Income Tax Brackets Canada Bc

The rates assume that british columbia will enact its proposed new top bc income tax rate of 20 5 on taxable income exceeding cad 220 000 starting 1 january 2020.

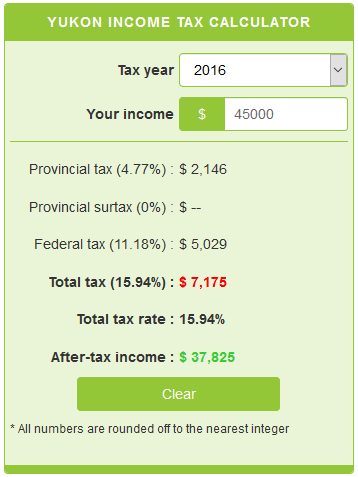

Income tax brackets canada bc. For example if your taxable income is more than 41 725 the first 41 725 of taxable income is taxed at 5 06 the next 41 726 of taxable income is taxed at 7 70 the next 12 361 of taxable income is taxed at 10 5 the next 20 532 of taxable income is. 2019 federal income tax brackets 2019 federal income tax rates. What are tax rates in bc. The highest provincial rate is applied above 157 749 however the federal rate is increased further after this income level.

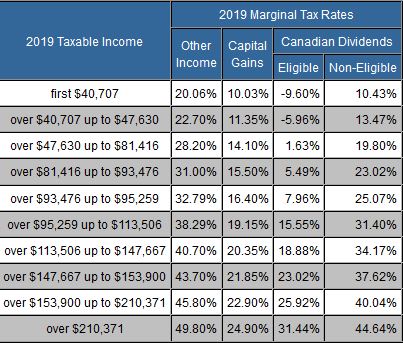

The personal income tax brackets and tax rates in british columbia are average compared to more heavily taxed provinces like manitoba and quebec. British columbia s tax brackets for tax year 2019. Please read the article understanding the tables of personal income tax rates. 20 5 between 48 535 and 97 069.

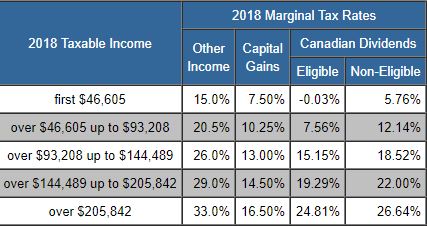

2020 canada tax brackets. In 2020 is 5 06 and it applies to income up to 41 725. The federal tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1 010. Interest and ordinary income 49 80 capital gains 24 90 canadian eligible dividends.

The table below illustrates how british columbia income tax is calculated on a 85 000 00 annual salary. Tax rates are applied on a cumulative basis. The highest combined bc tax bracket is 53 50 on every dollar you make over 220 000. It is set up as a progressive tax system similar to other jurisdictions in canada and you pay more in taxes as your taxable income increases.

You pay the higher tax rate on each additional dollar of income. Bc tax brackets are added to federal tax brackets to determine the total amount of income tax you pay. 15 up to 48 535 of taxable income. Without further ado here is a list of all federal and provincial income tax brackets for 2020.

The lowest tax bracket is 20 06 on the first 41 725 you make. British columbia tax rates current marginal tax rates bc personal income tax rates bc 2021 and 2020 personal marginal income tax rates bc income tax act s. Budget 2020 proposes adding a new tax bracket for income above 220 000 at a rate of 20 5. If it is not enacted the following rates will apply to taxable income above cad 214 368.

33 these amounts are adjusted for inflation and other factors in each tax year. Canada s federal taxes are calculated using the latest personal income tax rates and thresholds for british columbia in 2020. I ll include a few basic examples below of how you can calculate your own income tax rates in your province of residence. Are bc tax brackets.

The lowest tax rate in b c. There are 6 tax brackets in british columbia and 6 corresponding tax rates. Once your taxable income is determined which equals all sources of income minus applicable deductions reductions and credits you can find where you are in the tax brackets of british columbia.