Income Tax After Death Canada

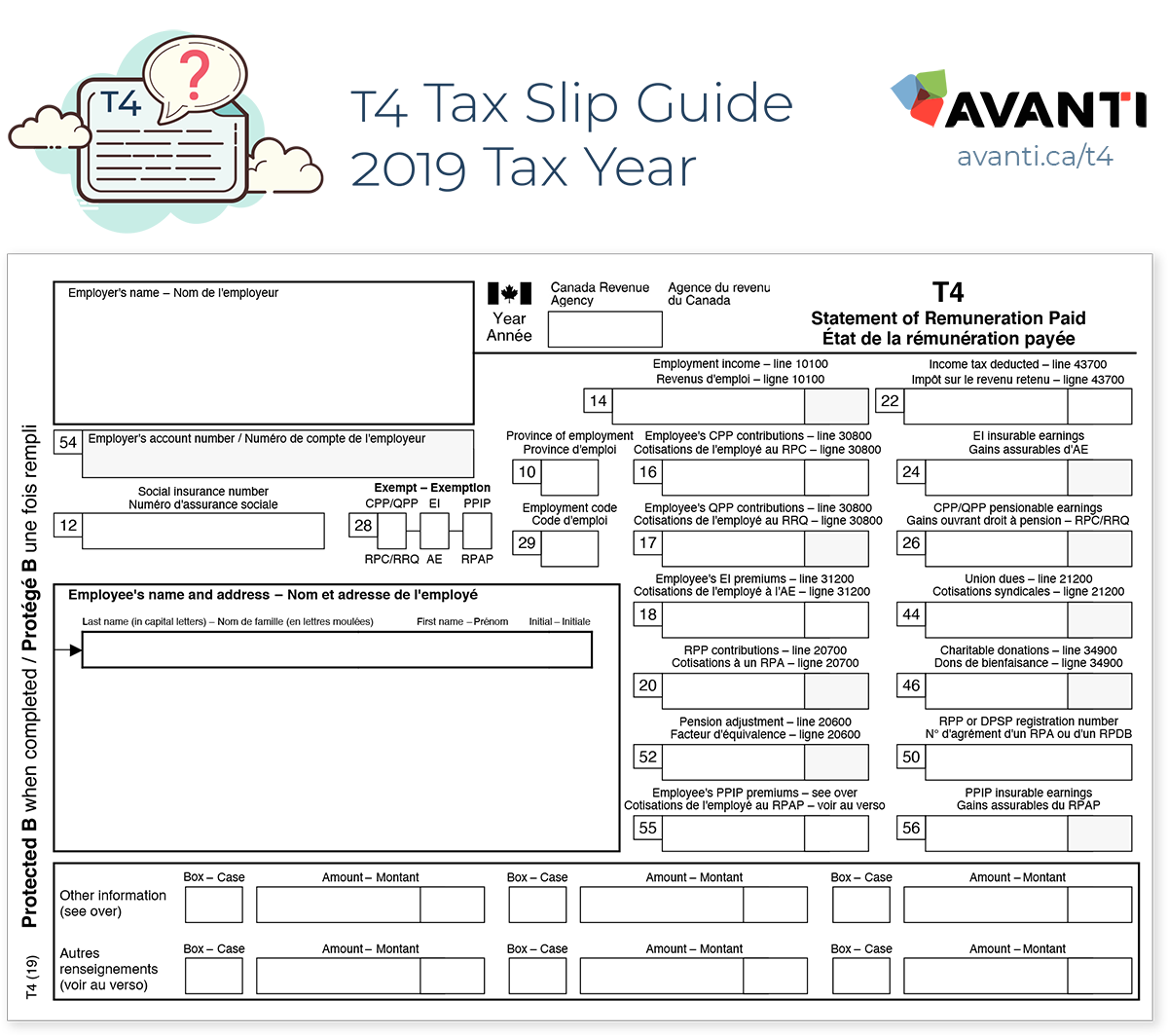

Report income earned after the date of death on a t3 trust income tax and information return to find out what income to report on the t3 return see chart 2 for more information see the t4013 t3 trust guide.

