Income Tax Rate Zimbabwe

This page provides zimbabwe personal income tax rate actual values historical data forecast chart statistics economic calendar and news.

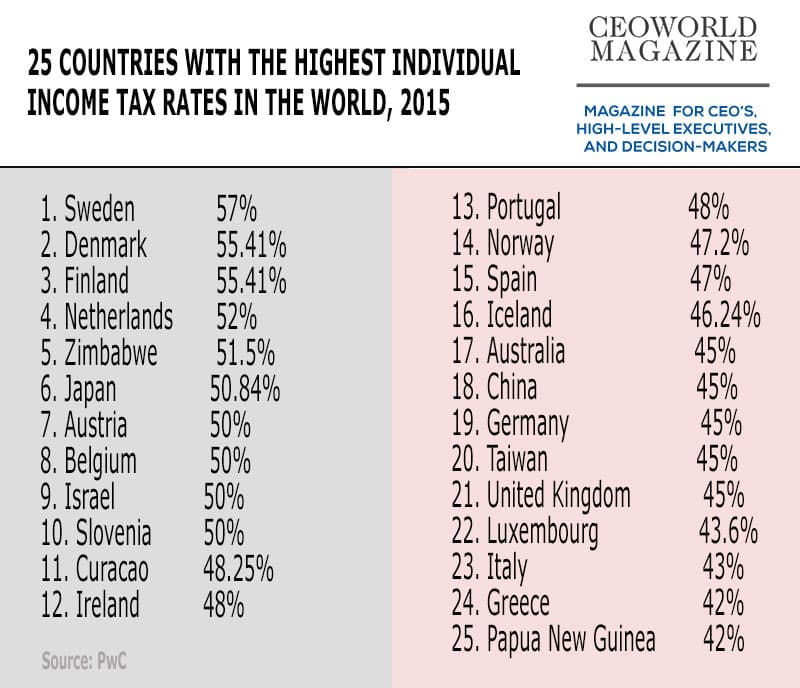

Income tax rate zimbabwe. Personal income tax rate in zimbabwe averaged 40 76 percent from 2004 until 2020 reaching an all time high of 51 50 percent in 2015 and a record low of 24 72 percent in 2020. Payment of certain taxes in foreign currency it appears the payment of tax in foreign currency now include the payment of. Zimbabwe presently operates on a source based tax system. The zimbabwe tax calculator is a diverse tool and we may refer to it as the zimbabwe wage calculator salary calculator or zimbabwe salary after tax calculator it is however the same calculator there are simply so many features and uses of the tool zimbabwe income tax calculator there is another that we refer to the calculator.

It is proposed to review the corporate income tax rate from 25 to 24. Will a non resident of zimbabwe who as part of their employment within a group company is also appointed as a statutory director i e. Business rents is taxed at the corporate rate of tax currently 24. A 3 of tax liability aids levy must be added to the total tax liability calculated.

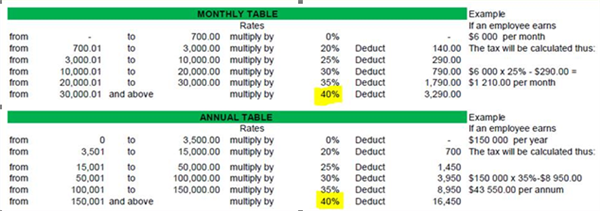

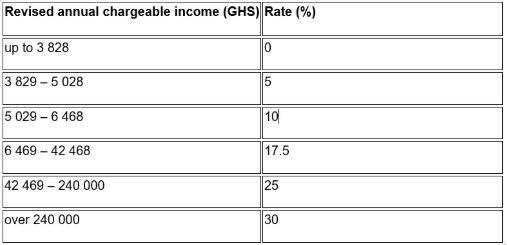

The tax tables below include the tax rates thresholds and allowances included in the zimbabwe tax calculator 2020. This means that income from a source within or deemed to be within zimbabwe will be subject to tax in zimbabwe unless a specific exemption is available. Nilai saat ini data historis perkiraan statistik grafik dan kalender ekonomi zimbabwe tarif pajak individu. What categories are subject to income tax in general situations.

August to december 2020 paye usd tax tables. Tax measures proposed in 2020 budget zimbabwe. Income tax zimbabwe 2020 national budget statement. The income tax rates and personal allowances in zimbabwe are updated annually with new tax tables published for resident and non resident taxpayers.

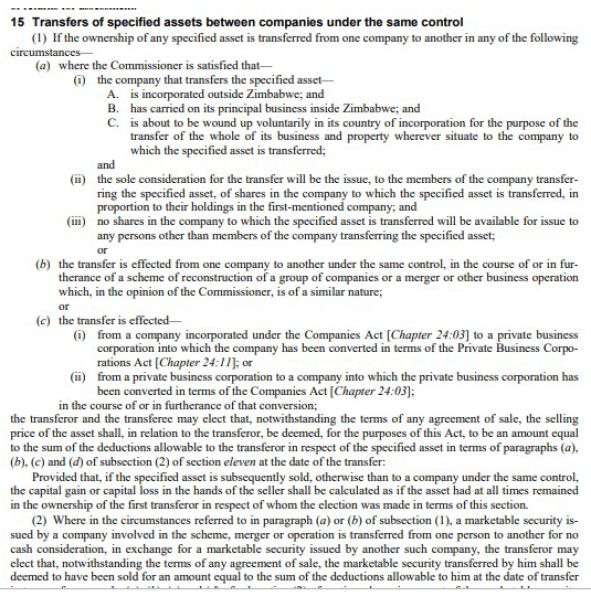

Remuneration and benefits and trade income. Member of the board of directors in a group company situated in zimbabwe trigger a personal tax liability in zimbabwe. Tax measures proposed in 2020 budget the national budget for 2020 presented on 14 november 2019 includes proposals concerning the corporate income tax value added tax vat capital gains tax certain indirect and excise taxes among other provisions. This rate includes a base rate of 24 plus a 3 aids levy.

That together with the aids levy gives an overall effective rate of 24 72.