Income Tax Brackets England

The starting rate for savings income is 10.

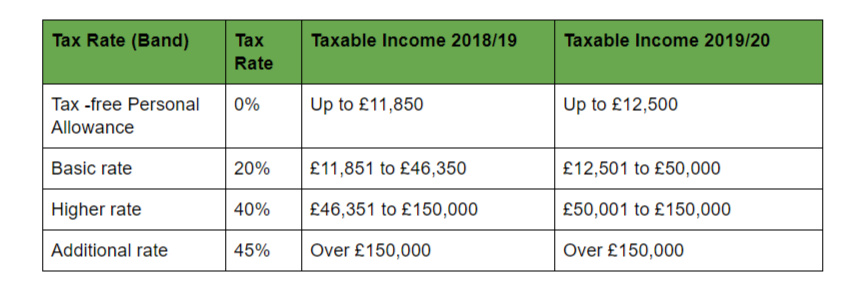

Income tax brackets england. Income tax rates and bands the table shows the tax rates you pay in each band if you have a standard personal allowance of 12 500. Below is a look at the uk income tax rates for 2019 20. How are income tax rates changing in 2019 20. If you need the tax rates for next year click the link to get the current 2020 21 uk income tax rates.

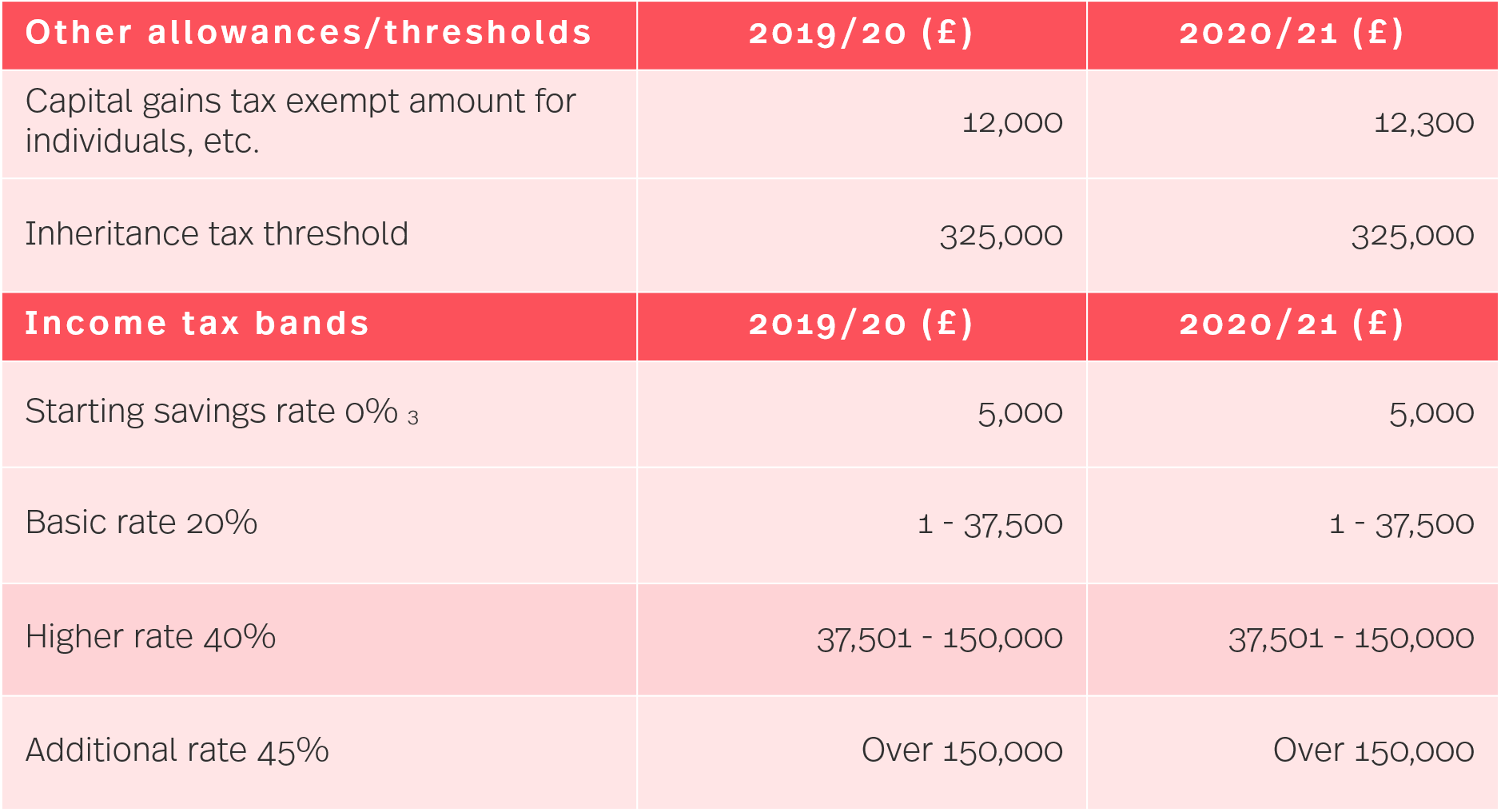

We ll also explain how these changes will affect your tax bill. This increases to 40 for your earnings above 46 350 and to 45 for earnings over 150 000. Rates allowances and duties have been updated for the tax year 2019 to 2020. It is not intended to represent the true tax burden to either the corporation or the individual in the listed country.

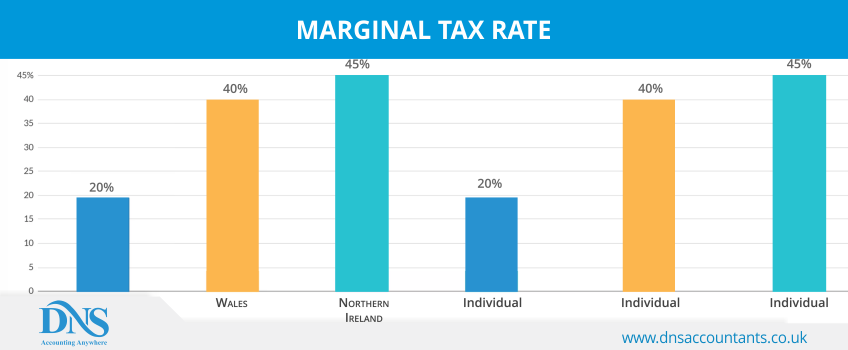

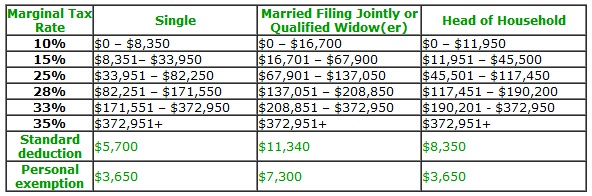

Corporate individual and value added taxes vat. The new tax year in the uk starts on 6 april 2020. For the fiscal year of 2016 17 these are the current tax rates in the uk. For the 2020 21 tax year if you live in england wales or northern ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 100 000.

