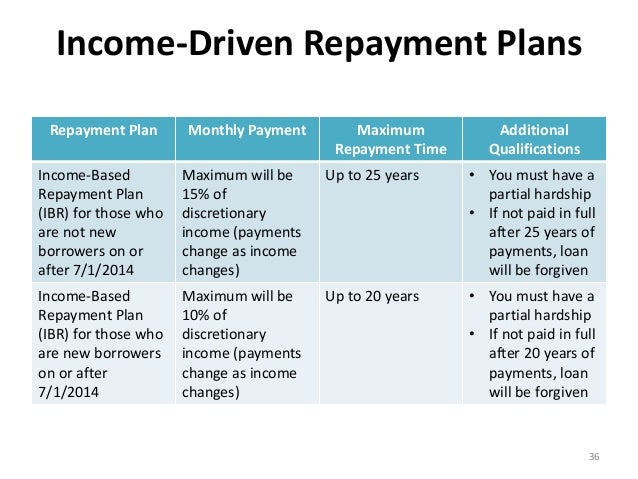

Income Driven Repayment Plan Comparison

Your payment amount is based on your adjusted gross income family size and total student loan debt.

Income driven repayment plan comparison. The most notable difference is the fact that you re eligible regardless of when you took out your first federal student loan. However those payments might not be affordable. Income driven plans only make sense in comparison to the standard repayment plan. This plan requires that you have a partial financial hardship as defined on the income driven repayment plan request.

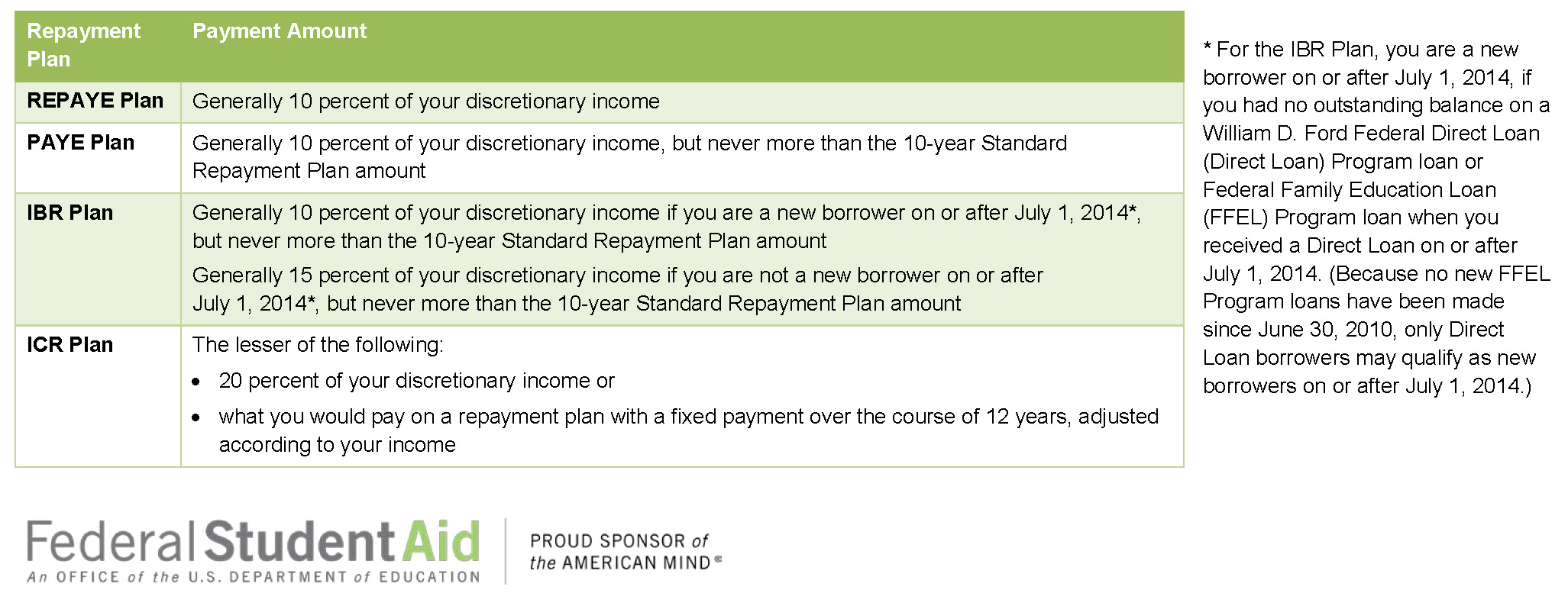

See the official income driven repayment plan request form for a comprehensive description of eligibility criteria for each of these plans. Depending on which you choose you ll pay anywhere between 10 to 20 of your monthly discretionary income based on annual updates. The complexity of the income driven repayment plans can cause borrowers to choose the wrong income driven repayment plan. Either 20 of your discretionary income with a 25 year term or what you ll pay with a fixed repayment term over 12 years whichever.

