Income Capitalization Approach Calculator

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)

The capitalized income approach or direct capitalization income approach is a valuation method used for real estate.

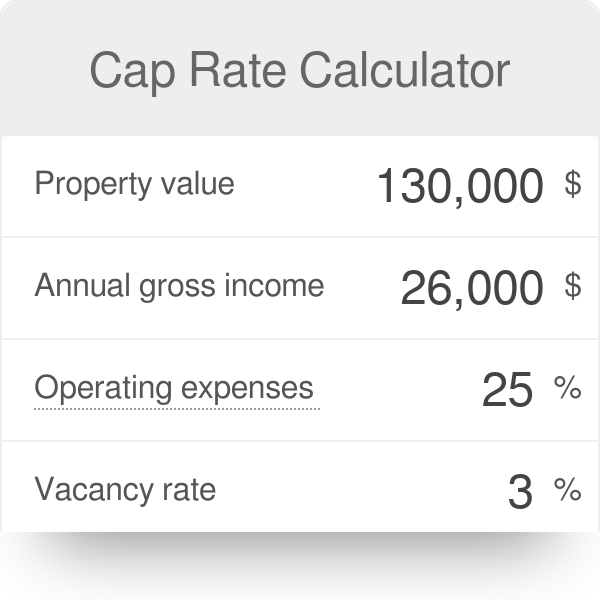

Income capitalization approach calculator. The capitalization rate and the net operating income noi. This approach is usually most appropriate for income producing commercial properties. Net operating income i capitalization rate r estimated value v 10 000 0 10 100 000. On this page we focus on the direct capitalization method.

The equity capitalization rate of the company is 12. The income capitalization approach formula. 1 50 000 10 debentures. The cap rate calculator alternatively called the capitalization rate calculator is a tool for all who are interested in real estate as the name suggests it calculates the cap rate based on the value of the real estate property and the income from renting it you can use it to decide whether a property s price is justified or to determine the selling price of a property you own.

Capitalization rate formula calculator. Capitalization rate can be defined as the rate of return for an investor investing money in real estate properties based on the net operating income that the property generates. This method uses net operating income estimates for a typical investment holding period. You can use the numbers from the previous examples to calculate the value.

Pv it should be noted that both excel and popular financial calculators utilize the net present value npv formula to find the. The income capitalization formula looks like this. Property market value net operating income noi capitalization rate. The formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset.

So here s how to calculate each of the. There are two approaches that fall under the income approach the direct capitalization approach and the discounted cash flow method. Sally is looking to buy a property that costs 115 000 and can rent for 750 a month. By dividing the net operating income of the subject property by the capitalization rate you have chosen you arrive at an estimate of 100 000 as the value of the building.

The yield capitalization method. An organization expects a net income of rs. As you can see this appraisal approach consists of two main variables. Calculate the value of the firm and overall capitalization rate according to the net income approach ignoring income tax.

She has done some research and has determined the net operating expenses to be 5 000 per year.