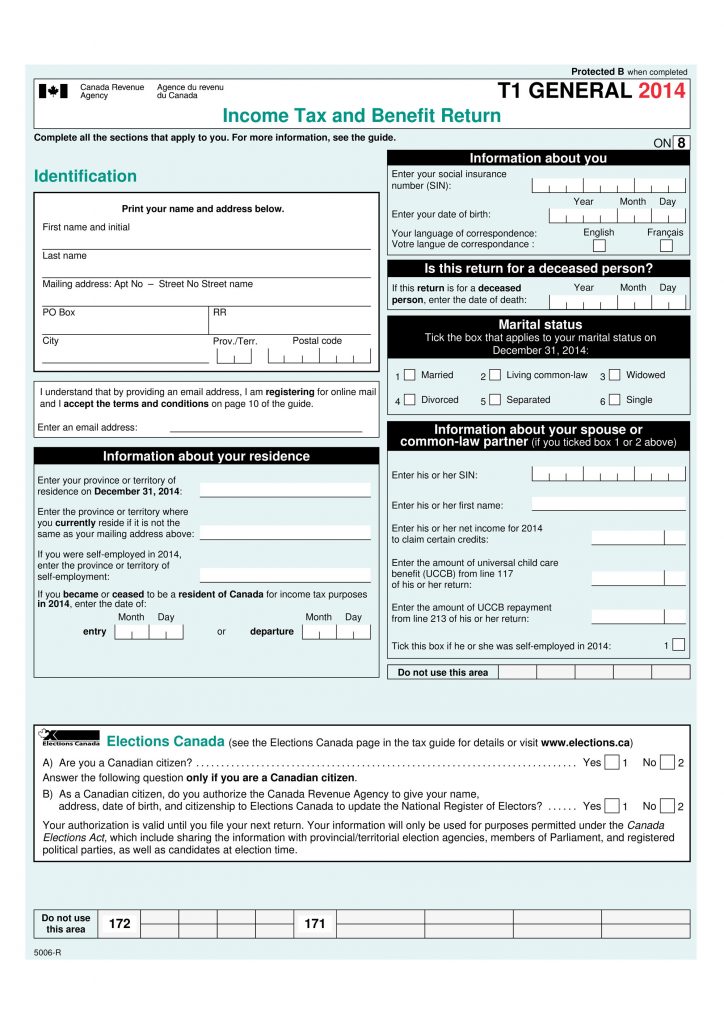

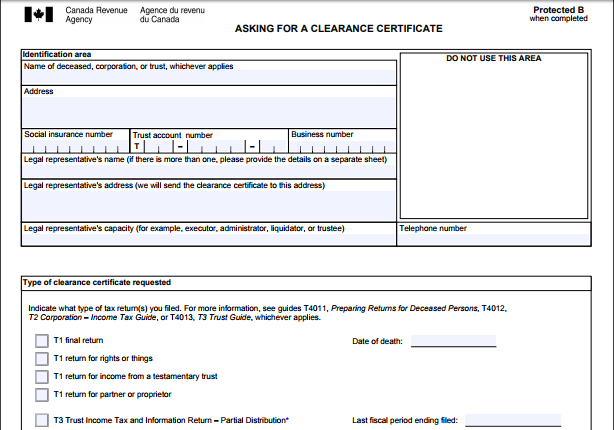

Income tax after death canada. You can contact us or complete the applicable information in the form on the back page of information sheet rc4111 what to do following a death and send it to your tax services office or tax centre. There is no inheritance tax or estate tax in canada per se. The final return can be e filed or paper filed. The optional returns are filed using the normal t1 personal tax return forms.

In canada there is no inheritance tax. You should provide the cra with the deceased s date of death as soon as possible. In essence the deemed realization at death under the income tax act is canada s death tax. Service canada should also be advised of the deceased s date of death.

Rollovers exemptions and elections. Luckily these rules are subject to certain potentially ameliorating provisions. On the final return report all of the deceased s income from january 1 of the year of death up to and including the date of death. You can minimize the amount of taxes payable by arranging your finances and property with the help of an estate.

The canada pension plan cpp or quebec pension plan qpp death benefit is paid to the estate of the deceased or may be paid to another person who applies for the benefit including the person. This means that the estate pays the taxes owed to the government rather than the beneficiaries paying. For more information or to get the address of the service canada centre nearest you call 1 800 622 6232. Reducing income tax at death.

Instead the canada revenue agency cra treats the estate as a sale unless the estate is inherited by the surviving spouse or common law partner where certain exceptions are possible. Canada s alternative to the inheritance tax. If the deceased person was paying tax by instalments see instalments for more information. First there are taxes on income or capital gains earned during the last year of life.

Advise service canada of the deceased s date of death. The deceased was a child for whom ccb or gst hst credit payments are paid. The disposition rule provides the backdrop for most estate tax planning. Avoid planning for your estate and you can leave a significant income tax liability upon your death.

With the exception of property passing to surviving spouses or possibly dependents upon death at tax cost there is a notional or deemed disposition of capital property owned by the deceased immediately prior to death. The deceased was receiving canada child benefit ccb payments for a child. Second there is interest or capital gains made on money in the estate. Although there is no death tax in canada there are two main types of income tax that are collected after someone dies.

These forms can be obtained from the canada revenue agency cra general income tax and benefit package web page. Working income tax benefit advance payments.