Income Tax Rate Zambia

All about income tax rates in zambia income tax and salaries income tax and wages income tax and deductions and more on mywage zambia.

Income tax rate zambia. Income tax is tax on profits made by limited companies partnerships and self employed individuals as well as on emoluments earned by employees. The wht rate for management and consultancy fees for non residents is 20 and is the final tax. Nilai saat ini data historis perkiraan statistik grafik dan kalender ekonomi zambia tarif pajak individu. The income tax act chapter 323 of the laws of zambia is the legislation that governs the taxation of income in zambia.

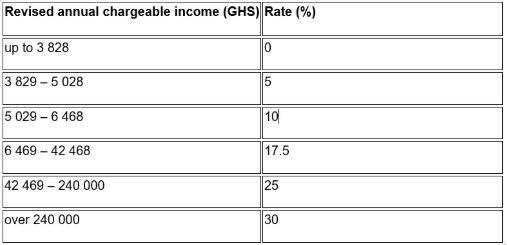

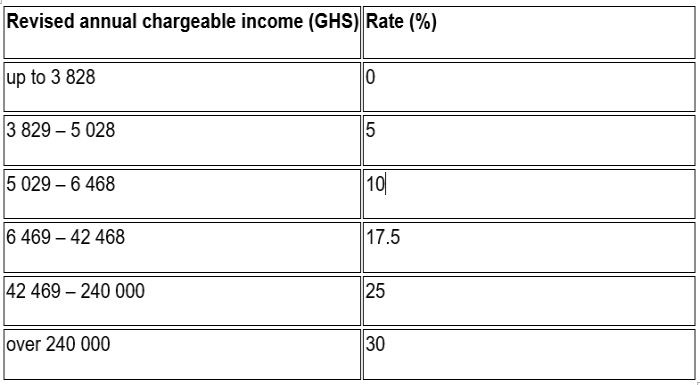

Income tax is a tax paid or levied on personal income. The rates of income tax applicable to an individual for the 2020 charge year are as follows. Personal income tax rates. Income tax rates and thresholds annual tax rate taxable income threshold.

Personal income tax rate in zambia averaged 35 83 percent from 2013 until 2018 reaching an all time high of 37 50 percent in 2017 and a record low of 35 percent in 2014. An annual income tax return containing all sources of income including rental income. Zambian residents are also subject to income tax on interest and dividends from a source outside zambia. In zambia the corporate income tax rate is a tax collected from companies.

The benchmark we use refers to the highest rate for corporate income. A flat rate of 4 on business turnover will be applied where turnover is zmw 800 000 or less per annum. This page provides zambia personal income tax rate actual values historical data forecast chart statistics economic calendar and news. What is income tax.

All profit making persons have an obligation to pay income tax on their profits. Income that is subject to turnover tax will not be subject to income tax or vat. Zambia residents income tax tables in 2019. The personal income tax rate in zambia stands at 37 50 percent.

Review the latest income tax rates thresholds and personal allowances in zambia which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in zambia. The definition of turnover for turnover tax purposes excludes interest rental income dividends and royalties. Choose a specific income tax year to see the zambia income tax rates and personal allowances used in the associated income tax calculator for the same tax year. Its amount is based on the net income companies obtain while exercising their business activity normally during one business year.