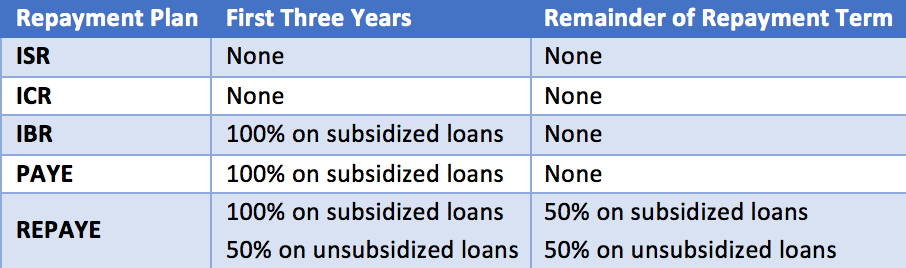

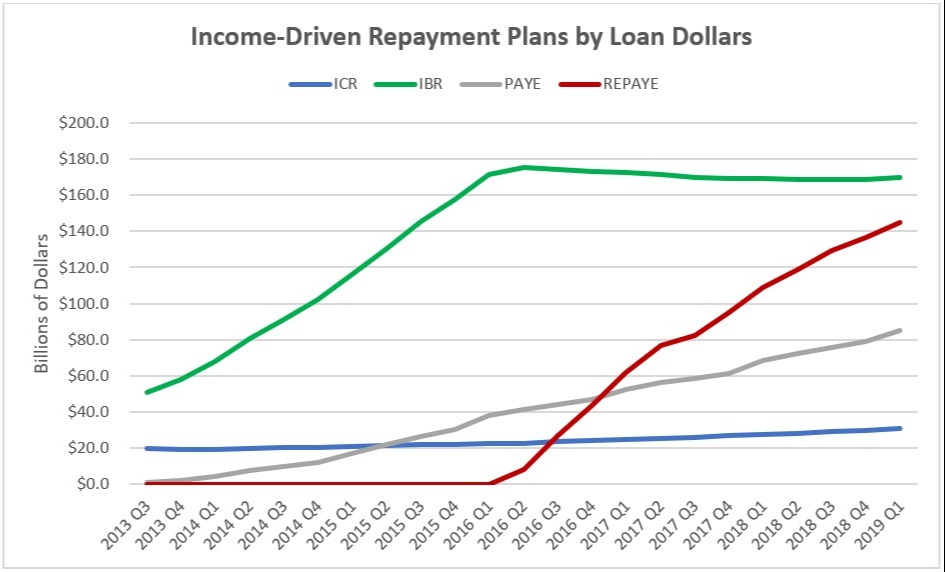

For the revised pay as you earn repaye pay as you earn paye income based repayment ibr and income contingent repayment icr plans under the william d. Income driven repayment comparison chart this chart compares selected criteria for the ibr icr paye and repaye repayment plans and does not describe all eligibility requirements. If you took out a student loan on or after july 1 2014 your repayment options may be even more attractive. Revised pay as you earn repaye which became available in december 2015 is the newest income driven repayment plan.

Your monthly payment amount will generally be 10 or 15 percent of your discretionary income depending on your loans disbursement dates. 10 of your discretionary income with a 20 year term but your payment will never be higher than your monthly payment under a 10 year standard repayment plan. 1845 0102 form approved expiration. Pros and cons of income based repayment plans compared to what.

Ford federal direct loan direct loan program and federal family education loan ffel programs. The isr plan might be a better choice if you have ffel loans and a low paying job but expect your income to increase like a medical resident. This plan is similar to paye with a few key differences. If you re overwhelmed by student loan bills consider signing up for an income driven repayment plan that can help ease the burden and free up more of your monthly income.

Under the standard program you make fixed monthly payments that cover your interest costs and loan balance over 10 years. Income driven repayment idr plan request. The income sensitive repayment isr plan and income based repayment ibr plan are your two main options for unconsolidated ffel loans.