Income Tax Brackets England 2019

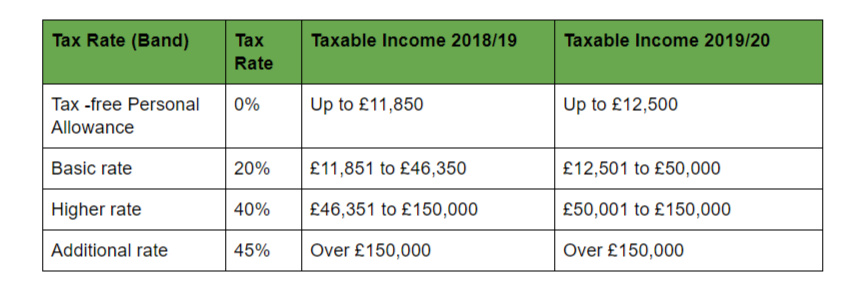

Uk income tax rates for tax year 2018 2019.

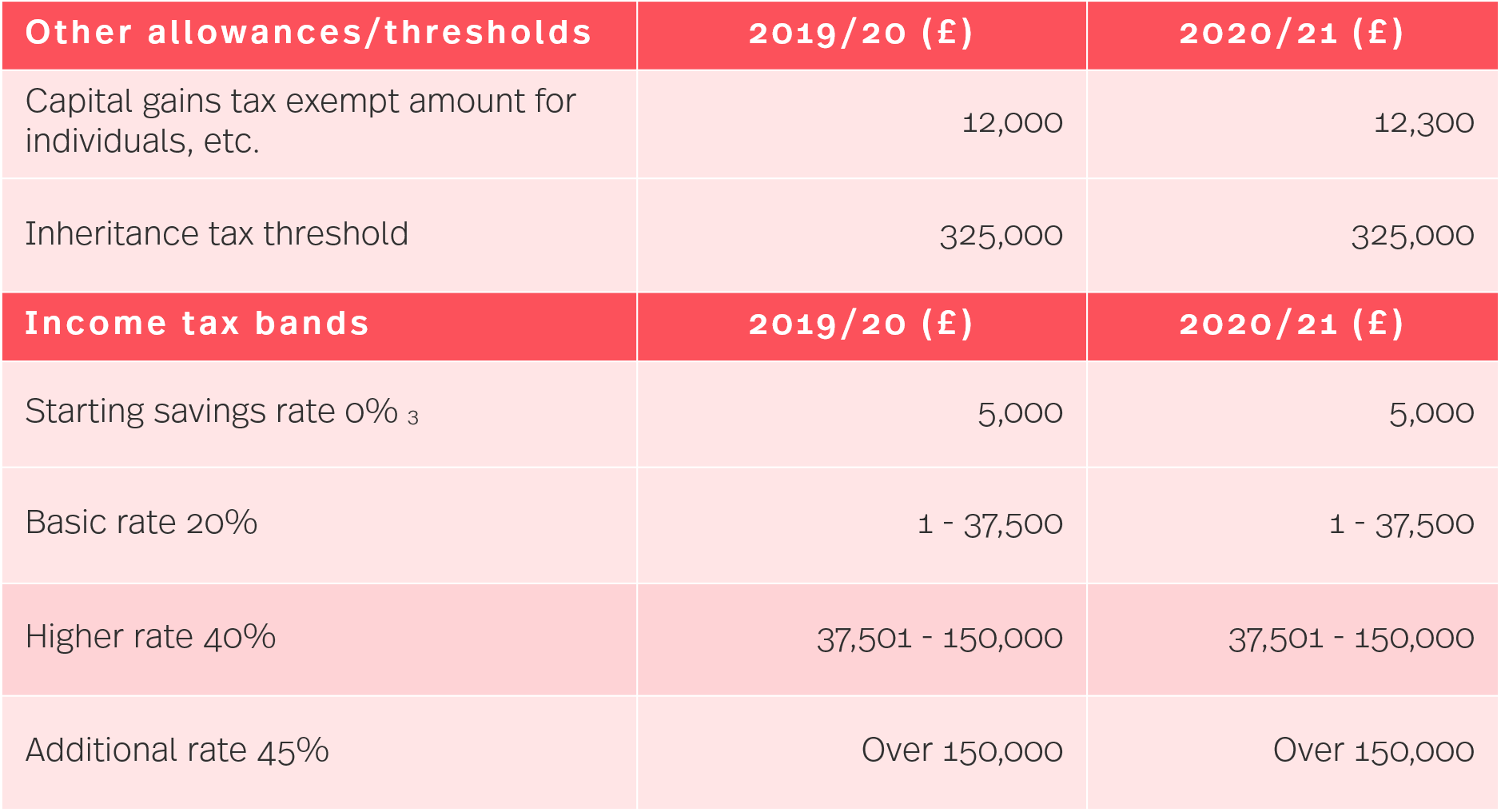

Income tax brackets england 2019. This table shows the tax brackets for 2020 21 and the rate at which each bracket is taxable. Tax band taxable income rate personal allowance up to 12 500 0. So by the time you earn 125 000 you ll pay income tax on everything you earn and get no personal tax free allowance. 10 0 from 2015 to 2016 up to 5 000.

This means that the minimum income you have to earn in a year to start paying tax in the uk will now be 12 500. Starting rate for savings. By using this site you agree we can set and use cookies. Income tax rates and bands the table shows the tax rates you pay in each band if you have a standard personal allowance of 12 500.

Uk income tax rates aren t going to change in 2020 21. On top of this their employer has to pay nearly 3 000 in employer nics. 2019 tax brackets for single filers married couples filing jointly and heads of households. Your earnings below 11 850 are tax free.

Income between 12 501 and 50 000 20 income tax. Income up to 12 500 0 income tax. This is your personal tax free allowance. This increases to 40 for your earnings above 46 350 and to 45 for earnings over 150 000.

Income between 50 001 and 150 000 40 income tax. Uktaxcalculators co uk free uk tax calculators for any income type. Up to 5 000. Code and design by ray arman.

For tax year 2018 2019 the uk basic income tax rate was 20. Scotland income tax bands and percentages. The tax tables below include the tax rates thresholds and allowances included in the united kingdom salary calculator 2019 which is designed for salary calculation and comparison. Income above 150 001 45 income tax.

The personal income tax rates and personal allowances in the united kingdom are updated annually with new tax tables published by hmrc. Income tax bands are different if you live in scotland. 2019 2020 tax rates and allowances. The new income tax rates and thresholds for 2019 20 are.

Income after allowances 2019 to 2020 income after allowances 2018 to 2019 income after allowances 2017 to 2018. 2019 2020 tax rates and allowances. Similarly the basic tax rate of 20 percent which currently applies if you earn up to 46 350 a year has been extended. Rate for unmarried individuals taxable income over for married individuals filing joint returns taxable income over for heads of households taxable income over.

An employee earning 28 000 a middle income earner in the uk will pay nearly 6 000 in income tax and nics.