Income Tax Calculator Singapore Foreigner

The calculator is provided for your free use on our website whilst we aim for 100 accuracy we make no guarantees as to the accuracy fo the calculator.

Income tax calculator singapore foreigner. If you make s 85 200 a year living in singapore you will be taxed s 18 148 that means that your net pay will be s 67 052 per year or s 5 588 per month. To qualify you must be physically present in a foreign country for at least 330 full days during any 12 month period. When filing income tax please fill in form b1 income tax return for residents. A personal income tax guide for foreigners in singapore.

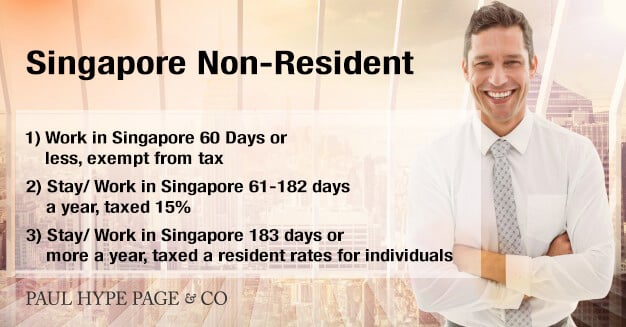

Foreigner who has stayed worked in singapore excludes director of a company for 183 days or more in the year preceding the ya. Singapore tax filing calendar. Tax season 2020 about your tax bill individuals foreigners required to pay tax deductions for individuals foreigners expenses donations reliefs rebates. About the singapore income tax calculator.

Singapore income tax calculator. Simply put the foreign earned income tax exclusion form 2555 allows citizens to exclude up to 105 900 of foreign earned income if they meet various requirements. Cpf cash top up relief. Otherwise you will be treated as a non resident of singapore for tax purposes.

Your average tax rate is 21 30 and your marginal tax rate is 11 50 this marginal tax rate means that your immediate additional income will be taxed at this rate. Use our free singapore personal income tax calculator for a hassle free easy way to estimate your personal income tax. Under the not ordinarily resident nor scheme you can enjoy either time apportionment of singapore employment income or tax exemption of employer s contributions to overseas pension fund or both. If you work for a foreign employer and need to travel overseas in the course of work you may enjoy time apportionment of employment income under.

Your foreign sourced income with the exception of those received through partnerships in singapore brought into singapore on or after 1 jan 2004 is tax exempt. In the interest of simplicity some details have been omitted. There are a few exceptions and edge cases to watch out for which this tool will help you catch. With concessionary foreign maid levy 170 per month 3 080.

Income tax calculator for non resident individuals xls 67kb compute income tax liability for non resident individuals locals and foreigners who are in singapore for less than 183 days 6. Singapore citizen sc or singapore permanent resident spr who resides in singapore except for temporary absences. The singapore income tax calculator is designed to allow you to calculate your income tax and salary deductions. The information in this summary is intended to be no more than a general overview of your tax position.

.jpg)