Income Tax Classes Arizona

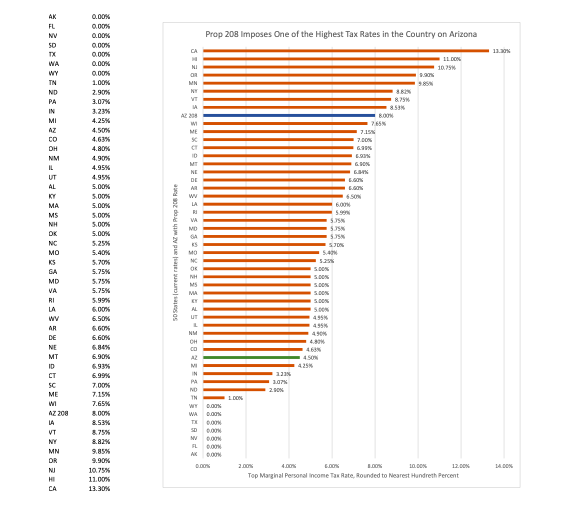

This latest tax hike would make arizona the state with the 10th highest income tax rate in the country whereas it previously had the 11th lowest according to the tax foundation the wall street journal reported in october.

Income tax classes arizona. Arizona tax practitioner institute classes. If enacted proposition 208 would impose an additional 3 5 tax on income over 250 000 for single filers and small businesses filing as pass throughs. Course materials are offered for a fee of 149 in most states and 99 in minnesota. City services team education unit compliance programs and specialty tax program teams.

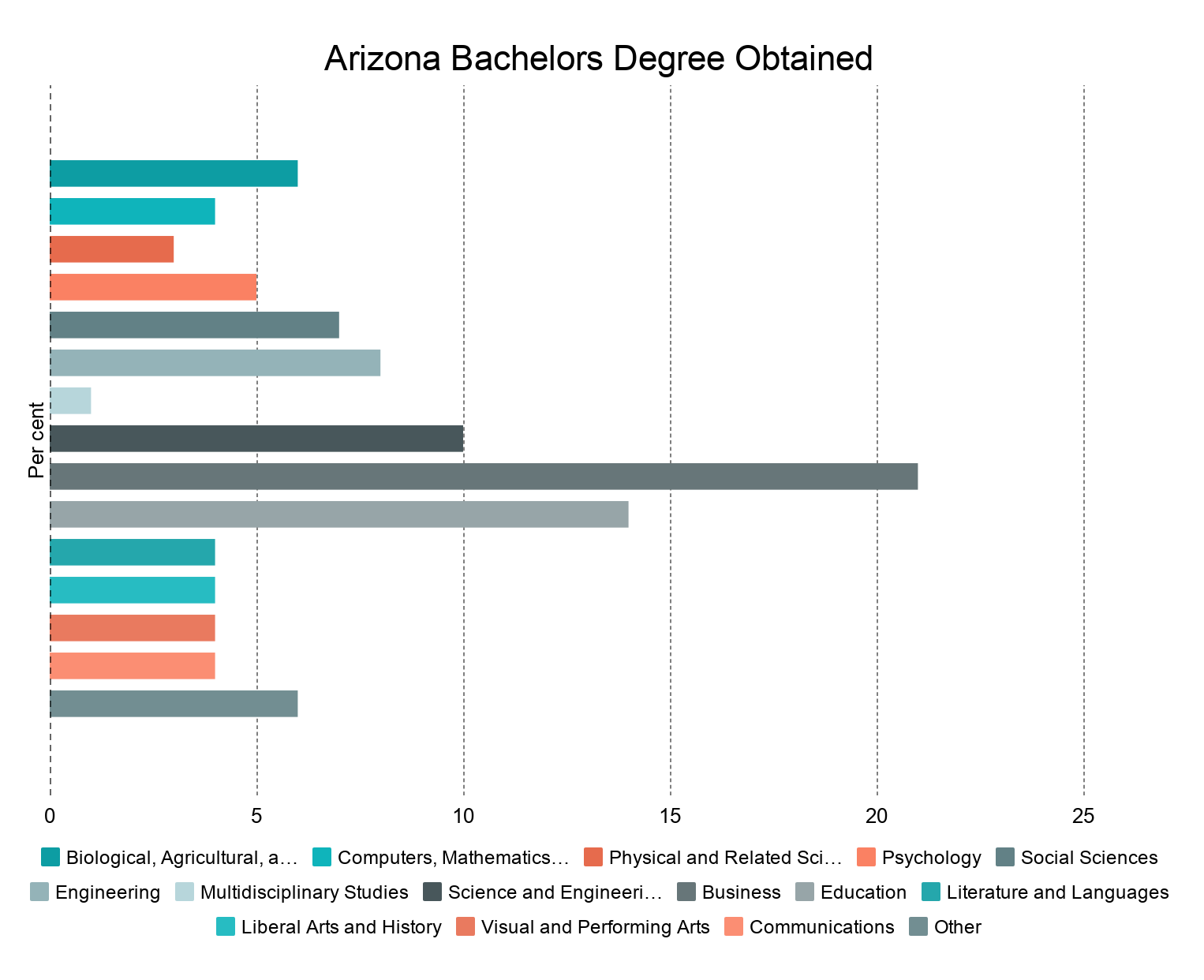

The income tax course is offered with no charge for tuition or course fees. Arizona collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The extra tax revenue would be used to fund various education related items. The emphasis is on preparing form 1040 and related forms and schedules.

The h r block income tax course is a comprehensive course which provides a foundation for understanding personal income tax returns. Complete election results the yes vote on prop. Walczak along with janelle cammenga wrote an analysis of the invest in education ballot initiative saying the proposal risks arizona s reputation as a business and residential migration hotspot. The arizona department of revenue s ador education outreach district serves as a liaison between the department and the state s cities towns and municipalities.

Like the federal income tax arizona s income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. In this beginner tax preparer course you will learn to prepare tax returns and research tax issues for most form 1040 individual non business taxpayers. Students are required to purchase course materials in all states except for new york and tennessee where purchase of some materials are optional. There are no tax practitioner institute classes currently scheduled.

Plus the basics of schedule c self employed tax returns. Arizona s maximum marginal income tax rate is the 1st highest in the united states ranking directly below arizona s. About the comprehensive tax course. Arizona decides 2020.

Our division consists of three areas. 208 the invest in education act passed with 52 of the vote.