Income Driven Repayment Plans Questions And Answers

Questions about the taxability of loan forgiveness.

Income driven repayment plans questions and answers. Yes you can still use an income driven repayment plan if you live and work outside of the u s. Income driven repayment plans lower your monthly payment which can provide flexibility and extra money for living expenses savings and investments. You do so by having a high level understanding a solid plan and a way to implement that plan. Pay as you earn paye.

For example under certain plans your income includes your and your spouse s income if you re married. Income driven repayment or idr is an umbrella term for four federal student loan repayment options. For the purposes of income driven repayment plans discretionary income is defined as the difference between your adjusted gross income and 1 5 times the federal poverty benchmark income level for your family size and state. Agi refers to adjusted gross income as reported on your federal income tax return.

The following questions and answers q a provide information about the income driven repayment plans that are available to most federal student loan borrowers. Income driven repayment paye repaye ibr. And where you work and live will have an impact on your taxable income. Before we start let s make sure you have the right idr request form.

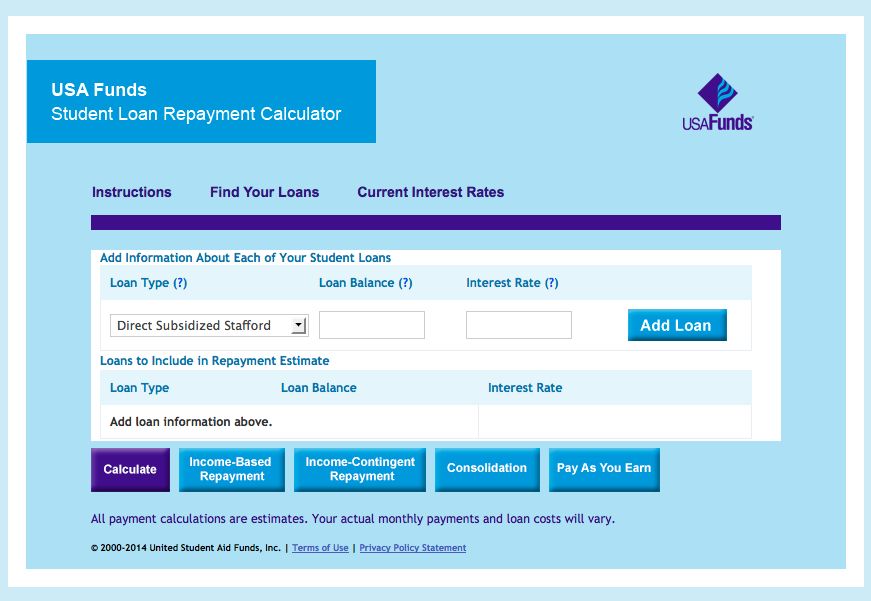

New grad student loan questions and answers. 4 the calculation and your monthly payment amount might differ depending on your repayment plan and your specific financial circumstances. Borrowers can also choose an income driven repayment plan which bases the monthly payment on a percentage of the borrower s discretionary income. The government forgives any remaining balance after 20 or 25 years.

The repayment plans are based on your loan types and taxable income. Rapid fire questions answers about ibr what are the income based repayment plan disadvantages. However an income driven repayment plan does not lower your interest rate. An income driven repayment idr plan is a type of federal plan to pay off your student loans that s based on your income.

The language around student loans gets confusing fast but some of the most perplexing terms have to do with income driven repayment plans. Throughout the q a we use the following terms. Revised pay as you earn repaye. However income based repayment ibr is actually the formal name of only one income driven repayment plan offered by the government.

In this post i ll not only go over how to apply for income driven repayment idr plan but i ll also answer some common idr questions. The current income driven repayment plan request form is the one numbered in the upper right hand corner as omb no 1845 0102. Depending on which you choose you ll pay anywhere between 10 to 20 of your monthly discretionary income based on annual updates. While an income driven repayment plan saves money in the short term it can be more expensive in the long run.