Income Driven Repayment Plan Married

Married loan borrowers could end up with a higher student loan payment than loan borrowers who are single.

Income driven repayment plan married. 1845 0102 form approved expiration. For both income based repayment ibr and pay as you earn repayment paye your monthly student loan payment is calculated based on your adjusted gross income agi. You ll just need to share some basic personal information about yourself and your finances. It all comes down to what plan you choose and your tax filing status married filing separately or jointly.

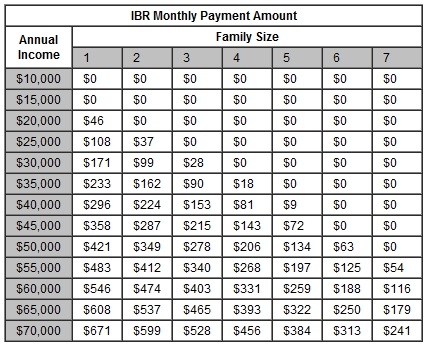

Income driven repayment idr plan request. You know the basics of income driven repayment plans right. Refer to this chart as hosted by the government s income based repayment plan page. For the revised pay as you earn repaye pay as you earn paye income based repayment ibr and income contingent repayment icr plans under the william d.

The pay as you earn paye repayment plan will have the lowest monthly payment 10 of discretionary income and shortest repayment term 20 years with a standard repayment cap on monthly payments and a way to avoid the marriage penalty e g if a married borrower files separate returns the loan payment will be based on just the borrower. For one they extend your repayment term by more than a decade from 10 years to at least 20 years. If a student loan borrower is married and the couple files a joint federal tax return then the annual income considered for the ibr plan will be a total of both married persons annual income. If you re married and file a joint tax return your monthly student loan payment is calculated on your joint agi.

This is called income driven repayment. If you re single an income driven repayment plan and the paperwork required to enroll is pretty straightforward. Many married couples have learned the hard way that ibr payments can be based upon the income of the couple. All of the income driven plans will factor in the income of the borrower s spouse if they are filing taxes together as married.

Instead of choosing the 10 year standard repayment plan many borrowers choose to repay their federal student loans according to their incomes. Ford federal direct loan direct loan program and federal family education loan ffel programs. But taking advantage of an income driven repayment plan when you re married can get complicated. When you fill out the paperwork for your income based repayment plan one of the questions that you will notice is that it asks if you are married.

This means you ll be burdened with student loan payments for many years and will also pay more interest. So a simple way to potentially lower your student loan payment. Income driven repayment plans can help you manage your student loans but they also have a few major drawbacks.