Income Tax Calculator Malaysia Monthly

About simple pcb calculator pcb calculator made easy.

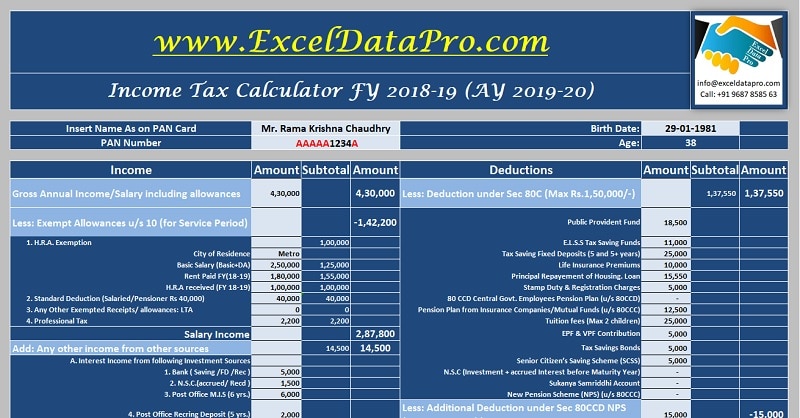

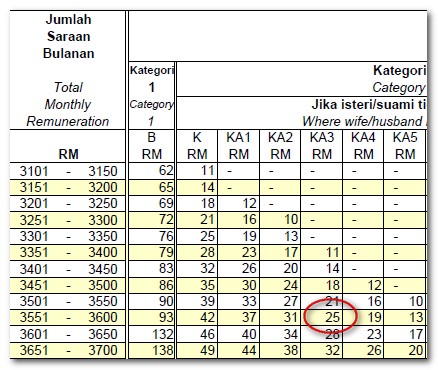

Income tax calculator malaysia monthly. Pcb stands for potongan cukai berjadual in malaysia national language. A simplified payroll calculator to calculate your scheduled monthly tax deduction aka potongan cukai berjadual. Monthly tax deduction pcb and payroll calculator tips calculator based on malaysian income tax rates for 2019. This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus only tax.

The calculator is designed to be used online with mobile desktop and tablet devices. The itrf is submitted to the irbm together with the payment for the balance of. Review the full instructions for using the malaysia salary after tax calculators which details malaysia tax. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you.

As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs. Simple pcb calculator is a monthly tax deduction calculator to calculate income tax required by lhdn malaysia. The annual wage calculator is updated with the latest income tax rates in malaysia for 2019 and is a great calculator for working out your income tax and salary after tax based on a annual income. Salary calculator malaysia.

Your average tax rate is 26 82 and your marginal tax rate is 35 00 this marginal tax rate means that your immediate additional income will be taxed at this rate. If you make rm 200 000 a year living in malaysia you will be taxed rm 53 632 that means that your net pay will be rm 146 368 per year or rm 12 197 per month. If monthly salary is rm 5 000 with a yearly bonus of rm 5 000 then for an employee who. Your average tax rate is 15 12 and your marginal tax rate is 22 50 this marginal tax rate means that your immediate additional income will be taxed at this rate.

If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582 that means that your net pay will be rm 59 418 per year or rm 4 952 per month. With a separate assessment both husband. Tax administration under sas is based on the concept pay self assess and file pay. The system is thus based on the taxpayer s ability to pay.

Review the full instructions for using the malaysia salary after tax calculators which details malaysia tax. Taxpayers compute their own taxes via income tax calculator malaysia. This means that low income earners are imposed with a lower tax rate compared to those with a higher income. Malaysia personal income tax calculator for ya 2020 malaysia adopts a progressive income tax rate system.

Pcb epf socso eis and income tax calculator. The calculator is designed to be used online with mobile desktop and tablet devices. The monthly wage calculator is updated with the latest income tax rates in malaysia for 2020 and is a great calculator for working out your income tax and salary after tax based on a monthly income. Monthly salary deductions are made for individuals having employment income or through installment for individuals having business income.