Income Tax Brackets Ontario Canada 2019

5 05 on the first 44 740 of taxable income 9 15 on the next 44 742 11 16 on the next 60 518 12 16 on the next 70 000 13 16 on the amount over 220 000.

Income tax brackets ontario canada 2019. Even for those who earn less than the personal amount filing a tax return is important. The 2019 tax rates and tax brackets for canada can be found below. 44 741 up to 89 482 third. Go to income tax rates revenu québec web site.

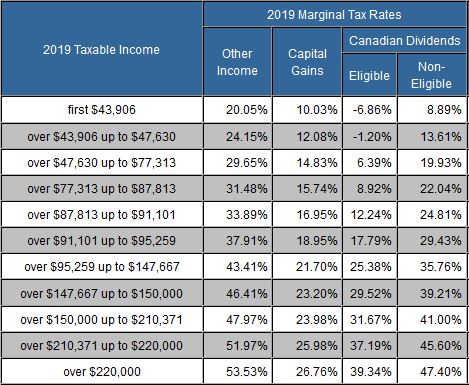

Marginal rate applies to dividends added to regular. 89 483 up to 150 000 fourth. For eligible dividends table takes into account gross up of 38 federal credit of 15 and provincial credit of 10. This edition does not include the december 9 2019 announcement proposing an enhancement to the federal basic personal amount.

Use these to determine how much you may owe at tax time. For 2020 you pay. Individuals resident in ontario on 31 december 2019 with taxable income in excess of 20 000 must pay the ontario health premium. How do the tax brackets work in canada.

15 on the first 48 535 of taxable income and. 44 740 or less second. Each tax bracket has a different rate of tax associated with it. For non eligible dividends table takes into account gross up of 15 federal credit of 9 03 and provincial credit of 3 2863.

There are 5 tax brackets. Enter your annual income taxes paid rrsp contribution into our calculator to estimate your return. 20 50 on the next 48 534 of taxable income on the portion of taxable income over 48 535 up to 97 069 and. The basic personal amount is the income level below which no taxes are levied.

The federal tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1 010. Your 2019 ontario income tax refund could be even bigger this year. 10 8 on the first 33 389 of taxable income 12 75 on the next 38 775 17 4 on the amount over 72 164. 2020 federal tax brackets and rates.

The federal tax rates in canada follow the same pattern with rates increasing as your taxable income goes up. Please read the article understanding the tables of personal income tax rates. In ontario tax brackets are based on net income for income tax purposes. The premium ranges from nil to 900 depending on the individual s taxable income with the top premium being payable by individuals with taxable income in excess of 200 599.

150 001 up to 220 000 fifth. The ontario income thresholds personal amounts surtax thresholds and tax reduction amounts have been indexed for 2020. Ontario tax rates current marginal tax rates ontario personal income tax rates ontario 2021 and 2020 personal marginal income tax rates. Easy income tax calculator for an accurate ontario tax return estimate.