Income Driven Repayment Plan When Married

This is called income driven repayment.

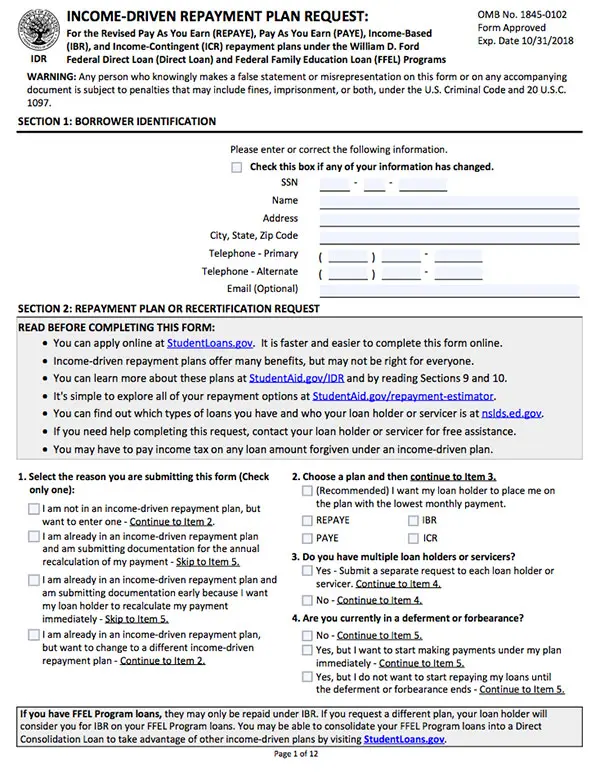

Income driven repayment plan when married. For one they extend your repayment term by more than a decade from 10 years to at least 20 years. You know the basics of income driven repayment plans right. If you re enrolled in an income driven repayment plan and you re married we not only ask about your income but also about your spouse s income as well. Ford federal direct loan direct loan program and federal family education loan ffel programs.

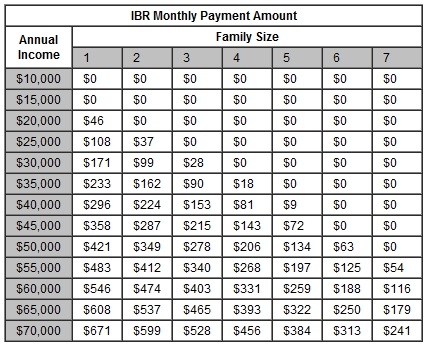

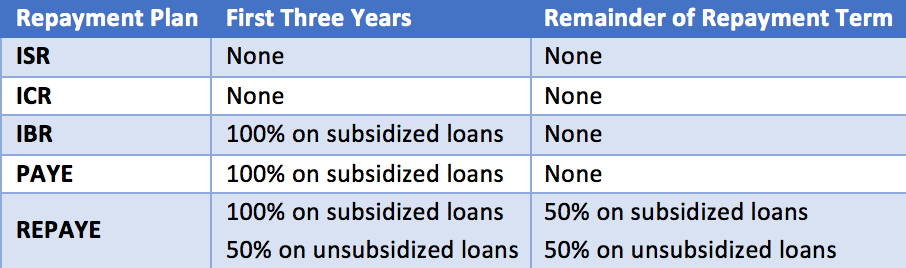

If you file separately they will only factor in your individual income. So a simple way to potentially lower your student loan payment and increase your potential student loan forgiveness is to lower your agi and married couples can potentially do this by filing separately versus. Income driven repayment plans can help you manage your student loans but they also have a few major drawbacks. Refer to this chart as hosted by the government s income based repayment plan page.

All of the income driven plans will factor in the income of the borrower s spouse if they are filing taxes together as married filing jointly however for three of the plans ibr icr and paye. However married filing separately can substantially lower your loan payment explained mark struthers a certified financial planner who founded sona financial. Married loan borrowers could end up with a higher student loan payment than loan borrowers who are single. Like the name and my brief description implies income driven repayment plans use your income and family size to calculate your payment.

When does my spouse s income affect my income based repayment amount. For the revised pay as you earn repaye pay as you earn paye income based repayment ibr and income contingent repayment icr plans under the william d. The pay as you earn paye repayment plan will have the lowest monthly payment 10 of discretionary income and shortest repayment term 20 years with a standard repayment cap on monthly payments and a way to avoid the marriage penalty e g if a married borrower files separate returns the loan payment will be based on just the borrower. It all comes down to what plan you choose and your tax filing status married filing separately or jointly.

Your household size stays the same but your income goes down when they calculate discretionary income. 1845 0102 form approved expiration. Many married couples have learned the hard way that ibr payments can be based upon the income of the couple. If you file jointly when your lender calculates what you can afford to pay on your loans they will use both of your incomes.

How does the loan forgiveness work. Income driven repayment idr plan request. If a student loan borrower is married and the couple files a joint federal tax return then the annual income considered for the ibr plan will be a total of both married persons annual income. For both income based repayment ibr and pay as you earn repayment paye your monthly student loan payment is calculated based on your adjusted gross income agi.