Is Passive Income Included In Qbi

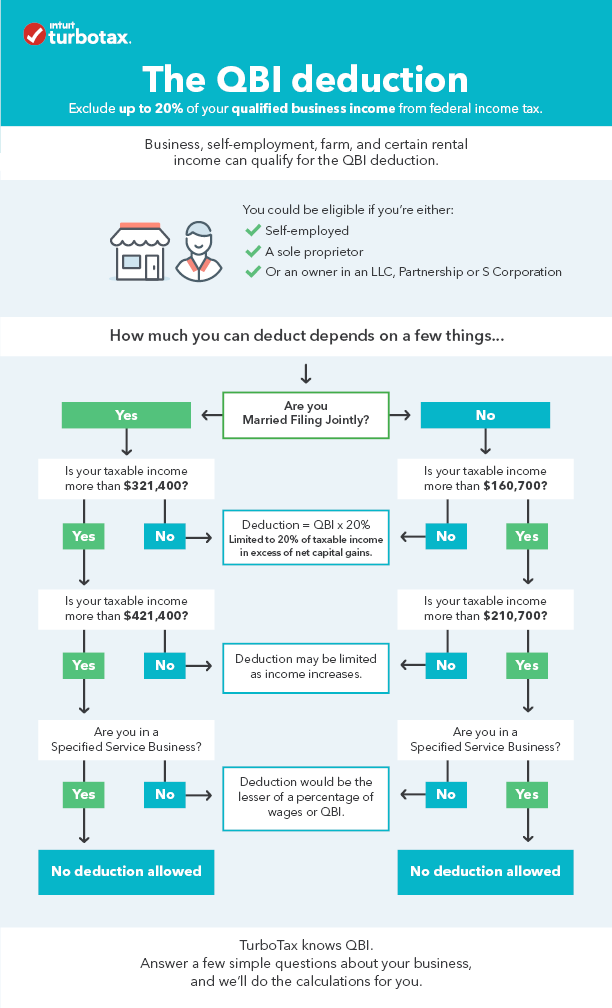

Learn if your business qualifies for the qbi deduction of up to 20.

