Income Tax Brackets Massachusetts

Massachusetts has a flat income tax rate which applies to both single and joint filers.

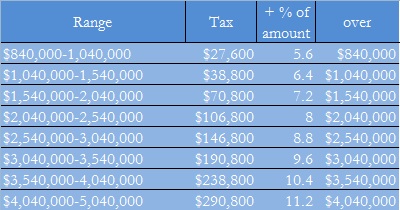

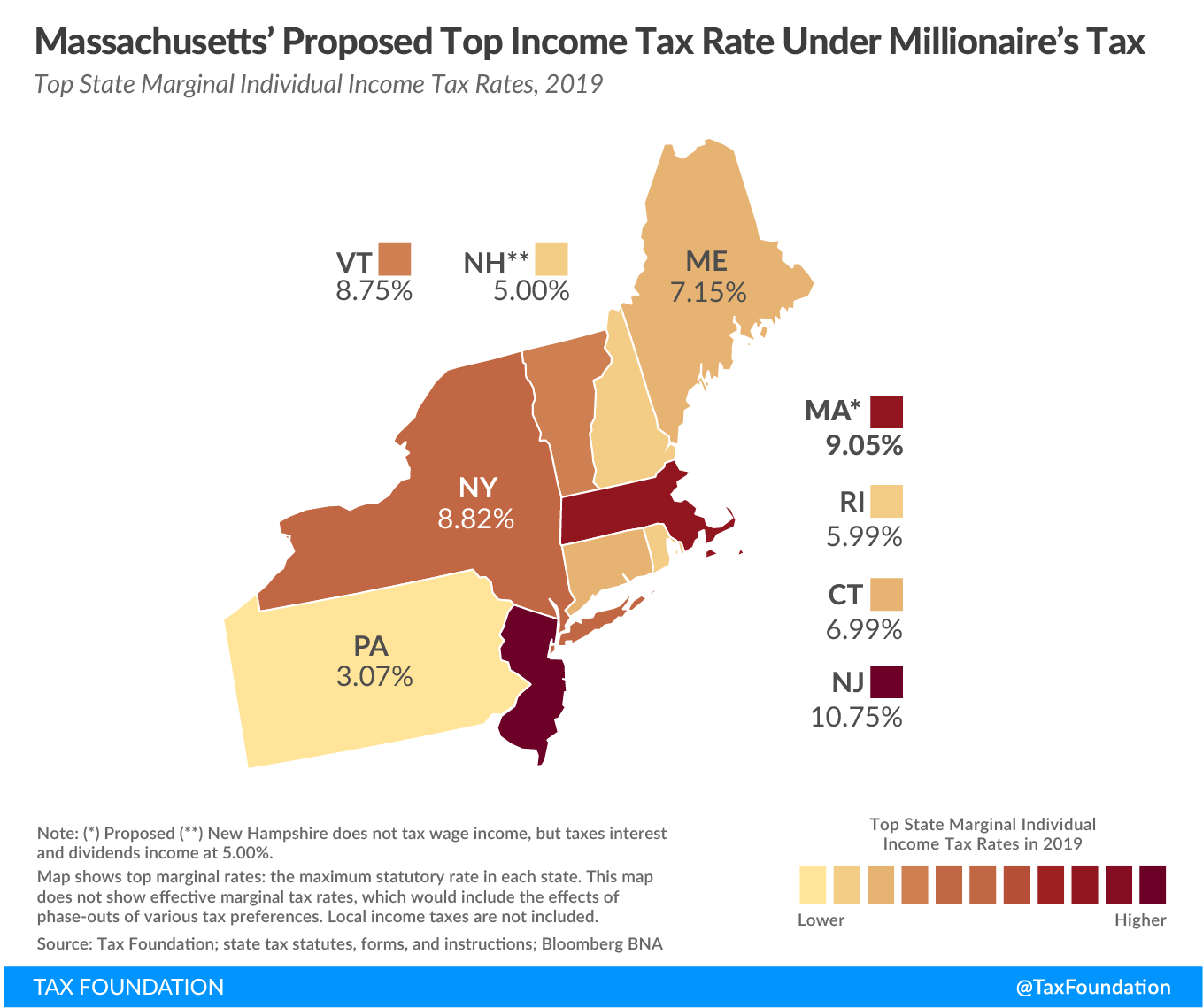

Income tax brackets massachusetts. When the clock strikes midnight and 2020 begins massachusetts residents will receive an income tax cut that has been two decades in the making. In the state of massachusetts there is just one personal income tax bracket. Which massachusetts tax bracket am i in. Massachusetts tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living.

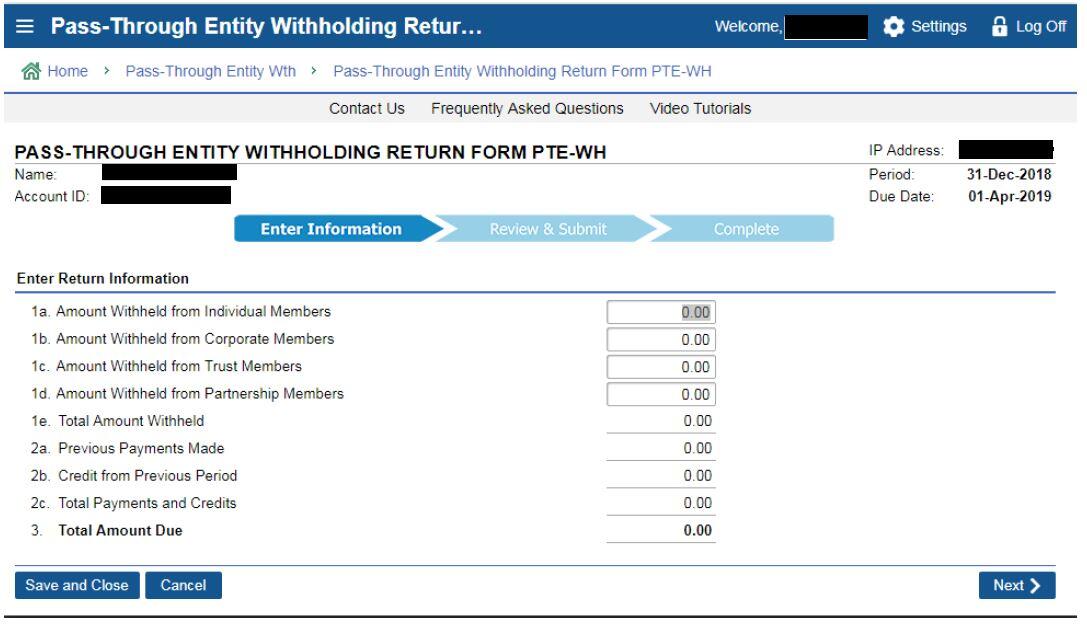

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in april 2020. The 15th day of the 4th month for fiscal year filings. What is the massachusetts income tax rate for 2019. Massachusetts s 2019 income tax rate is 5 05.

Every individual taxpayer is therefore in the same bracket regardless of filing status and amount. Tax year 2019 withholding. On new year s day massachusetts state income tax. The massachusetts income tax has one tax bracket with a maximum marginal income tax of 5 00 as of 2020.

In 2019 this amounts to 8 000 for single filers 14 400 plus 1 000 per dependent for head of household and 16 400 plus 1 000 per dependent for married couples filing jointly. Massachusetts imposes no state tax on those with very low incomes. Detailed massachusetts state income tax rates and brackets are available on this page. This means that these brackets applied to all income earned in 2018 and the tax return that uses these tax rates was due in april 2019.