Income Tax Calculator Ri

Rhode island s 2020 income tax ranges from 3 75 to 5 99.

Income tax calculator ri. Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan. Neuvoo online salary and tax calculator provides your income after tax if you make 57 000 in rhode island. This page has the latest rhode island brackets and tax rates plus a rhode island income tax calculator. Income tax tables and other tax information is sourced from the rhode island division of taxation.

Find your net pay from a salary of 57 000. The highest marginal rate applies to taxpayers earning more than 145 600 for tax year 2019. The rhode island tax calculator is designed to provide a simple illlustration of the state income tax due in rhode island to view a comprehensive tax illustration which includes federal tax medicare state tax standard itemised deductions and more please use the main 2020 21 tax reform calculator. Like most other states in the northeast rhode island has both a statewide income tax and sales tax.

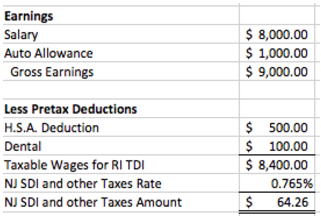

We calculate how much your payroll will be after tax deductions in rhode island. Your average tax rate is 20 11 and your marginal tax rate is 33 40 this marginal tax rate means that your immediate additional income will be taxed at this rate. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The rhode island income tax calculator is designed to provide a salary example with salary deductions made in rhode island.

If you make 55 000 a year living in the region of rhode island usa you will be taxed 11 063 that means that your net pay will be 43 937 per year or 3 661 per month. The income tax is progressive tax with rates ranging from 3 75 up to 5 99. Rhode island salary tax calculator for the tax year 2020 21 you are able to use our rhode island state tax calculator in to calculate your total tax costs in the tax year 2020 21. Rhode island has a progressive state income tax system meaning residents who earn more may pay a higher rate.

We strive to make the calculator perfectly accurate. Al ak az ar ca co ct de fl ga hi id il in ia ks ky la me md ma mi mn ms mo mt ne nv nh nj nm ny nc nd oh ok or pa ri sc sd tn tx ut vt va wa wv wi wy. The provided information does not constitute financial tax or legal advice. Our calculator has recently been updated in order to include both the latest federal tax rates along with the latest state tax rates.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax. Your household income location filing status and number of personal exemptions. Our tax calculator is based on data from 2020 in usa.