Income Tax Brackets Percentage Population

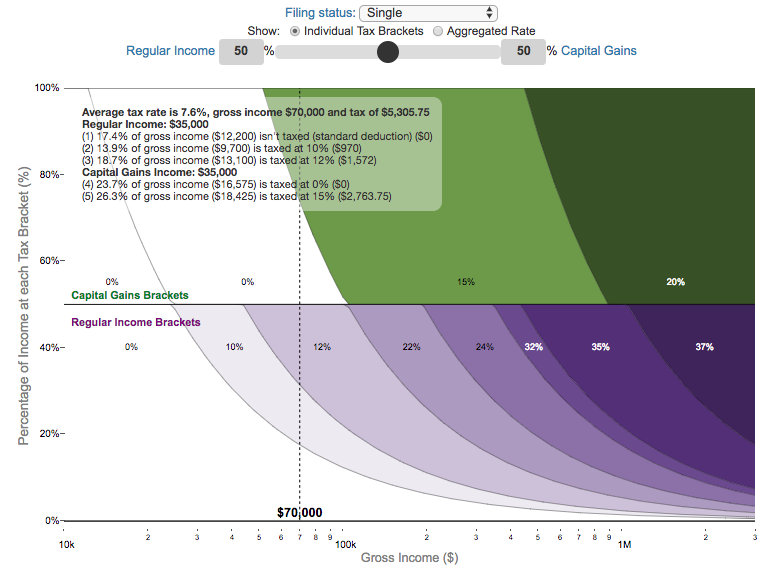

These households face a rate of 39 6 on their ordinary income although they face lower rates on income from long term capital gains and dividends.

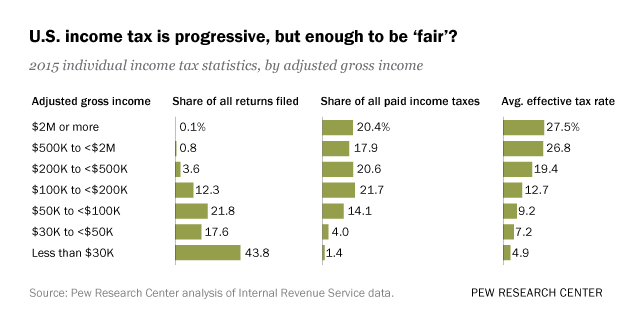

Income tax brackets percentage population. All in all the majority of american households 77 fall into the 15 tax bracket or below. 16 17 the tax rate increases very progressively rapidly at 13 ke year from 25 to 48 and at 29 ke year to 55 and eventually reaches 67 at 83 ke year while little decreases at 127 ke year. The total finnish income tax includes the income tax dependable on the net salary employee unemployment payment and employer unemployment payment. The bottom 50 percent of taxpayers taxpayers with agis below 41 740 faced an average income tax rate of 4 0 percent.

In fact just 3 percent of households are in the 28 percent bracket or above and another 2 5 percent pay the alternative minimum tax amt at a 26 or 28 percent rate. The 2017 irs data shows that taxpayers with higher incomes paid much higher average income tax rates than lower income taxpayers. According to the oecd a single person on an average salary without children will have the highest income tax rate in belgium some 42 8 percent of his or her earnings.