Income Tax Calculator Japan

This places japan on the 2nd place in the organisation for economic co operation and development after united states but before germany.

Income tax calculator japan. If you get non monetary benefits as part of your job for example if your employer provides you a house to live in this will also be treated as taxable income. The average monthly net salary in japan jp is around 430 000 yen with a minimum income of around 130 000 yen per month. Japan uses a progressive income tax scheme i e when your income is increased the tax is also increased. Pension contributions this is the pensions rate defined for 2020 in the 2020 income tax rates and thresholds.

Income tax calculator japan. Job status age prefecture and work industry affects social insurance and dependents affect income taxes. This tool is an online utility. To make it easier for you to assess your japanese tax liabilities we have created various japan tax calculators for your use.

Japan has the second most advanced economies in the world it is the third largest by the nominal gdp countries and the fourth. Taxes in japan zeikin 税金 are paid on income property and consumption on the national prefectural and municipal levels. Japan economy is the highest market oriented and third largest economy in the world. Your income tax yen.

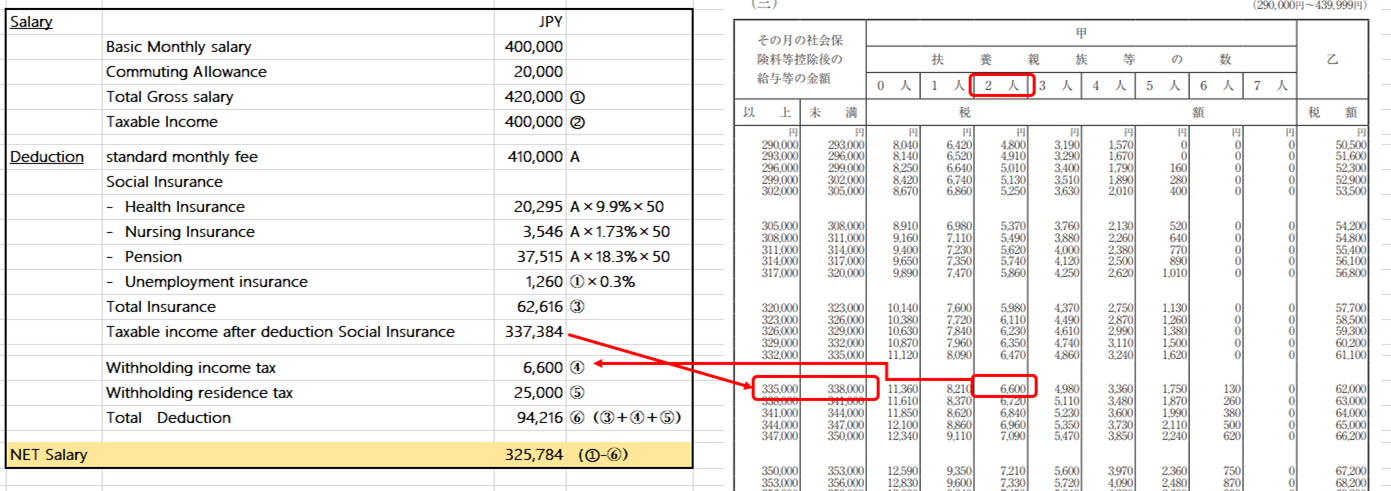

Monthly payroll calculations in japan include monthly salary overtime commuting and other allowances social insurance contributions and taxes. Japan income tax calculator. This amount needs to be calculated per salary segment using that table. Advanced features of the japan income tax calculator.

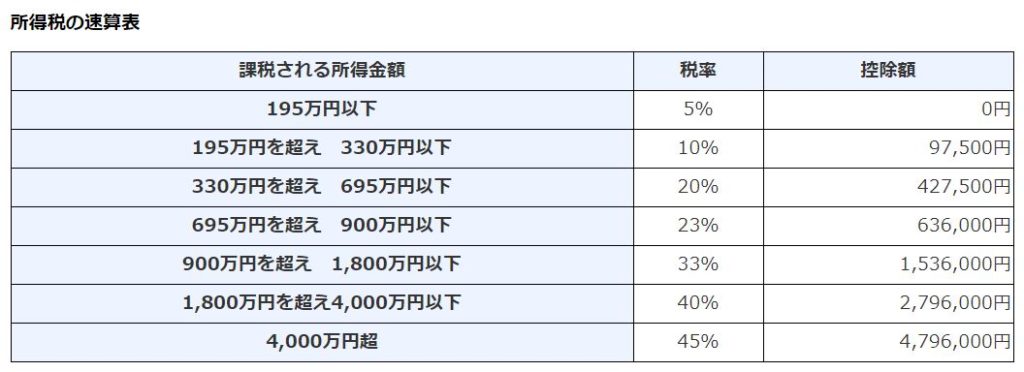

Fixed pension or of salary the default pension contributions are set as a percentage of your gross salary. Earned income deduction 1 950 000 income after earned income deduction. You can edit the rate as required. For example your salary was 2 090 000 then you d have to pay 5 on the first 1 950 000 and 10 on the last 140 000.

The payroll calculator estimates net salary payment across 2 scenarios. Income tax calculator japan. Income tax for japan is an individual pays tax on his income as a wage earner or as a self employed person. Easy and convenient to use and of great help to students and.

Code to add this calci to your website. If you are looking for the answer to the question of how to calculate your tax bill in japan then here is the income tax. The income tax calculation is based on your taxable income minus the standard personal deduction which is equal to 380 000y.