Income Tax Brackets Hmrc

See if your tax code has changed.

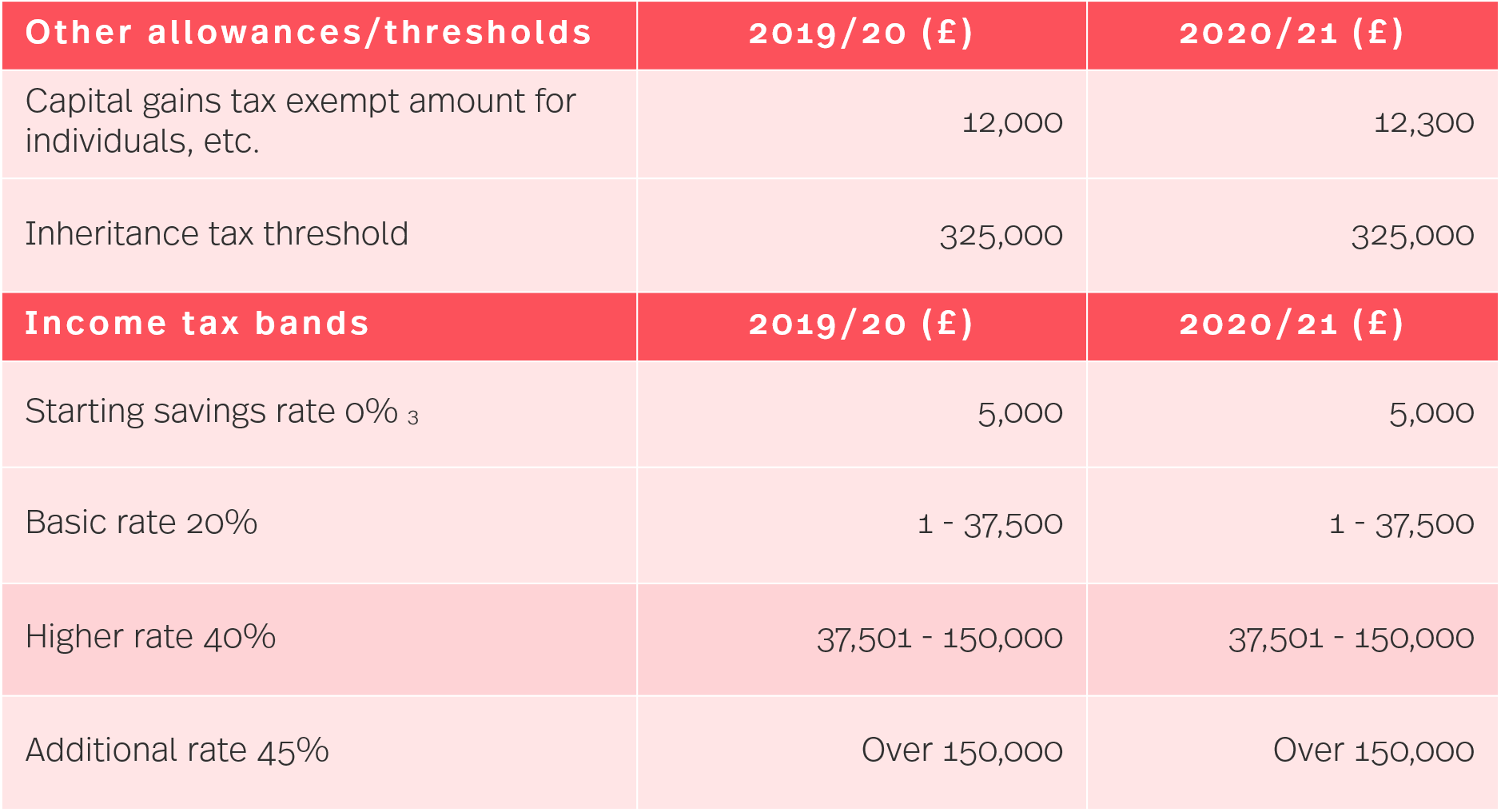

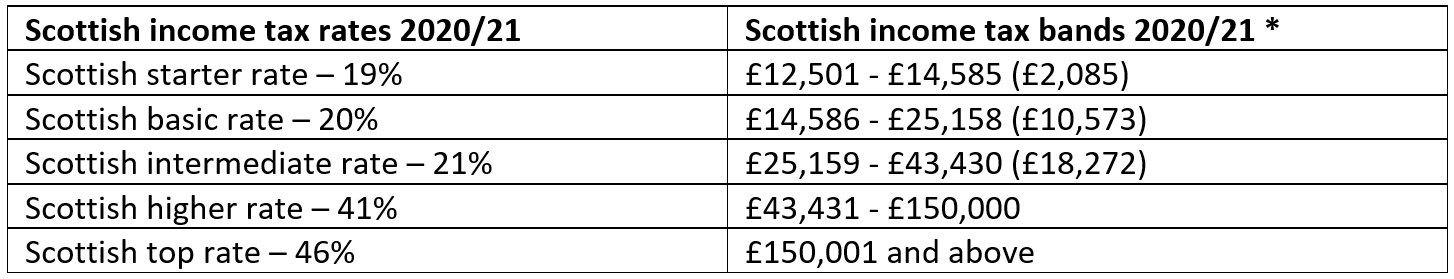

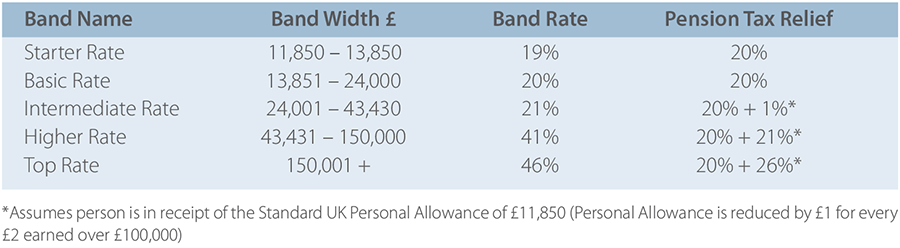

Income tax brackets hmrc. You can view income tax rates and allowances for previous tax years. The income tax rates and bands payable by scottish taxpayers will be those set by the scottish parliament. Check your tax code and personal allowance. Income tax bands are different if you live in scotland.

