Massachusetts Income Tax Schedule X

Enter the jury duty pay you reported on u s.

Massachusetts income tax schedule x. Schedule x other income. Massachusetts income tax payment voucher pdf 592 25 kb open pdf file 35 2 kb for 2019 schedule c 2. The massachusetts state tax tables for 2019 displayed on this page are provided in support of the 2019 us tax calculator and the dedicated 2019 massachusetts state tax calculator we also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state. Do notreport massachusetts state lottery winnings here.

Enclose with form 1 or form 1 nr py. Income exempt under us tax treaty. For 2020 the rate dropped to 5 its lowest in decades. Pre 1996 installment sales classified as ordinary income for massachusetts purposes from massachusetts schedule d line 10 are taxed as 5 25.

See schedule y line 17. Other massachusetts 5 25 income reported on u s. Schedules x and y may be used by taxpayers to report other income and deductions. Unlike the 6 25 sales tax which is collected by sellers use tax is generally paid directly to the state by the purchaser.

Massachusetts is one of only nine states that levy a personal income tax at a flat rate. We last updated massachusetts schedules x y in february 2020 from the massachusetts department of revenue. The state has a law enacted in 2002 that pegs the rate to state revenue. Use tax is a 6 25 tax paid on out of state or out of country purchases that are used stored or consumed in massachusetts and on which no massachusetts sales tax or less than 6 25 was paid.

Form 1040 line 21 and not reported elsewhere in form 1 lines 3 through 8 or schedule x lines 1 through 3 must be reported in line 4 of schedule x. Certain gambling losses are deductible under massachusetts law. In order to file massachusetts schedules x and y the taxpayer will need to file form 1 nr py or form 1 first depending on their residency status. The massachusetts department of revenue is responsible for publishing the latest.

Download or print the 2019 massachusetts schedules x y other income and deductions for free from the massachusetts department of revenue. If taxpayers need to report other income and deductions they must attach form 1 or form 1 nr py. Form 1040 schedule 1 that is subject to massachusetts tax as income on ma form 1 schedule x line 4. If you surrender jury duty pay to your employer in return for your normal salary while on jury duty then the amount is also deductible.

Open pdf file 592 25 kb for 2019 form pv. Toggle navigation taxform finder irs tax forms.

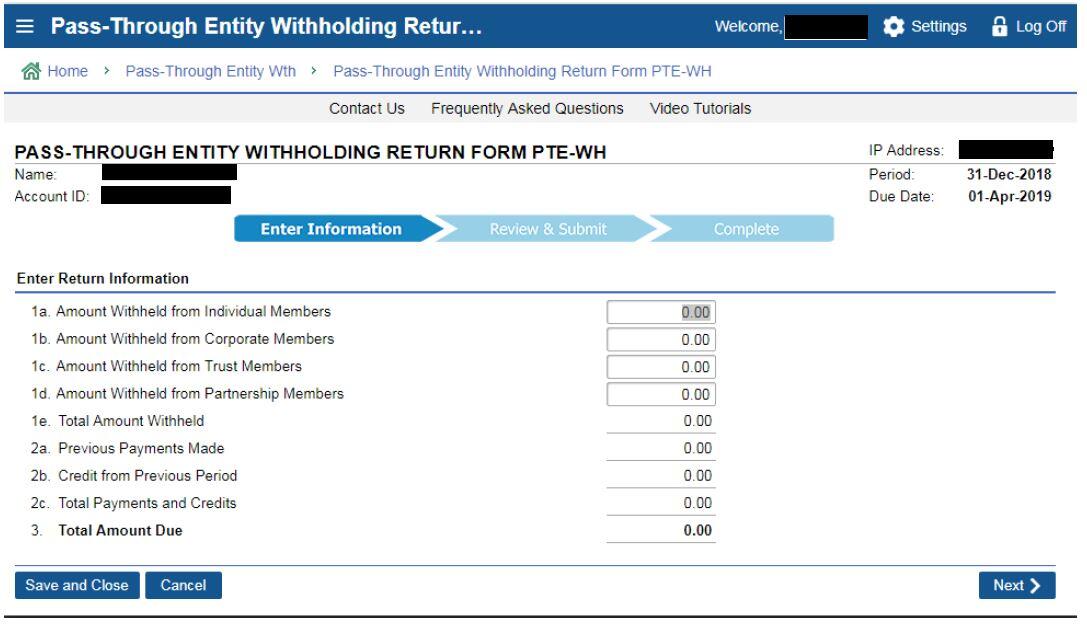

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)

/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)