Income Tax Brackets Greece

Permanent residents are taxed on their worldwide income in greece.

Income tax brackets greece. The personal income tax rate in greece stands at 44 percent. Below we have highlighted a number of tax rates ranks and measures detailing the income tax business tax consumption tax property tax and international tax systems. The rental income tax rate depends on whether the income is obtained by a company or an individual. This page provides the latest reported value for greece personal income tax rate plus previous releases historical high and low short term forecast and long term.

In addition on 8 may 2016 the law unified social security system reform of insurance and pension system income taxation and gaming taxation regulations has been adopted introducing. Property maintenance costs estimated at 5 are deducted from the tax base by default. Income tax rates for residents start at 0 per cent on income up to 8 400 or 10 000 and rise up to 40 per cent on income over 23 400 as shown below. The tax tables below include the tax rates thresholds and allowances included in the greece tax calculator 2020.

Foreign income received by a resident of greece will be added to the income received in greece and taxed accordingly unless a bilateral treaty for avoidance of double taxation applies between greece and the country which is the source of that income. Personal income tax rate in greece averaged 42 98 percent from 1995 until 2020 reaching an all time high of 45 percent in 1996 and a record low of 40 percent in 2002. The tax tables below include the tax rates thresholds and allowances included in the greece tax calculator 2019. The tax year in greece is the same as the calendar year i e.

The income tax rates and personal allowances in greece are updated annually with new tax tables published for resident and non resident taxpayers. Individuals pay a short term rental income tax at rates from 15 to 45 depending on the income amount. Employment rental and is calculated accordingly. Keep in mind that our ranking.

Personal income tax in greece and tax credits. 2 an individual in greece is liable for tax on their income as an employee and on income as a self employed person. The income tax rates and personal allowances in greece are updated annually with new tax tables published for resident and non resident taxpayers. Income tax is payable by all individuals earning income in greece regardless of citizenship or place of permanent residence.

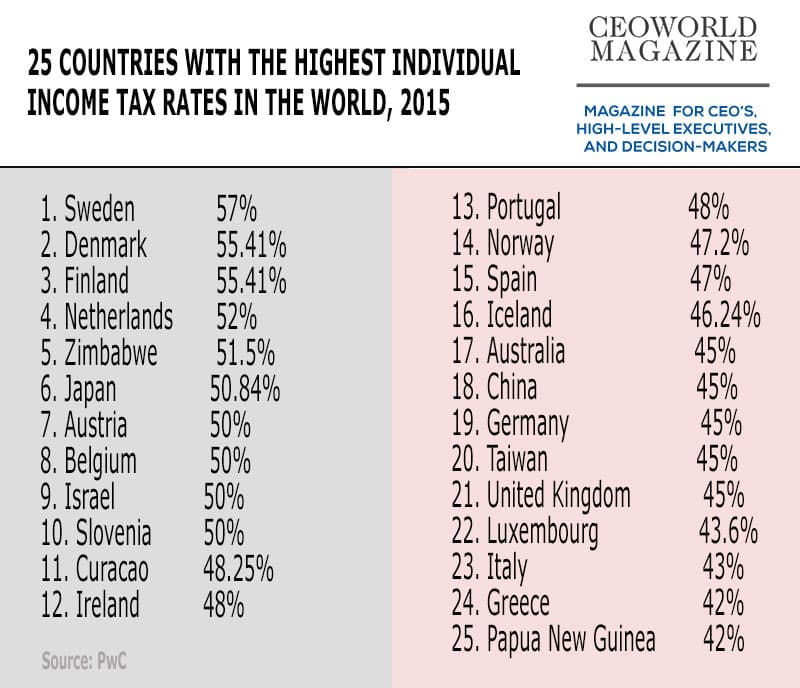

Countries with similar tax brackets include portugal with a maximum tax bracket of 46 00 austria with a maximum tax bracket of 50 00 and united kingdom with a maximum tax bracket of 50 00. The maximum income tax rate in greece of 45 00 ranks greece as one of the ten highest taxed countries in the world. Personal income tax rates as of 1 january 2013 income tax depends on the source of the income e g. How does the greece tax code rank.

Foreign pensions received by a resident of greece are subject to taxation in greece.