Income Tax Brackets Uk 2020 21

In scotland the starter rate of 19 is paid on taxable income over the personal allowance to 2 085 the basic rate of 20 is paid from 2 086 to 12 658 and the.

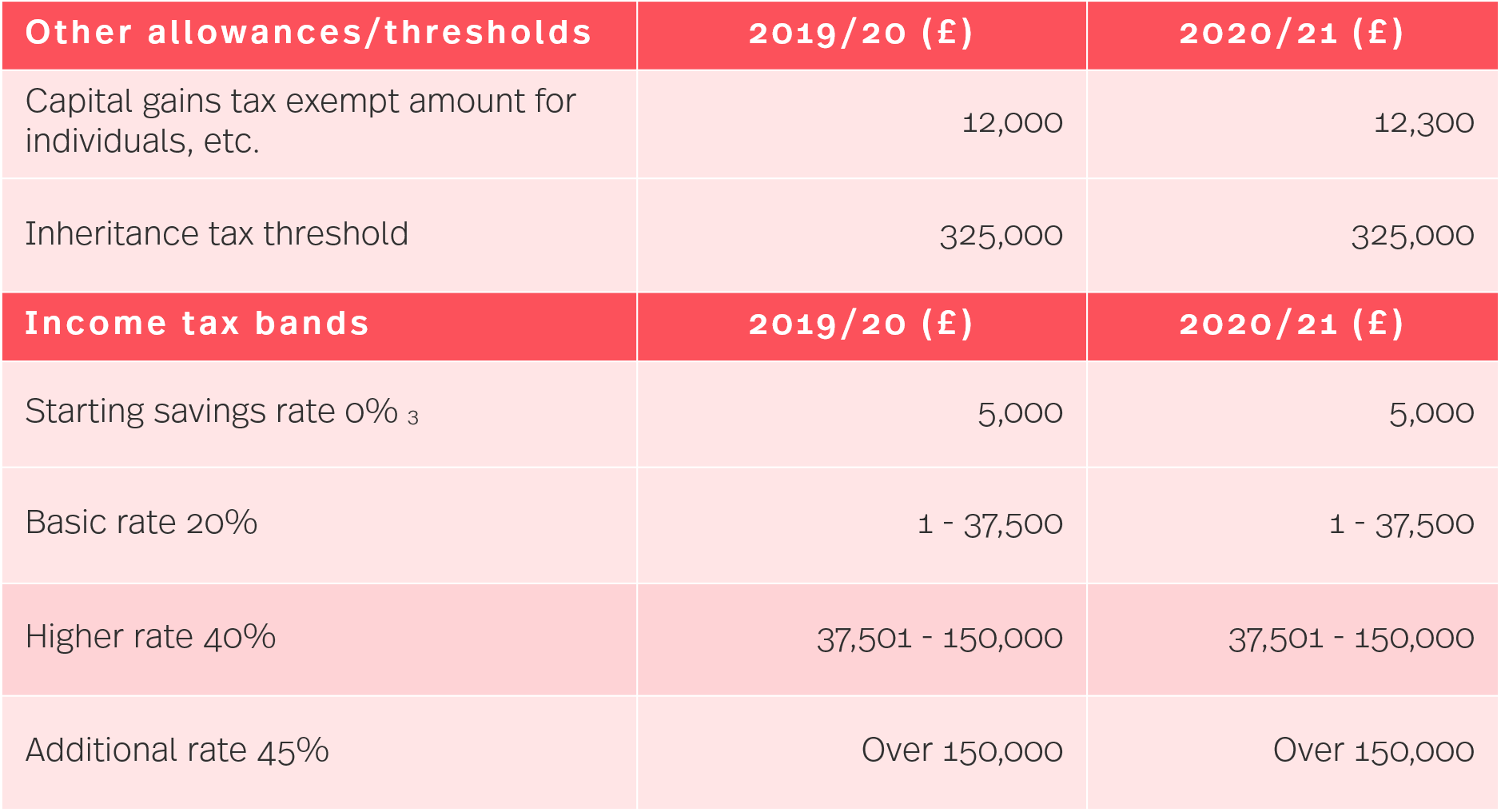

Income tax brackets uk 2020 21. Allowances 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018. Above that threshold dividends falling in the basic rate band pay tax at 7 5 in the higher rate band at 32 5 and dividends that fall within the additional rate band will be taxed at 38 1. And while the income tax brackets and personal tax allowance won t be changing in 2020 21 chancellor rishi sunak s highly anticipated budget speech on 11 march had good news for both the employed and self employed. The new tax year in the uk starts on 6 april 2020.

Uk income tax rates and bands 2020 21. In england wales and northern ireland the basic rate is paid on taxable income over the personal allowance to 37 500. For the 2020 21 tax year if you live in england wales or northern ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 100 000. Paye tax rates and thresholds 2020 to 2021.

Income limit for personal allowance. These rates come into effect at the start of the new tax year on april 6th 2020. Band taxable income tax rate. Here s what you need to know about the 2020 21 income tax rates and a rundown of how new budget measures will affect your.

240 per week 1 042 per month 12 500 per year. Tax rates and allowances have been added for the tax year 2020 to 2021. Uk paye tax rates and allowances 2020 21 this article was published on 03 03 2020 this page contains all of the personal income tax changes which were published on the gov uk site on fri 28 feb 2020. Taking into account the frozen personal allowance the maximum tax free income you can receive through dividends in 2020 21 is 14 500.