Income Tax Brackets Agi

Use this table to calculate the tax rate and tax brackets for filing your 2020 federal income taxes.

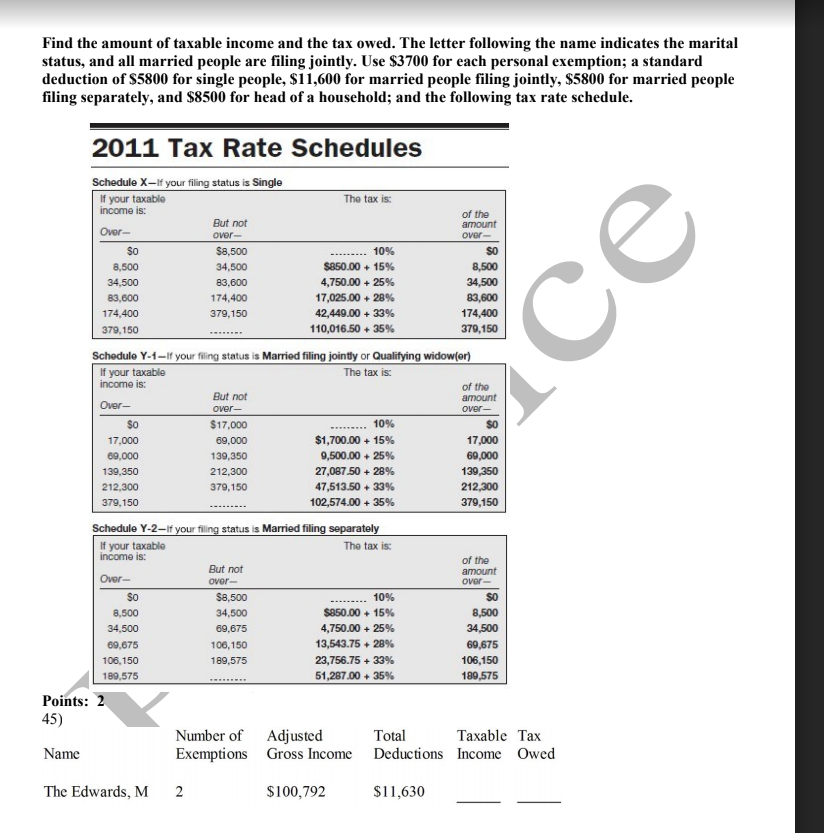

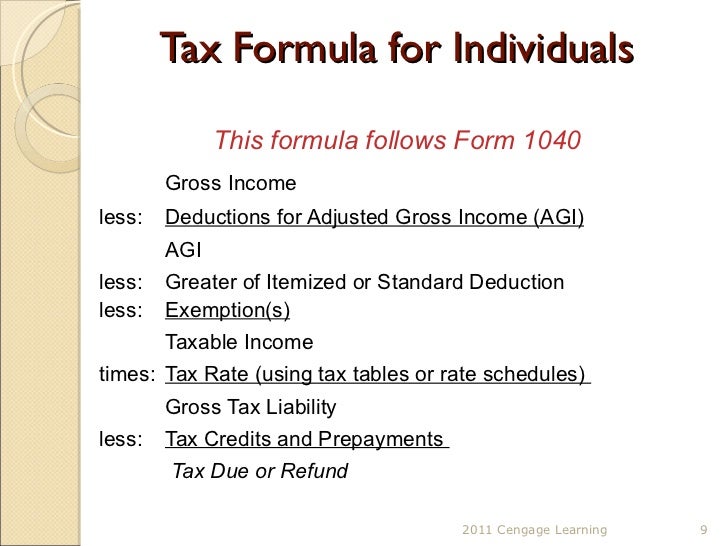

Income tax brackets agi. Remember to start with your taxable income which is your adjusted gross income minus your standard deduction or itemized deductions. The tax rates and brackets for 2021 are provided in the chart below. Total agi grew 780 billion from 2016 levels significantly more than the 14 billion increase from 2015 to 2016. Taxpayers reported 10 9 trillion in adjusted gross income agi on 143 3 million tax returns in 2017 the last tax year before the tax cuts and jobs act took effect.

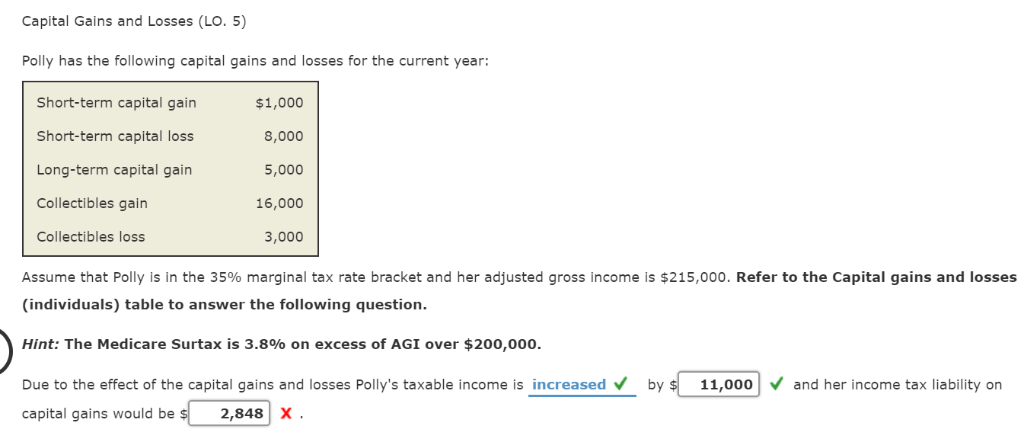

For married couples filing jointly the phase out of the credit will begin at 25 470 of adjusted gross income or earned. Taxable income is any money you made during the tax year on which you are required to pay income taxes. 2020 tax brackets rates. Assuming the single filer with 80 000 in taxable income opted for the standard deduction 12 400 the amount of his agi that went to the irs was 14 9 a far cry from 22.