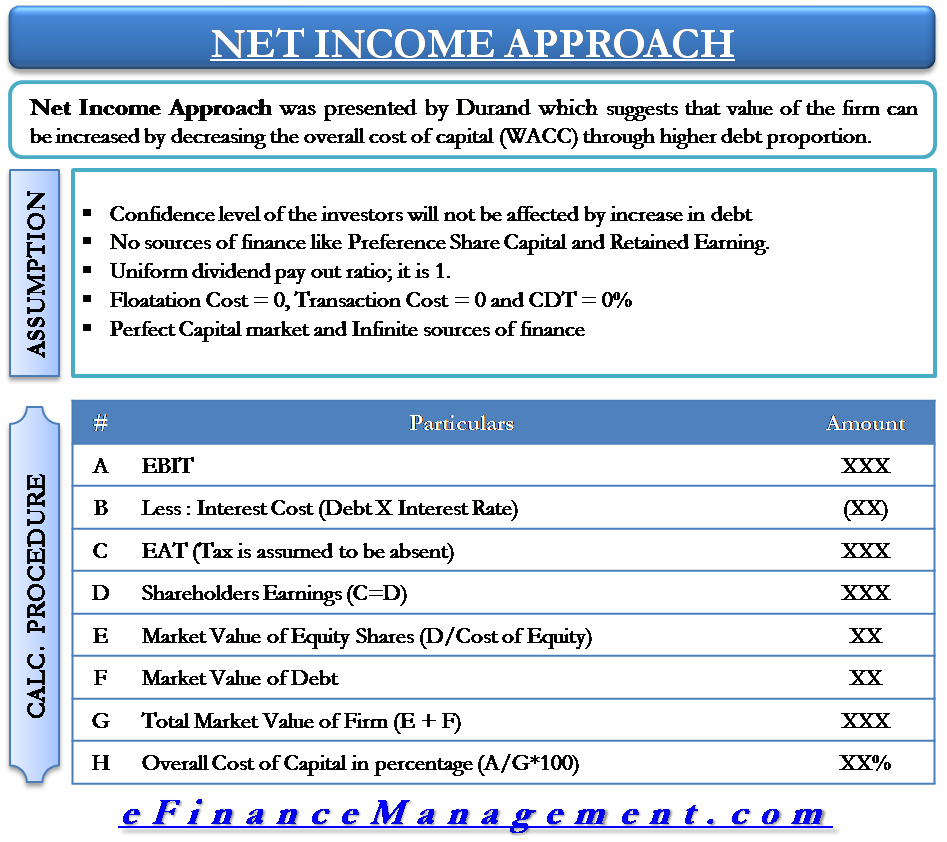

Income approach valuation calculator. Among the income approaches is the discounted cash flow methodology that calculates the net present value npv of future cash flows for a business. Discounted cash flow calculator business valuation bv is typically based on one of three methods. Create a forecast of the expected cash flows of the business for at least the next five years and then derive the present value of those cash flows. We ll dig into each one below.

