Income Tax Brackets Hourly Wage

Taxes on director s fee consultation fees and all other income.

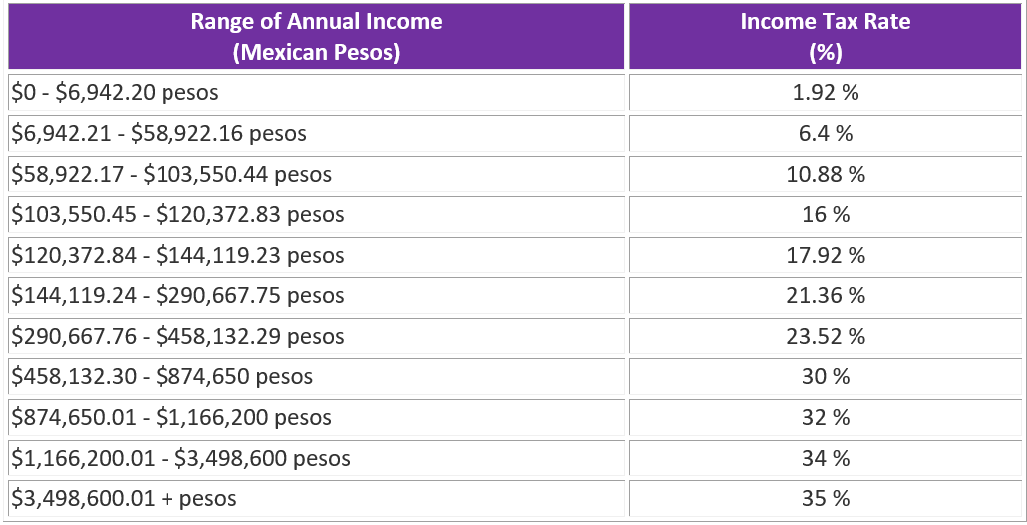

Income tax brackets hourly wage. The rates of. Effective tax rates don t factor in any deductions so if you wanted get closer to what percentage of your salary goes to uncle sam try using your adjusted gross income. Given that the second tax bracket is 12 once we have taken the previously taxes 9 875 away from 27 600 we are left with a total taxable amount of 17 725. Assuming the single filer with 80 000 in taxable income opted for the standard deduction 12 400 the amount of his agi that went to the irs was 14 9 a far cry from 22.

In australia income tax brackets are fairly simple and are a good indicator of the amount of tax you will need to pay. For example if your salary puts you in the 40 tax bracket then you only pay 40 tax on the segment of earnings in that income tax band. Previously this salary slab was not included in the income tax deduction bracket. Employers from the total salary or wages paid to their employees on a fortnightly basis as from 1 january 2019.

Who is liable to pay fortnightly salary or wages tax. Working online digital nomads paying tax in thailand. All forms of earnings are generally taxable and fall under the personal income tax bracket. Any person who earns or derives salary or wages income in papua new guinea is liable to pay tax on that income at the fortnightly rates declared by the act.

This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. For the lower part of your earnings you ll still pay the appropriate 20 or 0. However there are many ways you can reduce the amount of tax you pay either through deductions tax free threshold savings strategies and certain tax offsets you may be eligible for. According to the income tax slabs for fy 2020 21 a certain amount of income tax will be deducted from the salaries of individuals earning more than pkr 600 000 per annum.

If you had 50 000 of taxable income you d pay 10 on that first 9 875 and 12 on the chunk of income between 9 876 and 40 125. Latest income tax slab rates in pakistan. After taking 12 tax from that 17 725 we are left with 2 127 of tax. Marginal bands mean you only pay the specified tax rate on that portion of salary.

More information about the calculations performed is available on the about page. This ranges from a work salary to capital gains or dividends lease transactions or even selling clothes on the sidewalk as long as the earnings are over 150k per year. Given that the first tax bracket is 10 you will pay 10 tax on 9 875 of your income. And then you d pay 22 on the rest because some.

From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22.