Income Brackets In The United States

The range of these brackets vary depending on the state.

Income brackets in the united states. 2019 pdf 1 2 mb this report presents data on income earnings income inequality and poverty in the united states based on information collected in the 2020 and earlier current population survey annual social and economic supplements cps asec conducted by the u s. New hampshire s median household income is 74 057 making it the eighth highest in the united states. Income in the united states is measured by the united states department of commerce either by household or individual the differences between household and personal income is considerable since 42 of households the majority of those in the top two quintiles with incomes exceeding 57 658 now have two income earners. Data originated in the united states census bureau s annual asec survey first released in september 2020.

Additionally new hampshire has one of the lowest unemployment rates among states of 2 6. New hampshire has the highest economic security of any state and boasts the lowest poverty rate in the country of 6 4. The university of minnesota s minnesota population center harmonizes it making it easy to do these calculations especially for the household income by year. The rest of the states in the nation as well as d c use their own set of tax brackets.

In fact fewer than 3 percent of all united states taxpayers were included in the top three tax brackets ranging from 28 to 35 percent that year. Income and wealth in the united states after the economic recession in 2009 income inequality in the u s. Is more prominent across many metropolitan areas. This difference becomes very apparent when comparing the percentage of.

The personal income tax rate in the united states stands at 37 percent. Download income and poverty in the united states. On this page are estimated united states individual income brackets for 2020 you ll also find the average median and top 1 of individual incomes in the united states. All such people including related subfamily members are considered as members of one family.

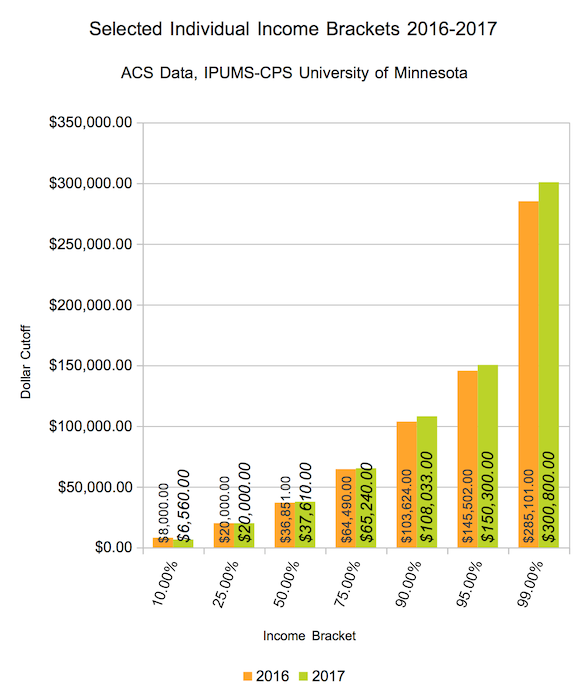

Personal income tax rate in the united states averaged 36 71 percent from 2004 until 2020 reaching an all time high of 39 60 percent in 2013 and a record low of 35 percent in 2005. According to cbs news the number of people who claimed no income tax liability between 1950 and 1990 averaged at approximately 21 percent with a low of 18 percent in 1986. 2016 and 2017 data a family is defined by the united states census bureau for statistical purposes as a group of two people or more one of whom is the householder related by birth marriage or adoption and residing together. Methodology on 2020 united states household income brackets.

This page provides united states personal income tax rate actual values historical data forecast chart statistics economic calendar. States with income tax brackets.