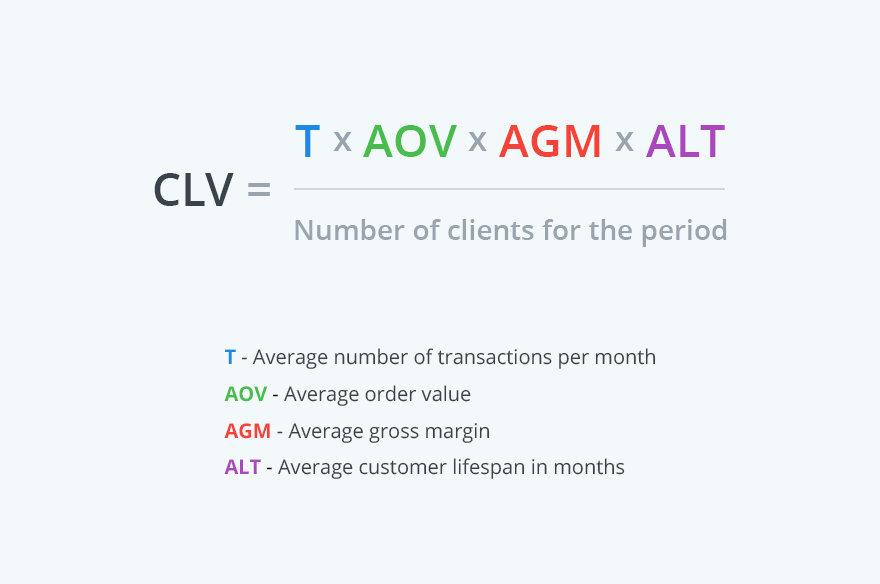

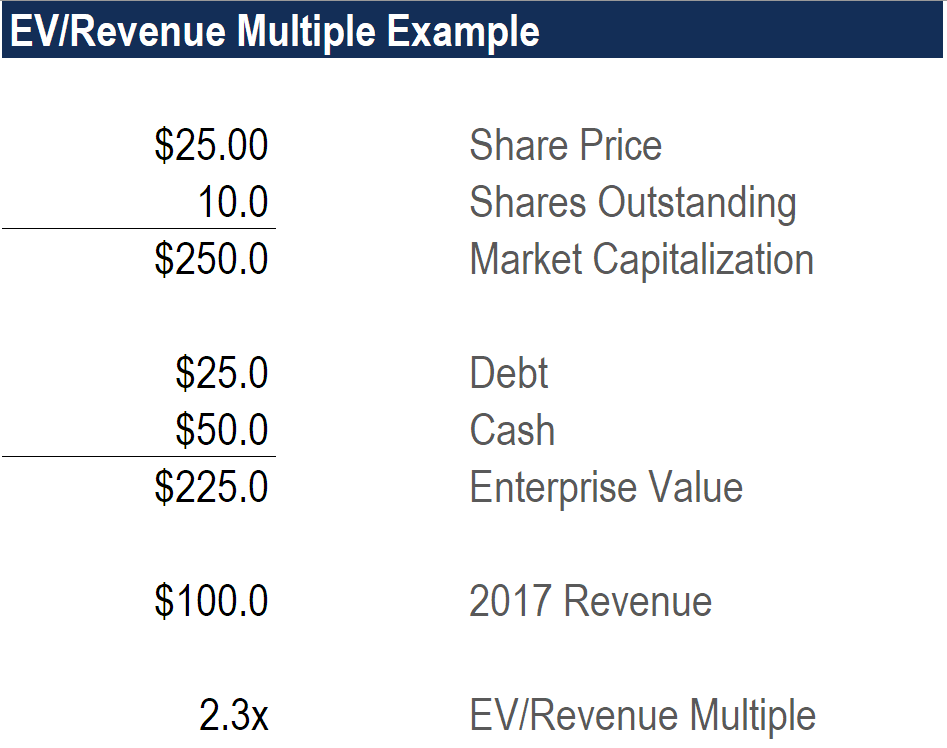

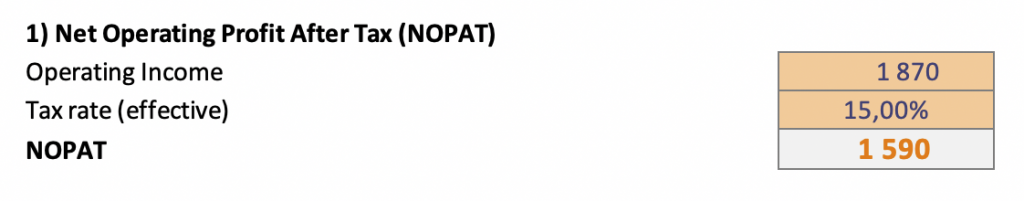

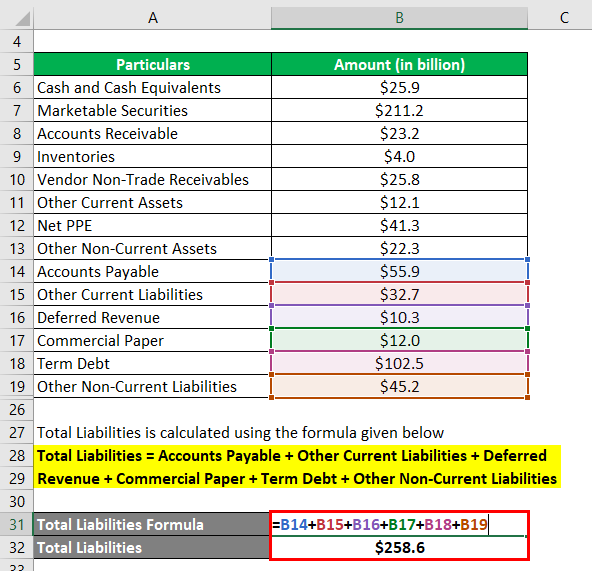

In income approach of business valuation a business is valued at the present value of its future earnings or cash flows. Business valuation discounted cash flow business valuation is typically based on three major methods. Calculating net operating income. Two of the most common business valuation formulas begin with either annual sales or annual profits also known as seller discretionary earnings multiplied by an industry multiple.

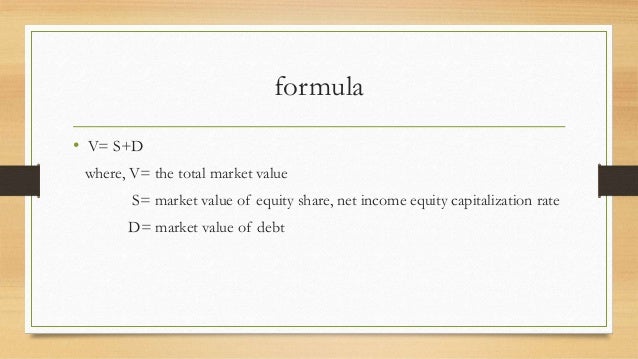

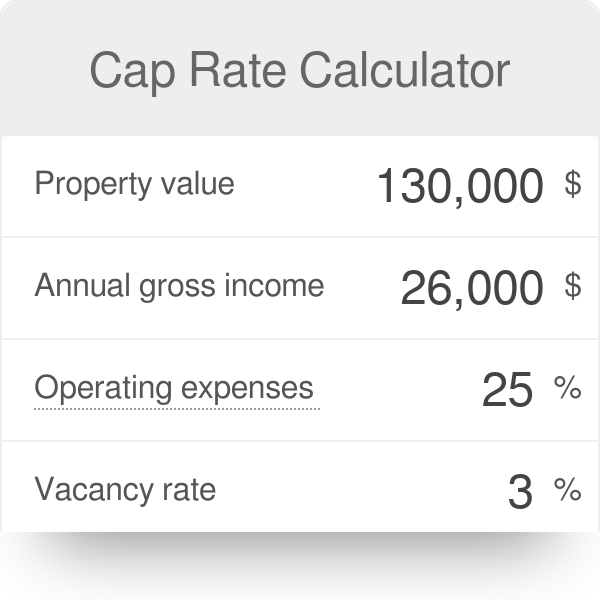

This present value figure is the basis for a sale price. When it comes to more complex calculations there are three broad classifications of business valuation methods. The income approach the cost approach or the market comparable sales approach. The cap rate calculator alternatively called the capitalization rate calculator is a tool for all who are interested in real estate as the name suggests it calculates the cap rate based on the value of the real estate property and the income from renting it you can use it to decide whether a property s price is justified or to determine the selling price of a property you own.

A business valuation calculator helps buyers and sellers determine a rough estimate of a business s value. Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for small size or lack of marketability. Both methods are great starting points to accurately value your business. If a rental cottage costs 120 000 to buy and the projected monthly income from the rental is 1 200 the capitalization rate is 12 percent 12 x 1200 120 000.

Future earnings cash flows are determined by projecting the business s earnings cash flows and adjusting them for changes in growth rate cost structure and taxes etc. Income based valuations value your company based on the amount it is expected to generate. By dividing the net operating income of the subject property by the capitalization rate you have chosen you arrive at an estimate of 100 000 as the value of the building. How to calculate income you may find one other part of the formula that test writers occasionally like to ask about.

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)