Income Tax Rate Thailand

In thailand there are two main types of taxpayer resident and non resident.

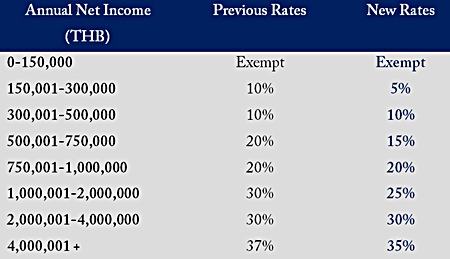

Income tax rate thailand. Tax rates of personal income tax in thailand. For employees income taxes will be directly deducted from your salary. Employment income shall be taxed at the progressive tax rate the same tax rate as residents of thailand. Over 300 000 but less than 500 000.

A non resident taxpayer is also entitled to claim for personal allowance. In thailand the revenue department is responsible for taxes on income. The amount taxed varies on your income and is from 10 37. To pay personal income taxes you will have to apply for a thai tax id card.

This article will deliver personal income tax information. Personal income tax rate in thailand averaged 36 13 percent from 2004 until 2019 reaching an all time high of 37 percent in 2005 and a record low of 35 percent in 2013. Residents who derive income from abroad are taxable on that income if remitted into thailand in the year in which it is received. Exempted no tax.

Allowances for spouse and child are only available to non resident if the spouse and child are residents in thailand in the concerned tax year. Personal income tax pit rates. One saving grace is that thailand does not have a 45 tax rate like some countries and in 2019 the 30 tax rate band was expanded so you can earn more at that rate before being put onto the 35 band. Over 150 000 but less than 300 000.