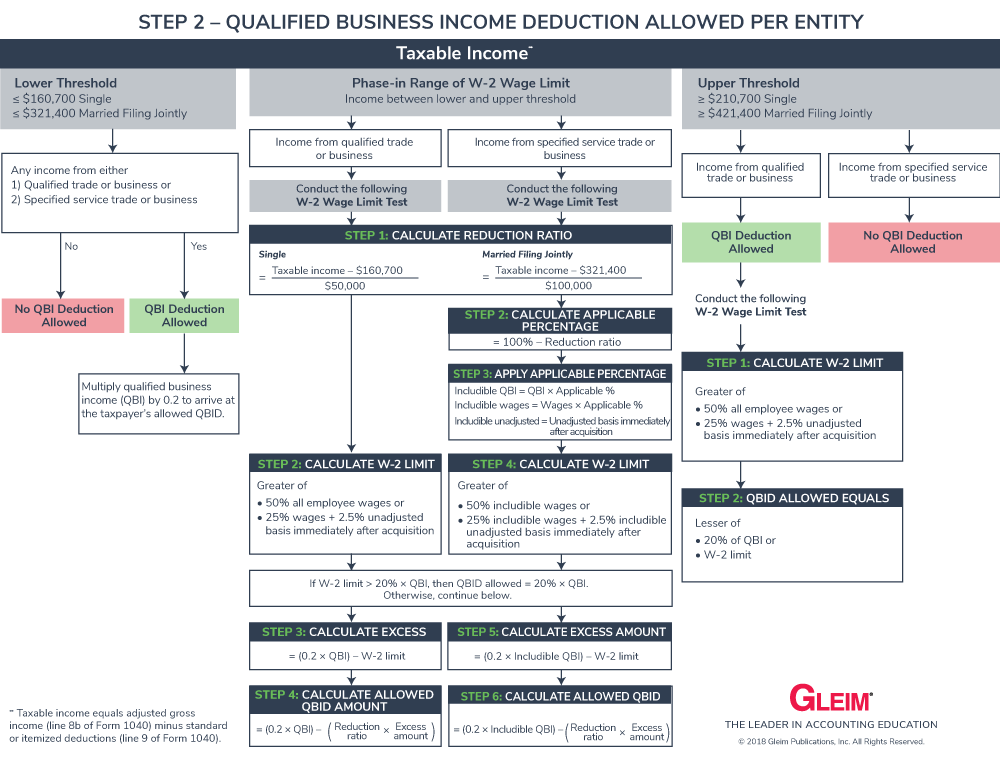

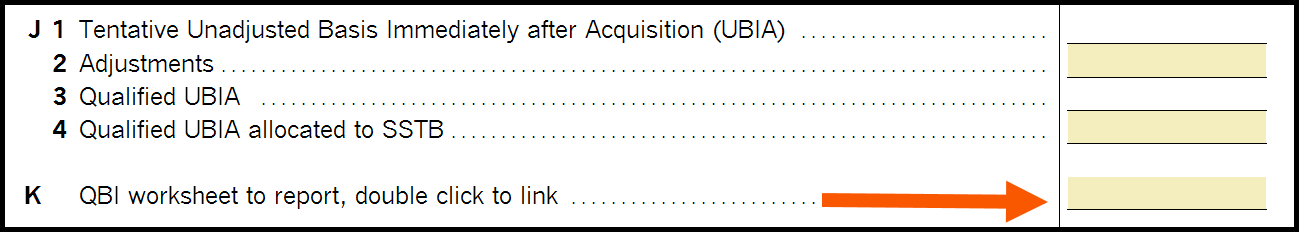

Is passive income included in qbi. A nonpassive non sstb loss of 50 000. The tax cuts and jobs act passed in december of 2017. The qbi component is subject to limitations depending on the taxpayer s taxable income that may include the type of trade or business the amount of w 2 wages paid by the qualified trade or business and the unadjusted basis immediately after acquisition ubia of qualified property held by the trade or business. It drastically cut the corporate tax rate but it also introduced the qualified business income qbi deduction.

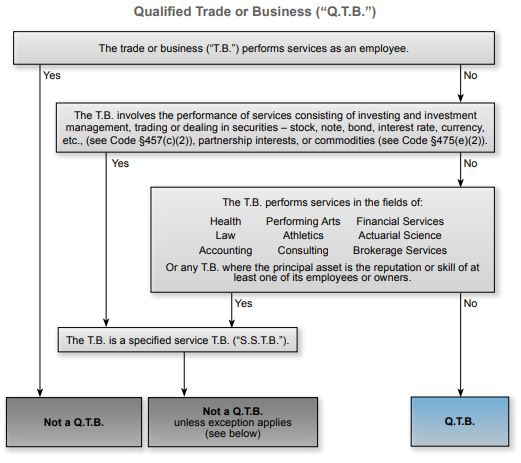

The qbi deduction is typically not available to those who only receive passive investment income e g dividends interest capital gains. The qbi deduction offers a way to lower the effective tax rate on the profits of owners of pass through entities trade or business where the income passes through to the owner s individual tax return. Qbi in year 2 is 100 000 200 000 less 50 000 non sstb loss and less 50 000 loss carryforward. The qualified business income qbi deduction is a tax deduction for pass through entities.

Netting income and losses qbi qbl final regs if net amount is a loss net loss is carried forward no w 2 or basis amounts carry forward if net of all positive and negative qbi positive the loss must be allocated among all the businesses that produce qbi in proportion final regs suspended losses before 1 1 18 are excluded. Combined qbi is the aggregate of the deductible amount for each of a taxpayer s qualified trades or. Reits traditionally invest primarily in commercial real estate or real estate financing and can either be publicly or privately traded. And long term capital gain of 10 000.

