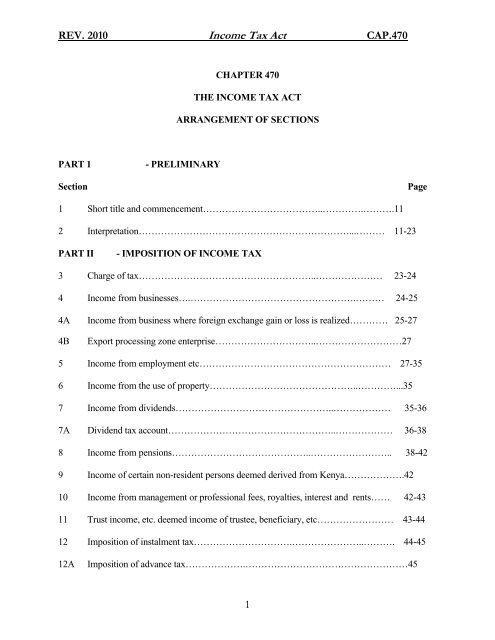

Income Tax Brackets Kenya

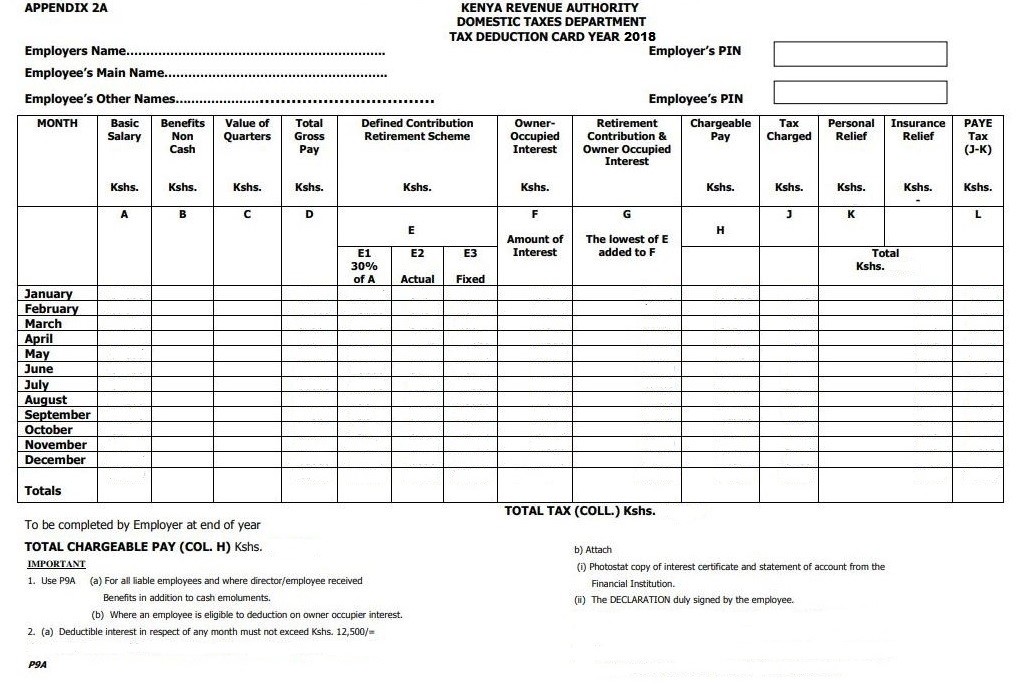

Kenya residents income tax tables in 2019.

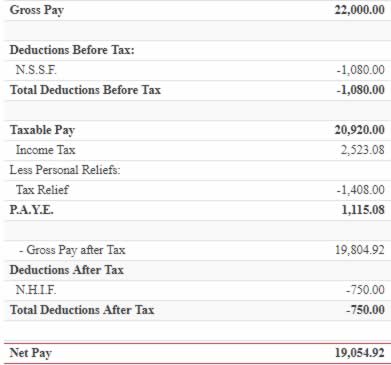

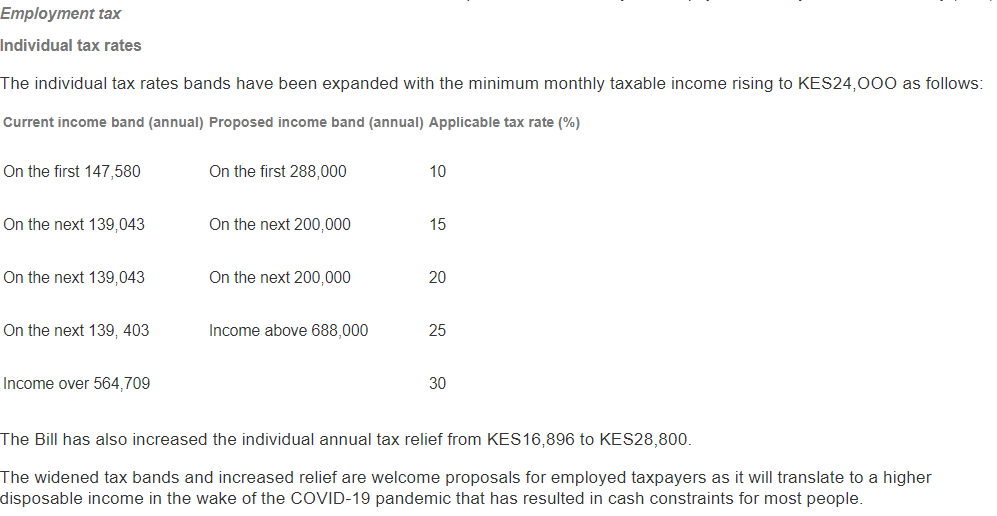

Income tax brackets kenya. The employer is required to pay fringe benefit tax on any loans advanced to employees at an interest rate below the prevailing market interest rate. As shown above the maximum rate of 25 will be charged on income in excess of kes 688 000. Kra paye rates 2020 in kenya income tax brackets. Ksh40 668 ksh57 333.

Kra paye new rates 2020 in kenya income tax brackets. Income tax is imposed on. On the next ksh 126 403 15. Business income from any trade or profession.

Up to ksh288 000. Ksh488 001 ksh688 000. Below are the new paye rates in kenya effective january 2019. This applies to all loans issued after 11 june 1998 and to those issued on or before 11 june 1998 but whose terms and conditions have changed after this date.

Up to ksh24 000. Income tax is a tax charged for each year of income upon all the income of a person whether resident or non resident which is accrued in or was derived from kenya. Income tax rates based on location of business. Individual tax rates for 2020 are different from those in 2019 in april the government adjusted the tax rates to cushion kenyans against the economic impact of coronavirus.

On the next ksh 126 403 20. Income from 286 623 01. For tax non residents the statutory rate is at thirty seven point five per cent 37 5. Income from 147 580 01.

On the next ksh. Any amount paid to non resident individuals in respect of any employment with or services rendered to an employer who is resident in kenya or to a permanent establishment in kenya is subject to income tax charged at the prevailing individual income tax rates. Non resident employees are taxable only on their income earned from within kenya or derived from kenya. Ksh 28 800 per year.

Income from a digital. Ksh 2 400 per month. On all income over ksh. Ksh288 001 ksh488 000.

With effect from 25th april 2020. In kenya the statutory income tax rate for tax residents is thirty per cent 30. Personal relief of kshs. Income tax rates and thresholds annual tax rate taxable income threshold.

On the first ksh. Personal income tax rates effective 25 april 2020 the tax rates applicable to taxable income are tabulated as follows. 7 months ago 3208 views. Following the adjustments below were the final and verified tax rates in kenya for the year 2020.

Income from 425 666 01.