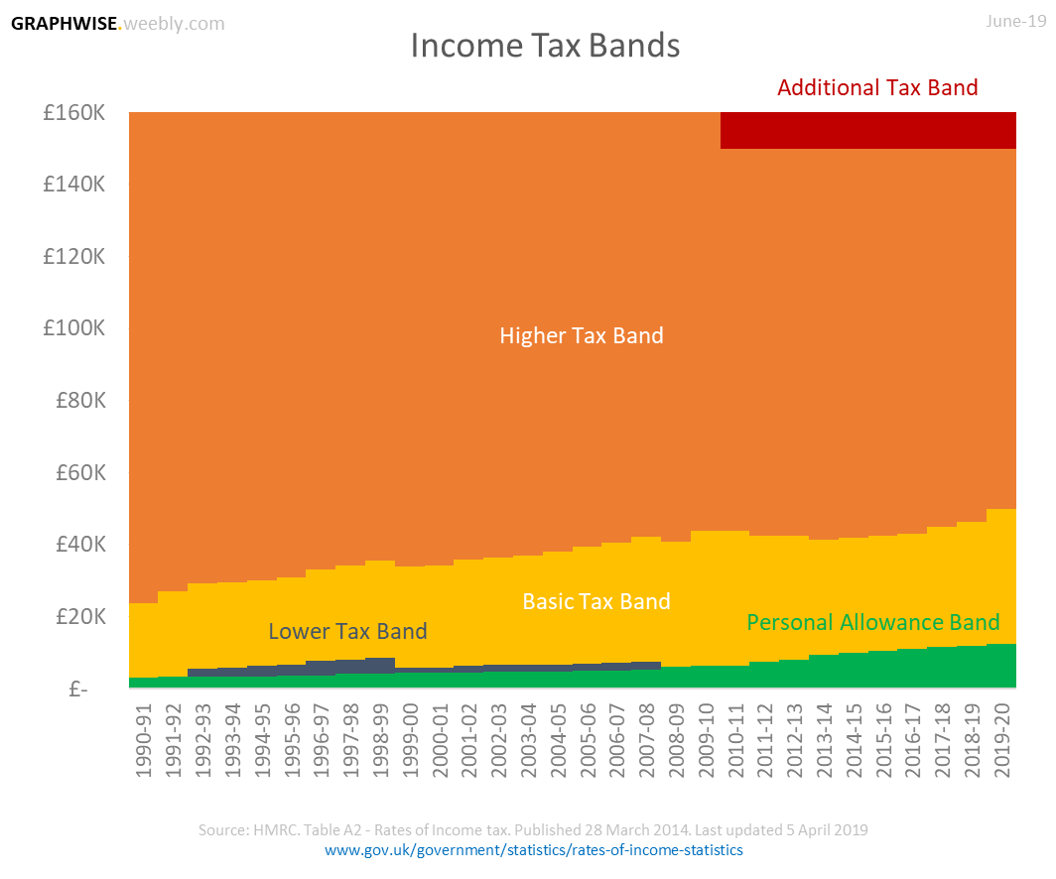

In the example shown the tax brackets and. How scottish income tax works. Tax rates and allowances have been added for the tax year 2020 to 2021. Many taxpayers therefore pay several different rates.

On 4 march 2020 the scottish parliament set the. New tax bands and allowances are usually announced in the chancellor of the exchequer s budget or autumn statement. Scottish rates and bands for 2020 to 2021. Rates are assessed in brackets defined by an upper and lower threshold.

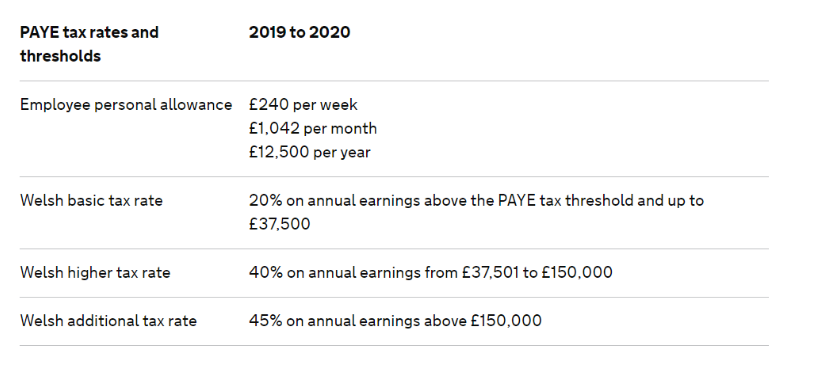

For the 2020 21 tax year if you live in england wales or northern ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 100 000. Income tax rates and bands the table shows the tax rates you pay in each band if you have a standard personal allowance of 12 500. Use the service to. The table shows the 2020 to 2021 scottish income tax rates you pay in each band if you have a standard personal allowance of 12 500.

45 pence for all business miles. Income tax is a tax you pay on your earnings find out about what it is how you pay and how to check you re paying the right amount using hmrc s tax calculator. 45 pence for the first 10 000 business miles in a tax year then 25 pence for each subsequent mile for national insurance purposes. You do not get a personal allowance if you earn over.

Receipts from scottish income tax will be collected by hmrc and paid to the scottish government via hm treasury. As taxable income increases income is taxed over more tax brackets.

.jpg)