Irs Non Passive Income

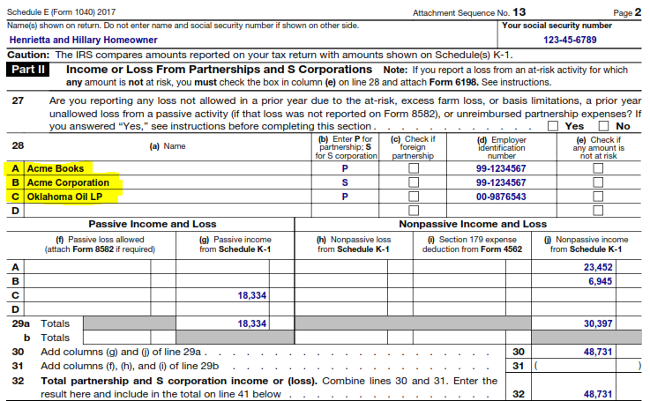

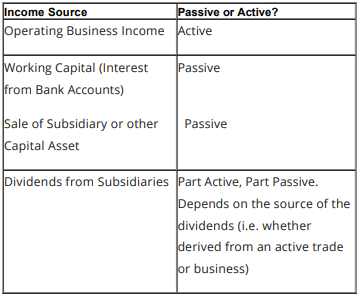

Included in nonpassive income is any active income such as wages business income or investment income.

Irs non passive income. For the most part when it comes to passive income tax it is usually deducted on passive income. What is non passive income. Payment for tasks that you complete on a regular basis. Many people are unaware of the tax implications as well as the potential benefits of this alternative.

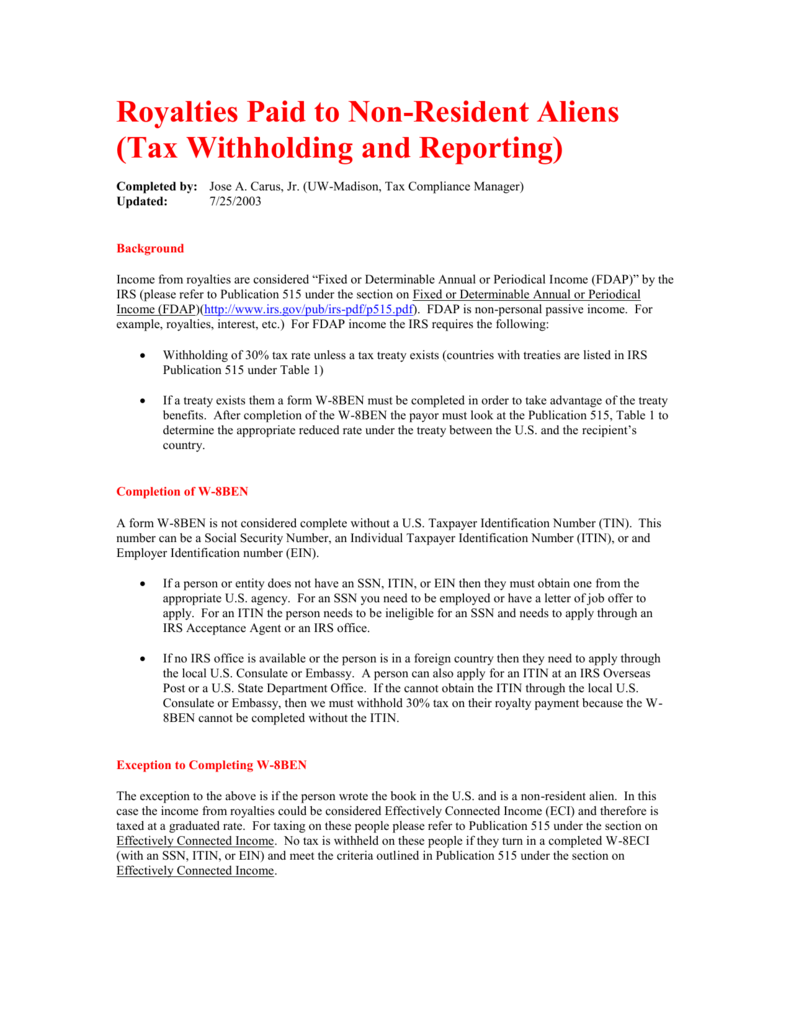

This can come through a number of sources such as interest from peer to peer lending royalty payments most rental income and the like. The irs considers a revenue stream as passive if you do not have a material participation in. Non passive income is revenue that cannot be classified as passive income for tax purposes. Non passive income would be defined as any work performed on a regular substantial and continuous basis which would include.

Passive income is income earned without active involvement.