From employment is above the limit of 5 000 gbp after you have deducted your personal allowance the 10 rate does not apply. This is a list of the maximum potential tax rates around europe for certain income brackets. However if your non savings income e g. Tax thresholds rates and codes the amount of income tax you deduct from your employees depends on their tax code and how much of their taxable income is above their personal allowance.

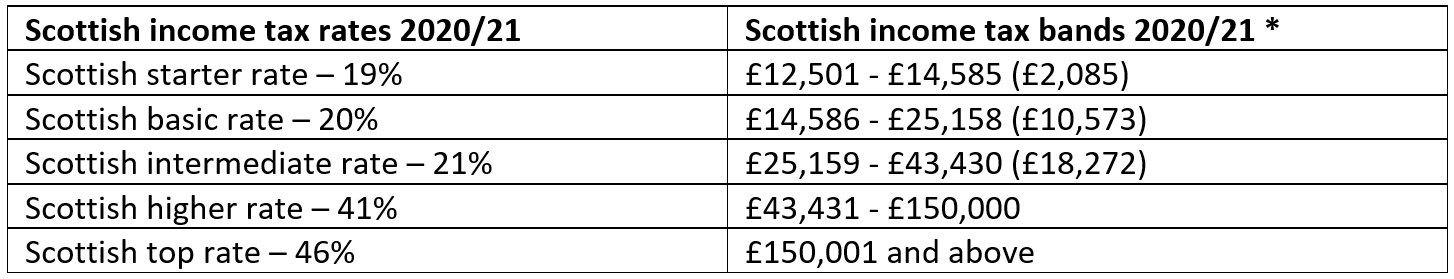

Uk income tax rates for tax year 2018 2019. Income tax bands are different if you live in scotland. Income limit for personal allowance. Allowances 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018.

Tax rates and allowances have been added for the tax year 2020 to 2021. And while the income tax brackets and personal tax allowance won t be changing in 2020 21 chancellor rishi sunak s highly anticipated budget speech on 11 march had good news for both the employed and self employed. Your earnings below 11 850 are tax free. It is focused on three types of taxes.