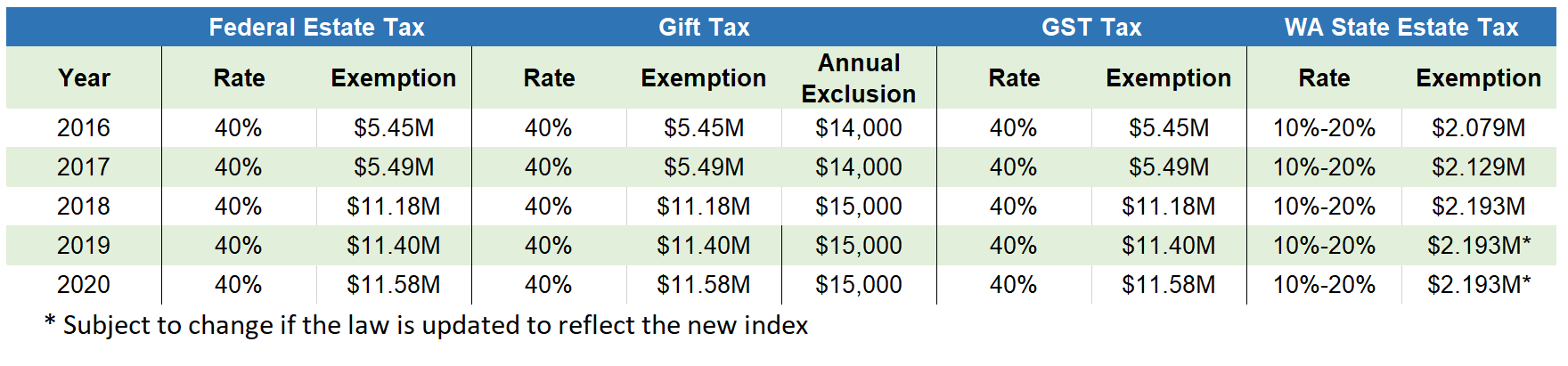

Income Tax Brackets Exemptions

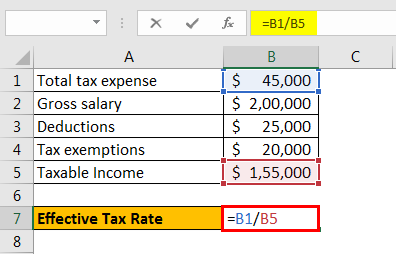

The federal corporate income tax system is flat.

Income tax brackets exemptions. There are seven federal individual income tax brackets. For ya 2019 a personal tax rebate of 50 of tax payable up to maximum of 200 is granted to tax residents. 205 901 321 600. 35 300 20 balance 40.

584 201 744 800. 37 062 26 of taxable income above 205 900. Georgia s income tax rates were last changed two years ago for tax year 2018 and the tax brackets were previously changed in 2009. 445 101 584 200.

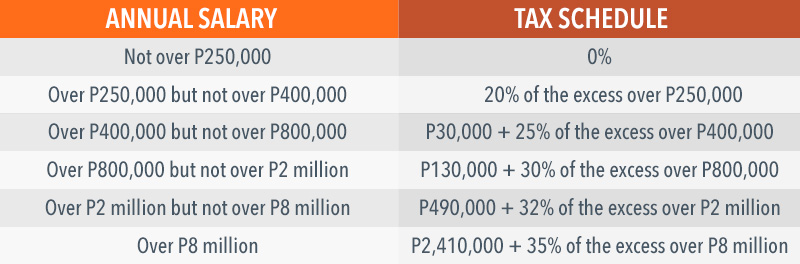

Ya 2017 for ya 2017 a personal tax rebate of 20 of tax payable up to maximum of 500 is granted to tax residents. The tax code has seven income tax brackets with the lowest tax rate being 10 percent. Prizes p10 000 or less graduated income tax rates over p10 000. There are seven federal individual income tax brackets.

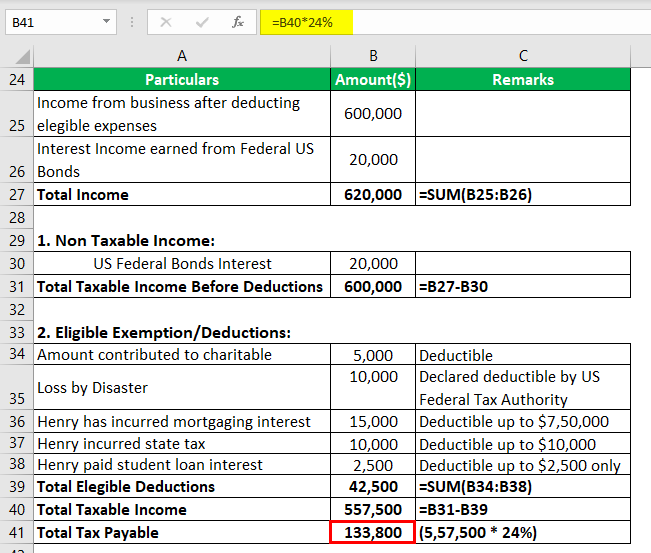

67 144 31 of taxable income above 321 600. 18 of taxable income. The federal corporate income tax system is flat. Standard deductions nearly doubled under the tax code overhaul that went.

A tax exemption excludes certain income revenue or even taxpayers from tax altogether. Those earning an annual salary of p250 000 or below will continue to be exempted from paying income tax. Due to inflation 200 000 in 1944 has the buying power of 2 896 988 51 today. For example nonprofits that fulfill certain requirements are granted tax exempt status by the irs preventing them from having to pay income tax.

105 429 36 of taxable income above 445 100. Winnings except from pcso and lotto 20 from pcso and lotto. Taxable income r rates of tax r 1 205 900. In georgia different tax brackets are.

Those earning between p250 000 and p400 000 per year will be charged a lower income tax rate of 15 on the excess over p250 000. Royalties on books as well as literary musical compositions 10 in general. Back in 1944 during world war 2 the top tax bracket was 94 and applied to income over 200 000. Interest from currency deposits trust funds and deposit substitutes.

Single or widowed or surviving civil partner without qualifying children. 155 505 39 of taxable income above 584 200. Georgia has six marginal tax brackets ranging from 1 the lowest georgia tax bracket to 5 75 the highest georgia tax bracket. 321 601 445 100.

Each marginal rate only applies to earnings within the applicable marginal tax bracket. The highest earners pay 37 percent. From year 2023 onwards the income tax rates will be further adjusted as follows. That means you have to earn nearly 2 9 million dollars before you would ever pay a 94 tax rate on a single dollar of income.