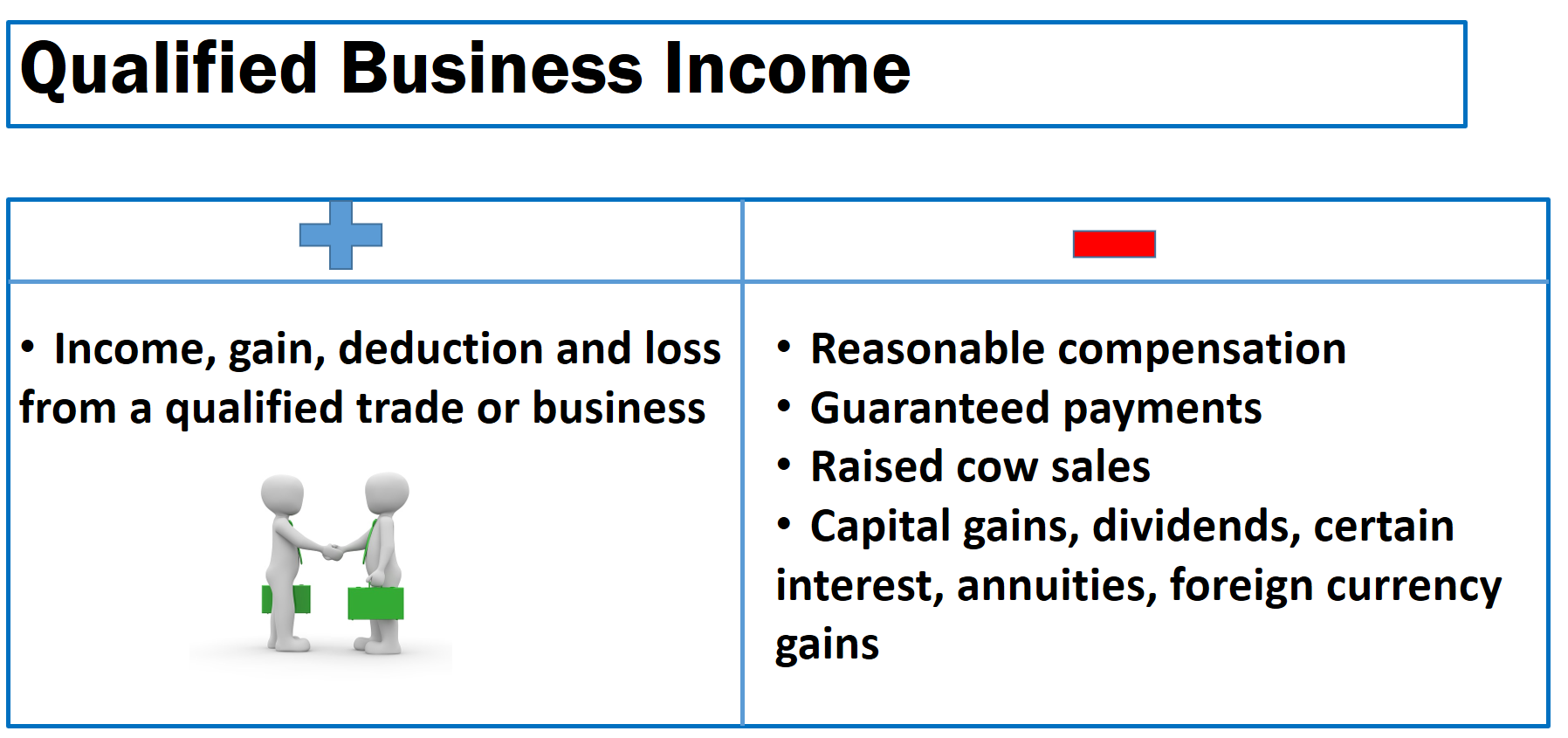

Qbi is for any tax year the net amount of qualified items of income gain deduction and loss with respect to any qualified trade or business of the taxpayer. Since howard and marian are above the taxable income threshold of 315 000 their qbi deduction needs to be computed with reference to the jccil. On their joint return howard and marian report taxable income before any qbi deduction of 350 000. We will assume there was no inflation in 2019 so all 2020 thresholds and tax brackets are unchanged.

The inclusion of reits in the qbi deduction therefore provides. Passive rental activities that are not considered a trade or business for example a single family dwelling rented out for a year or more in which there is little or no interaction between the landlord and the tenants other than periodically collecting rent and the occasional repair. However it does not include any qualified reit dividends or qualified ptp income.