Income Tax Calculator Canada Monthly

Canada income tax calculator find out your federal taxes provincial taxes and your 2020 income tax refund for tax year 2019.

Income tax calculator canada monthly. The canada monthly tax calculator is updated for the 2020 21 tax year. Tax assessment year the tax assessment year is defaulted to 2020 you can change the tax year as required to calculate your salary after tax for a specific year. You can calculate your monthly take home pay based of your monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2020 tax tables use the simple monthly canada tax calculator or switch to the advanced canada monthly tax calculator to review nis payments and income tax deductions for 2020. Canadian corporate tax rates for active business income.

After tax income is your total income net of federal tax provincial tax and payroll tax. The average monthly net salary in canada is around 2 997 cad with a minimum income of 1 012 cad per month. The basic personal tax amount cpp qpp qpip and ei premiums and the canada employment amount. Province of residence alberta british columbia manitoba new brunswick newfoundland and labrador northwest territories nova scotia nunavut ontario prince edward island quebec saskatchewan yukon.

We strive for accuracy but cannot guarantee it. Advanced features of the canada income tax calculator. Or you can choose tax calculator for particular province or territory depending on your residence. Calculate your combined federal and provincial tax bill in each province and territory.

It will confirm the deductions you include on your official statement of earnings. Rates are up to date as of april 28 2020. Number of children and number of children who qualify for dependents allowance. This places canada on the 12th place in the international labour organisation statistics for 2012 after france but before germany.

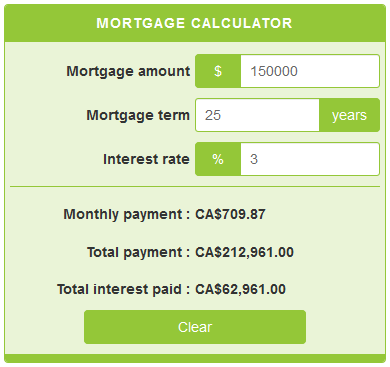

This calculator is intended to be used for planning purposes. These calculations are approximate and include the following non refundable tax credits. If you make 52 000 a year living in the region of ontario canada you will be taxed 11 959 that means that your net pay will be 40 041 per year or 3 337 per month. Use the payroll deductions online calculator pdoc to calculate federal provincial except for quebec and territorial payroll deductions.

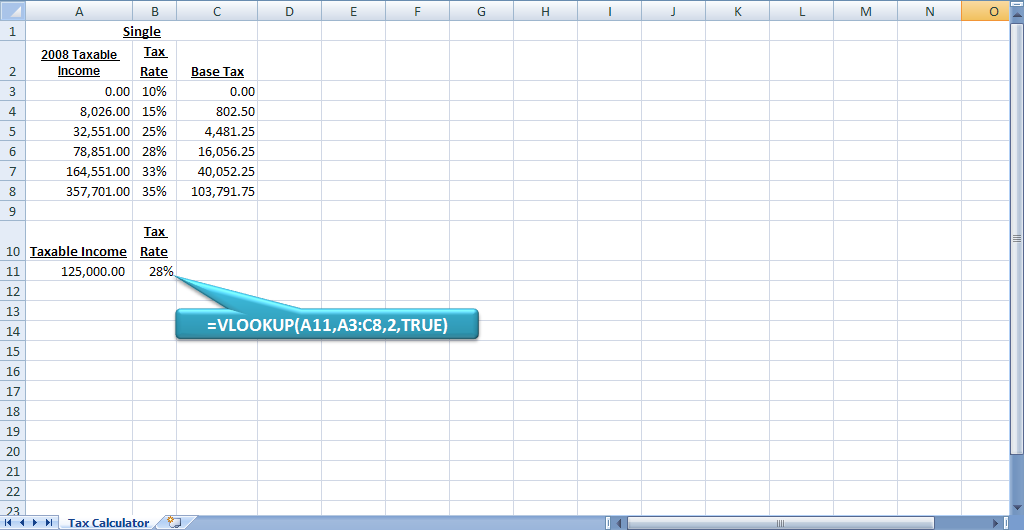

2020 includes all rate changes announced up to july 31 2020. You assume the risks associated with using this calculator. In canada each province and territory has its own provincial income tax rates besides federal tax rates below there is simple income tax calculator for every canadian province and territory. Your average tax rate is 23 00 and your marginal tax rate is 35 26 this marginal tax rate means that your immediate additional income will be taxed at this rate.

In canada income tax is usually deducted from the gross monthly salary at source through a pay as you earn paye system. 2020 tax brackets and most tax credits have been verified to canada revenue. Calculations are based on rates known as of june 20 2020 including bc budget changes and 2020 increases to federal and yt basic personal and spousal amounts.