Income Tax Brackets Under Obama

Improvements to the earned income tax credit eitc and child tax credit ctc enacted in 2009 under president obama and recently made permanent provide.

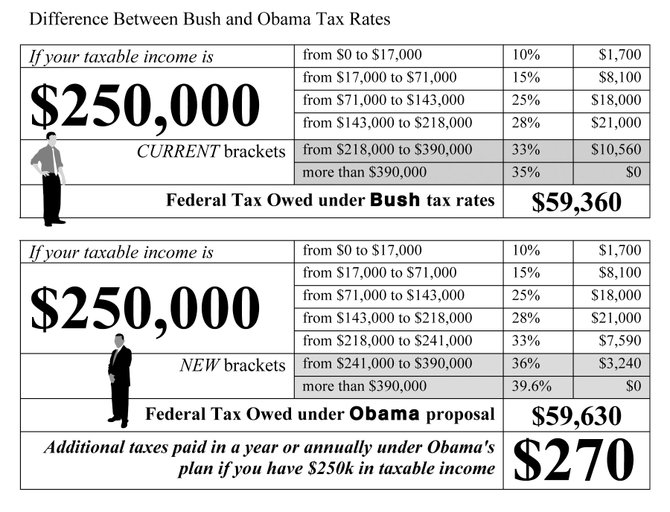

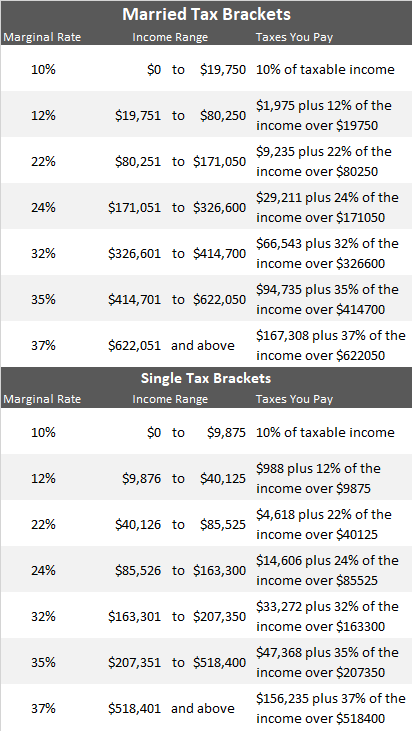

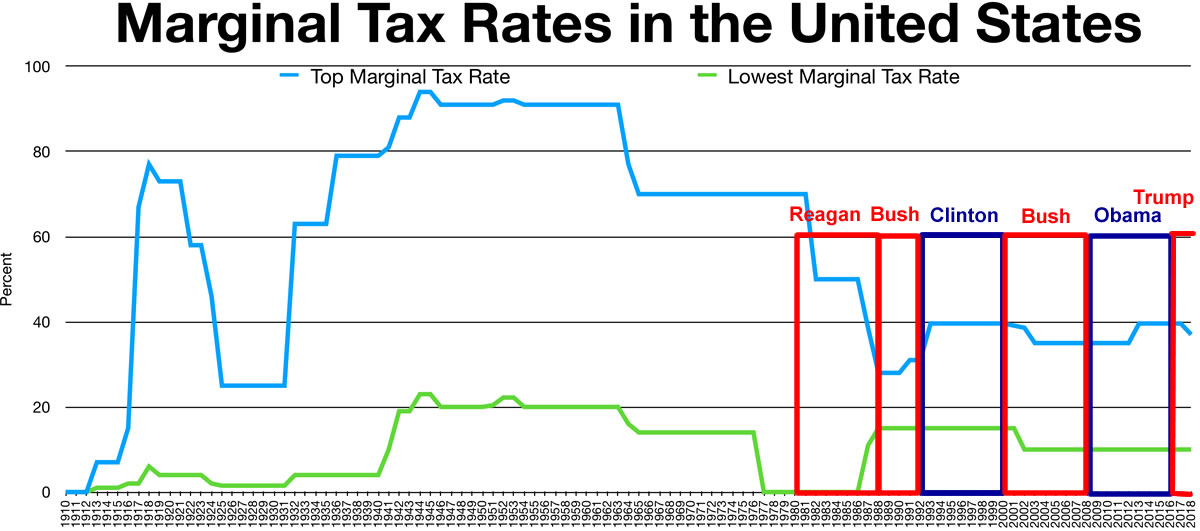

Income tax brackets under obama. But as a percentage of the whole 100 000 your tax is about 17. For example if you are single you paid a 10 rate on income up to 9 325. The brackets are generally adjusted each year for inflation. The bush tax cuts have remained through the obama administration with a 35 percent marginal income tax for the top income bracket and a 15 percent capital gains income tax.

Under president obama the number of tax brackets was expanded to 7. The tax rates that applied to the tax brackets were the same under each president with one exception. It cut payroll taxes by 2 percentage points adding 112 billion to workers spendable income. It extended a college tuition tax credit.

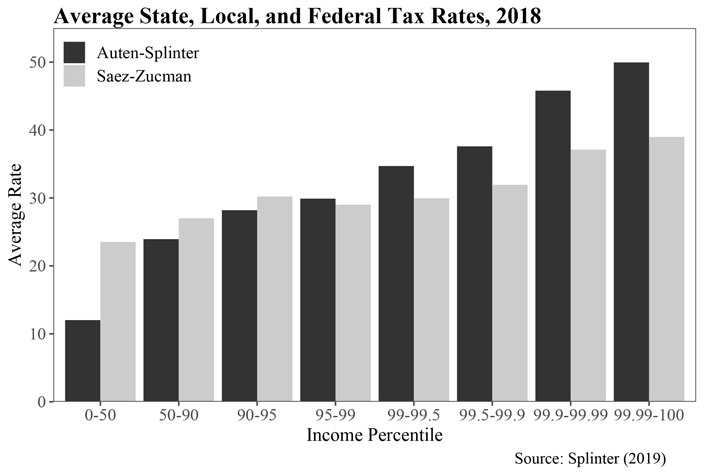

Then the pandemic floored the stock market causing it to plunge roughly 30. From the tax policy center. But middle earners paid. Via the tax policy center here is the list of top bracket marginal tax rates from the introduction of the income tax in 1913 to a few years ago.

70 700 x 25. As of 2013 the tax policy center found that under obama the top 1 of earners paid an effective federal tax rate of roughly 32 compared to about 27 under bush. It extended the bush tax cuts through 2012 and unemployment benefits through 2011. A typical family making 50 000 a year received tax cuts totaling 3 600 in president obama s first term more if they were putting a child through college.

The only thing that changed under president obama was the addition of a 39 6 top tax rate that applied to a new top tax bracket. In 2017 income over 9 325 was taxed at a 15 rate up to 37 950. When people refer to president obama s tax cuts they generally refer to the 858 billion tax cut deal signed in 2010. Stocks made considerable gains under obama which continued when trump took office promising tax cuts and deregulation.

The rates apply to the income in a given bracket. So for taxpayers also subject.