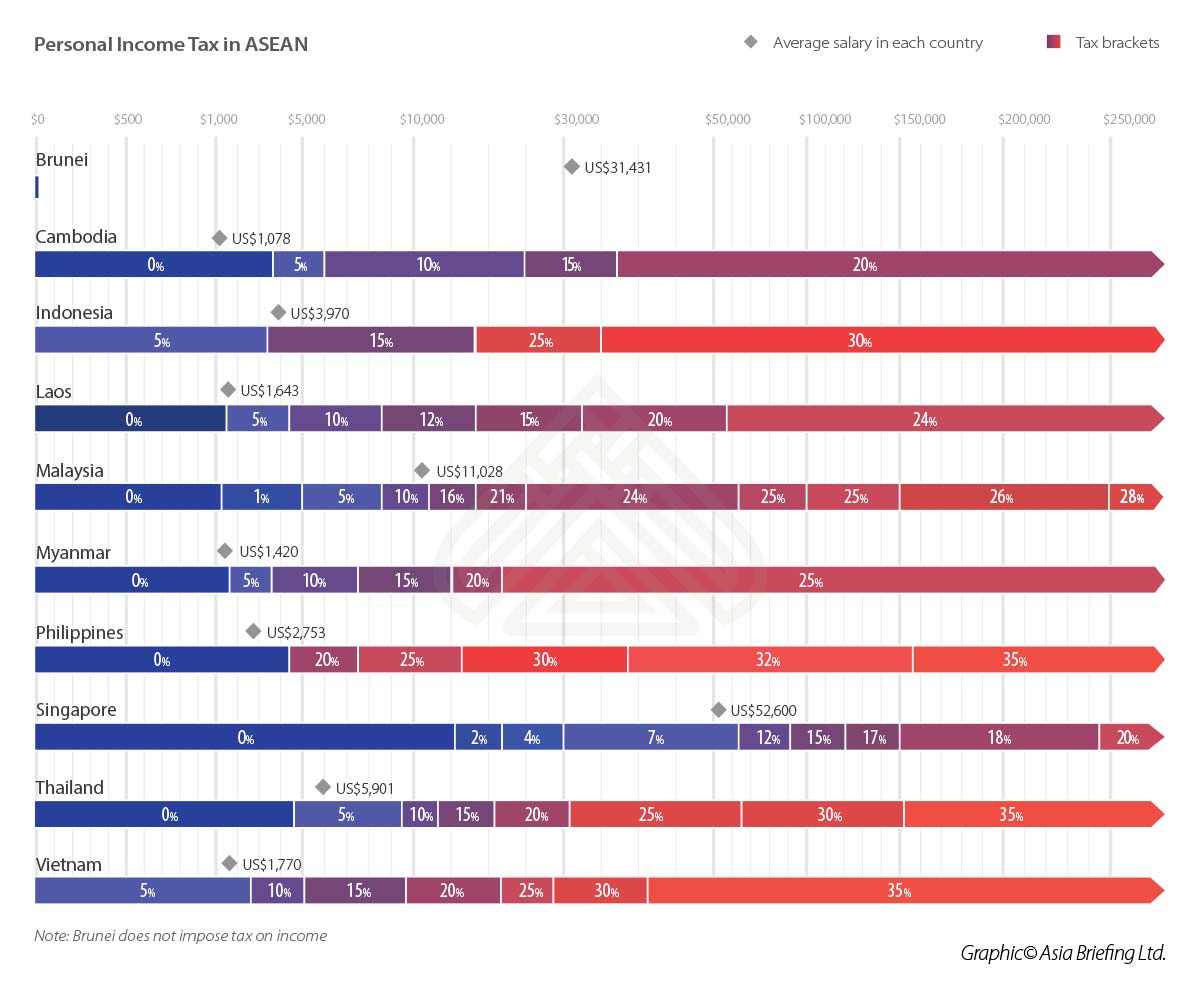

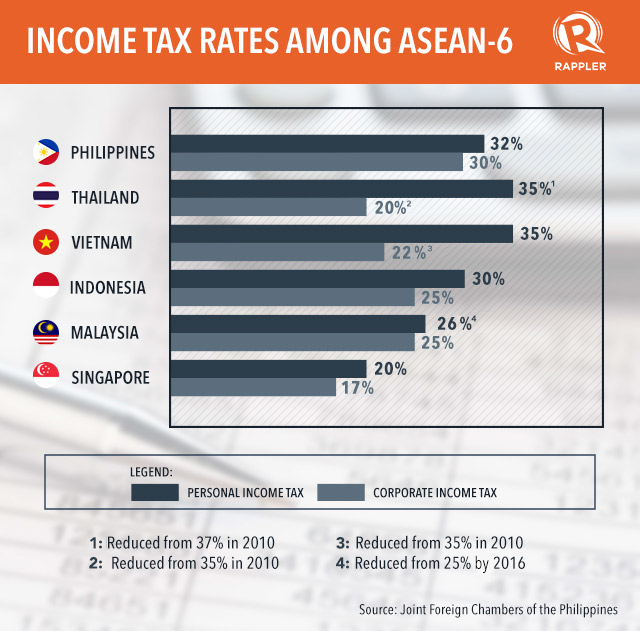

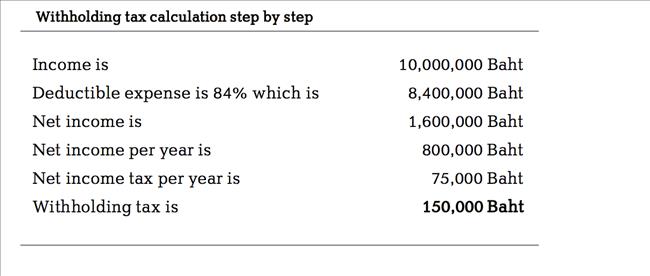

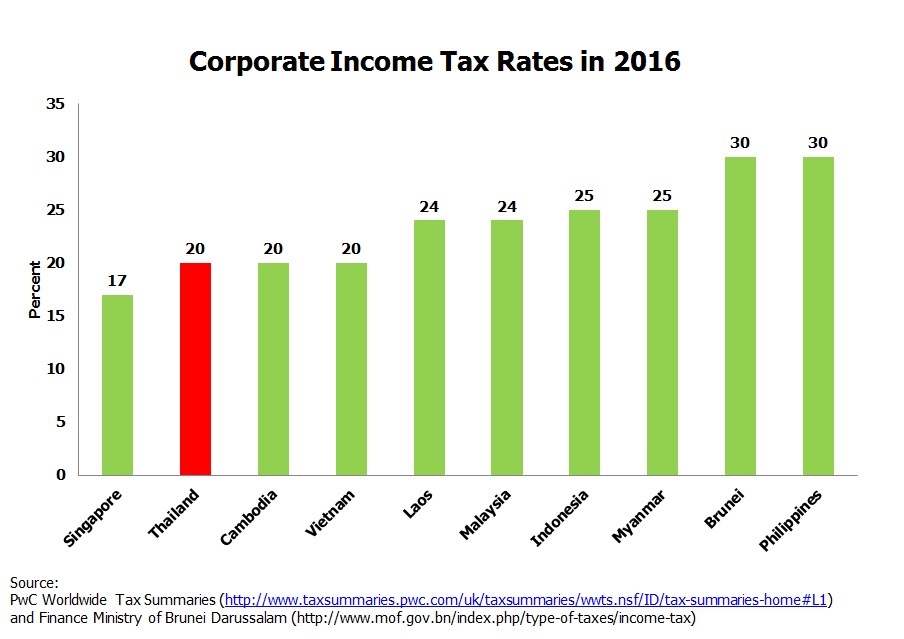

Thailand highlights 2020 page 2 of 8 corporate taxation. Resident individuals who live in thailand for more than 180 days a year are taxed on their worldwide income. Rates corporate income tax rate 20 in general branch tax rate 20 capital gains tax rate 20 residence a limited company or partnership is considered resident if it is incorporated in thailand and registered with the ministry of commerce. Income tax included corporate income tax and personal income tax while a corporate income tax is fixed rate personal income tax is tax on certain level of income.

Personal income tax pit 2020. Thailand residents income tax tables in 2019. A resident is a person who resides in thailand for more than 180 days in a calendar year and a resident is liable to pay tax on any income earned in thailand as well as on a portion of any income that is brought into thailand from overseas. Taxable income in bahts.

Thailand is not a tax haven. This page provides thailand personal income tax rate actual values historical data forecast chart statistics economic calendar and news. Net income thb pit rate 0 to 150 000. The personal income tax rate in thailand stands at 35 percent.