Income Calculator New Hampshire

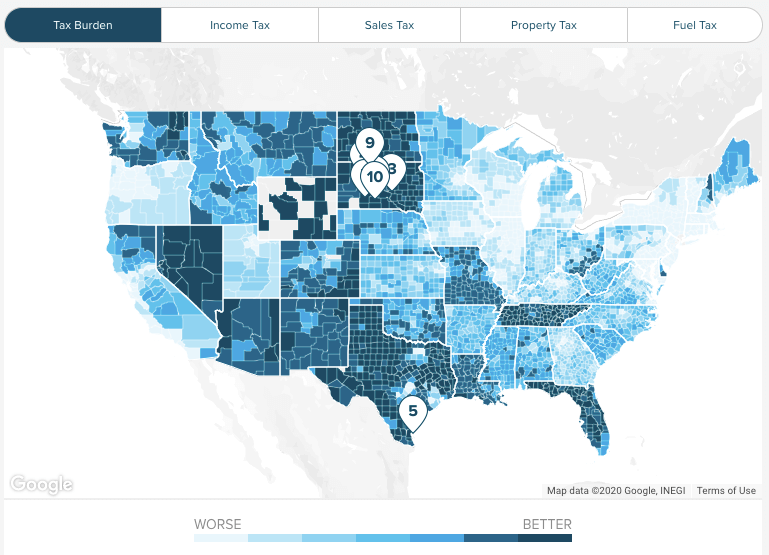

The interest and dividends tax is a flat rate of 5.

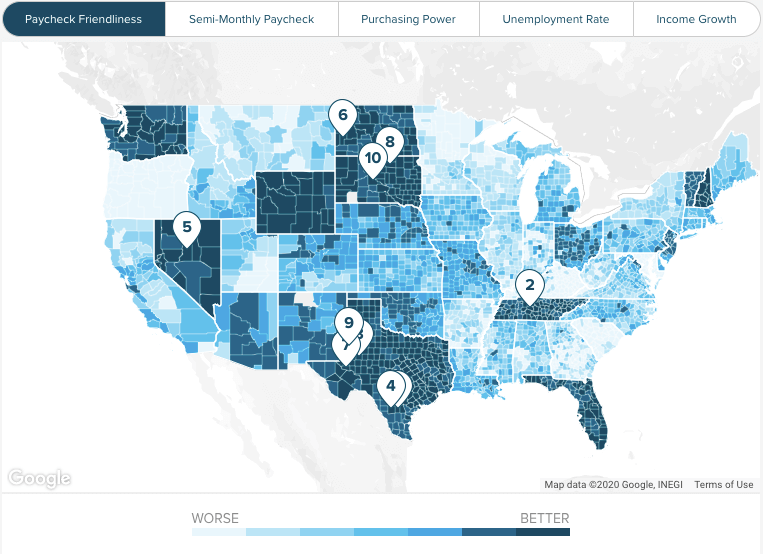

Income calculator new hampshire. It is recommended that you start by reviewing and completing all income and expense related links before moving on to the textboxes and the court selection field then finishing by selecting wether you wish to make your payments on a weekly bi weekly or monthly basis by. There are no local income taxes in any new hampshire counties or cities. New hampshire is known as a low tax state. Neuvoo online salary and tax calculator provides your income after tax if you work in new hampshire.

Our data is based on 2020 tax tables from usa. But while the state has no personal income tax and no sales tax it has the third highest property tax rates of any u s. Use gusto s salary paycheck calculator to determine withholdings and calculate take home pay for your salaried employees in new hampshire. New hampshire does not have any state income tax on wages.

Find your net pay for any salary. If you re considering a move to the granite state make sure to take a look at our new hampshire mortgage guide. Use this free tool to calculate 2020 new hampshire poverty levels including monthly totals annual income amounts and percentages of new hampshire poverty levels like 133 135 138 150 200 and more. The standard exemption for that tax is 2 400 for single filers and 4 800 for married persons filing jointly so taxpayers with income from interest and dividends below that amount do not have to pay any taxes.

We calculate how much your payroll will be after tax deductions in any region. Consequently the median annual property tax payment here is 5 388. Our tax calculator is based on data from 2020 in usa. This tool was created by 1984 network.

State with an average effective rate of 2 20. It will help. If you would like to help us out donate a little ether cryptocurrency to the following address. We calculate how much your payroll will be after tax deductions in new hampshire.

Find your net pay from a salary of 86 000. New hampshire does tax income from interest and dividends however. We ll do the math for you all you need to do is enter the applicable information on salary federal and state w 4s deductions and benefits.